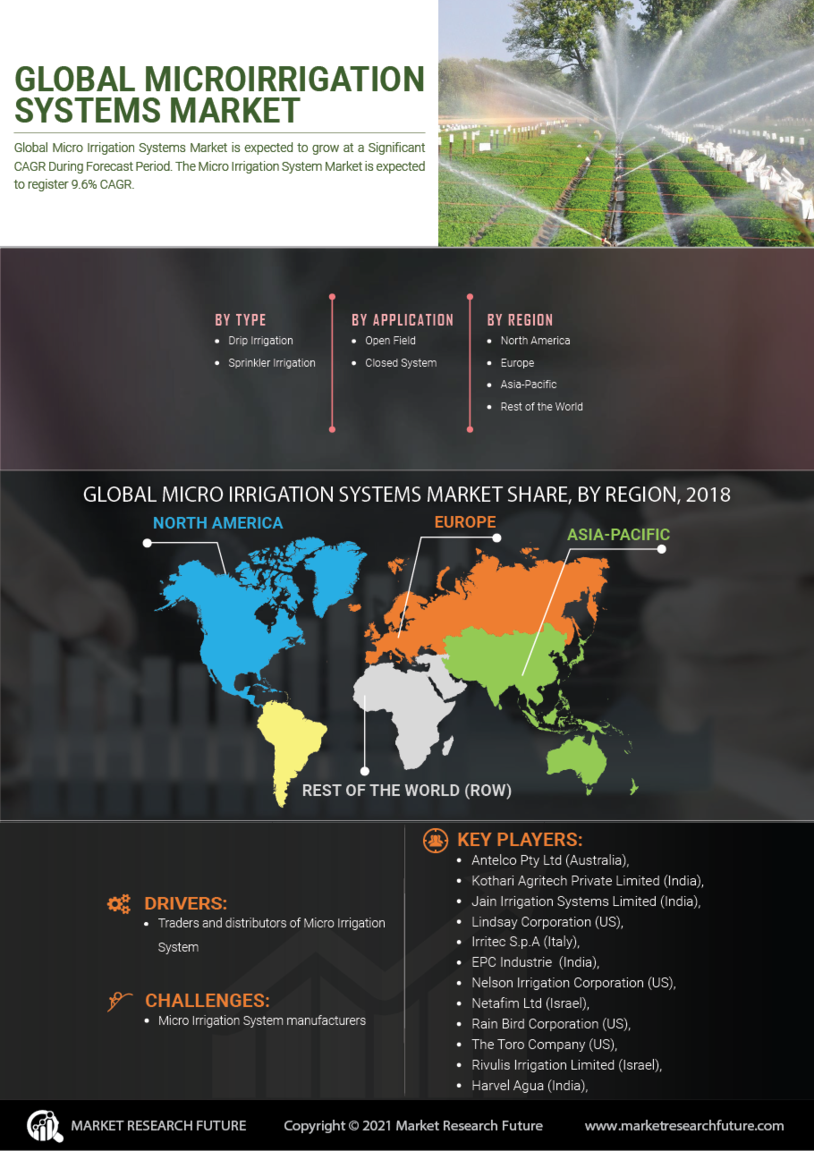

Major market players are spending a lot of money on R&D to increase their product lines, which will help the micro irrigation system market grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Micro irrigation system competitors must offer cost-effective items to expand and survive in an increasingly competitive and rising micro irrigation systems market environment.One of the primary business strategies manufacturers adopt in the micro irrigation system industry to benefit clients and expand the market sector is manufacturing locally to reduce operating costs. In recent years, the micro irrigation system industry has provided better yields with some of the most significant benefits. The micro irrigation system markets major player such as Netafim Limited (Israel), The Toro Company (US), Metro Irrigation (India), Lindsay Corporation (US), and others are working on expanding the market demand by investing in research and development activities.Netafim Limited (Israel) The Company provides irrigation equipment and water technologies for agriculture, landscape, and mining, including irrigation drips, sprinklers, valves, and flexible pipes. Customers around the world benefit from Netafim's services.

In March A collaboration between Netafim Limited and FluroSat (Australia), a leader in remote sensing and analytics, was announced to integrate FluroSat's data into NetBeat, the company's cloud-based platform for automated irrigation and

fertigation. This way, Netafim Limited's customers could get irrigation recommendations tailored to their specific sites.Also, Lindsay Corporation (US) manufactures and sells irrigation equipment used to irrigate crops, including center pivots and lateral moves. A part of the Company's business is outsourcing manufacturing and production services to original equipment manufacturers in the United States.

In July in announcing the acquisition of Net Irrigate, LLC (US), Lindsay Corporation acquired a company providing remote monitoring solutions to irrigation customers through the Internet of Things. By acquiring the company, the company would be able to expand its irrigation technology offerings.

Recent News:Netafim India has introduced an innovative irrigation system with anti-clogging technology that guarantees optimal nutrient and water delivery in October 2023. By 2025, the organization intends to utilize the new system on 25,000 hectares and reach 35,000 producers throughout the nation.Rivulis, a global leader in micro irrigation solutions, makes the most exhaustive body of information on drip irrigation available to farmers and agribusinesses worldwide for free in November 2023. An industry-leading initiative that provides drip irrigation professionals with the means to enhance their skills and ensure that their operations are of the highest caliber in order to optimize yield and quality. Sustaining commercial viability in the agricultural sector is becoming increasingly difficult due to the ongoing pressure on profit margins. The complexities exacerbated by climate change make proper irrigation more crucial than ever before.Enhancing quality and yields is the primary aim of every agricultural endeavor, and this is accomplished via the manipulation of climate, nutrition, water, and genetics. One of these four major factors is water, which can be regulated with the help of drip irrigation solutions, such as those offered by Rivulis. These systems deliver water and plant nutrients directly to the roots of the plants, thereby conserving water and nutrients. Containing four modules, the Irrigation Drip Guide is accessible via the Rivulis Knowledge Hub.