Research Methodology on Mechanized Irrigation Market

INTRODUCTION

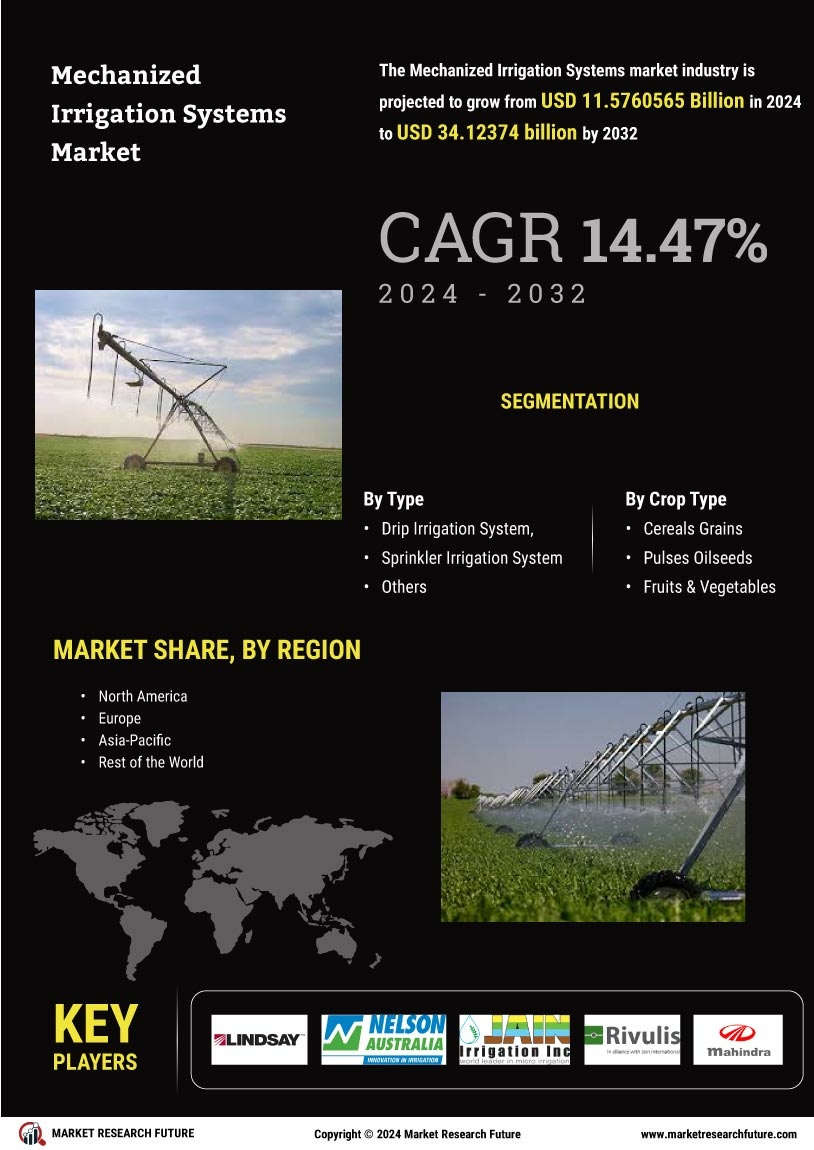

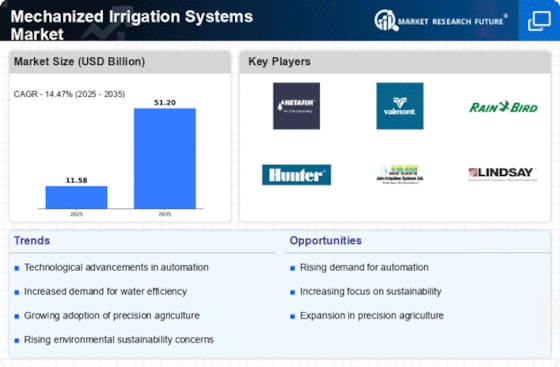

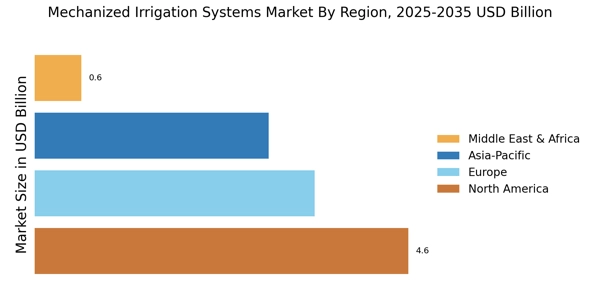

The research report titled “Mechanized Irrigation Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2030”, prepared by Market Research Future (MRFR), provides an in-depth analysis of the global mechanized irrigation market. The analysis to be presented is based on two primary research approaches: primary research and secondary research.

The report states that mechanized irrigation is an efficient and cost-effective form of irrigation that utilizes various mechanized means to water the soil. It provides precise, efficient, and uniform distribution of water. The report identifies factors such as a rising population, concerns regarding the supply of water and improved living standards of people which is resulting in an increased demand for food products, as major reasons for the growth of the mechanized irrigation market.

RESEARCH METHODOLOGY

1.0 INTRODUCTION

The research methodology adopted to conduct this study was to collect, organize, and analyse data from different sources. The research methodology is divided into four parts – primary research and secondary research, data collection, and data analysis. The primary research approach is used to obtain first-hand information from the market participants while the secondary research approach is used to locate and collect secondary data from existing sources. The data collection methods used include desk research, telephone interviews, and experts’ opinions. The approaches used for data analysis include the bottom-up approach, top-down approach, factor analysis, time-series analysis and demand-side and supply-side data triangulation. The study as such is an analysis of the previous studies.

2.0 RESEARCH APPROACH

This project has been conducted using a mixed-method research approach, as it combines both qualitative and quantitative methods. This approach is logical because it allows for a broad interpretation of the data and the ability to provide a holistic overview of the market. The primary research approach was used for obtaining primary data from direct interviews and surveys. The secondary research approach was used for gathering information from published reports, books, and various journals.

3.0 DATA COLLECTION

3.1 Primary Research

Primary data was collected or gathered through direct interviews and surveys. The target population of this research was the key market players of the mechanized irrigation market such as manufacturers, suppliers, distributors, and other industry experts. The interviews were conducted with the help of semi-structured questionnaires.

3.2 Secondary Research

Secondary data was collected through published reports, books, journals, magazines, and online databases. An extensive review of the available literature on the market was conducted to capture the current and recent trends in the mechanized irrigation market. The collected data was then analyzed and organized.

4.0 DATA ANALYSIS

The data gathered from both primary and secondary sources was compiled, tabulated, and analyzed to assess and forecast the performance of the mechanized irrigation market for 2023 to 2030. A data triangulation was also conducted to ensure the accuracy and precision of the report. The approaches used for data analysis include the bottom-up approach, top-down approach, factor analysis, time-series analysis and demand-side and supply-side data triangulation.

CONCLUSION

The research methodology adopted in this study includes primary research and secondary research and has been conducted using desk research, telephone interviews, and expert opinion. Data triangulation was conducted to ensure the accuracy and precision of the report. This report is an analysis of existing data and publications to provide a holistic overview of the mechanized irrigation market.