Rising Cyber Threat Landscape

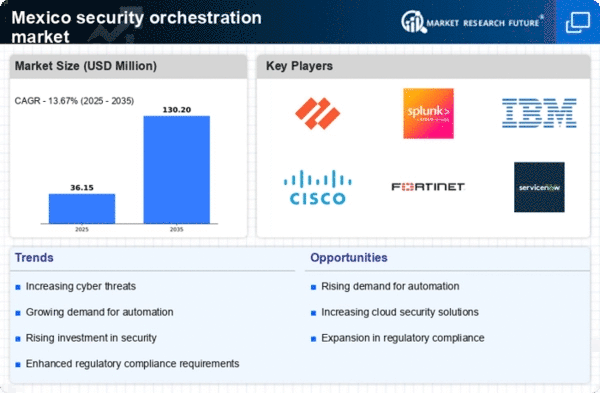

The security orchestration market in Mexico is experiencing growth due to an escalating cyber threat landscape. As organizations face increasing incidents of data breaches and cyberattacks, the demand for robust security solutions intensifies. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Mexican businesses to invest in security orchestration to enhance their defenses. This market is projected to grow at a CAGR of 15% from 2025 to 2030, driven by the need for integrated security solutions that can respond swiftly to threats. The urgency to protect sensitive data and maintain customer trust is likely to propel the adoption of security orchestration technologies across various sectors in Mexico.

Growing Awareness of Data Privacy

In Mexico, there is a growing awareness of data privacy and protection, which is driving the security orchestration market. With the implementation of regulations such as the Federal Law on Protection of Personal Data Held by Private Parties, organizations are compelled to adopt comprehensive security measures. This law mandates that companies must ensure the confidentiality and integrity of personal data, leading to increased investments in security orchestration solutions. As of 2025, it is projected that the data protection market in Mexico will reach $1.5 billion, highlighting the importance of compliance in shaping security strategies. Consequently, businesses are likely to prioritize security orchestration to meet regulatory requirements and protect customer information.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly influencing the security orchestration market in Mexico. These technologies enable organizations to automate threat detection and response, thereby improving operational efficiency. In 2025, the market for AI in cybersecurity is expected to reach $38 billion, indicating a strong trend towards automation in security processes. By leveraging AI and ML, companies can analyze vast amounts of data in real-time, allowing for quicker identification of potential threats. This technological advancement is likely to enhance the capabilities of security orchestration platforms, making them more appealing to Mexican enterprises seeking to bolster their cybersecurity posture.

Demand for Incident Response Capabilities

The demand for enhanced incident response capabilities is a key driver of the security orchestration market in Mexico. Organizations are increasingly recognizing the importance of having a well-defined incident response plan to mitigate the impact of security breaches. In 2025, it is estimated that 60% of Mexican companies will have implemented formal incident response strategies, reflecting a shift towards proactive security measures. This trend is likely to fuel the adoption of security orchestration solutions that facilitate coordinated responses to incidents. By streamlining communication and automating workflows, these solutions can significantly reduce response times and minimize damage, making them essential for businesses aiming to safeguard their assets.

Investment in Cybersecurity Infrastructure

Investment in cybersecurity infrastructure is a prominent driver of the security orchestration market in Mexico. As organizations recognize the critical need for robust security frameworks, they are allocating substantial budgets towards enhancing their cybersecurity capabilities. In 2025, it is anticipated that Mexican companies will increase their cybersecurity spending by 20%, reflecting a growing commitment to protecting digital assets. This investment trend is likely to encompass security orchestration solutions, which provide a comprehensive approach to managing security operations. By integrating various security tools and processes, organizations can achieve greater visibility and control over their security posture, thereby fostering a more resilient cybersecurity environment.