Rising Cyber Threats

The increasing frequency and sophistication of cyber threats in Mexico is a primary driver for the runtime application-self-protection market. As organizations face a growing number of attacks, including ransomware and data breaches, the need for robust security measures becomes paramount. In 2025, it is estimated that cybercrime could cost the Mexican economy over $10 billion annually. This alarming trend compels businesses to invest in advanced security solutions, including runtime application self-protection, to safeguard their applications and sensitive data. The runtime application-self-protection market industry is thus witnessing heightened demand as companies seek to mitigate risks associated with cyber threats, ensuring the integrity and availability of their applications.

Growing Regulatory Landscape

The evolving regulatory landscape in Mexico is a significant driver for the runtime application-self-protection market. With regulations such as the Federal Law on Protection of Personal Data, organizations are compelled to adopt stringent security measures to protect sensitive information. Non-compliance can result in hefty fines, which may reach up to 4% of annual revenue. As a result, businesses are increasingly turning to runtime application self-protection solutions to ensure compliance and safeguard their applications. The runtime application-self-protection market industry is thus experiencing growth as organizations seek to align their security practices with regulatory requirements, ultimately enhancing their overall security posture.

Digital Transformation Initiatives

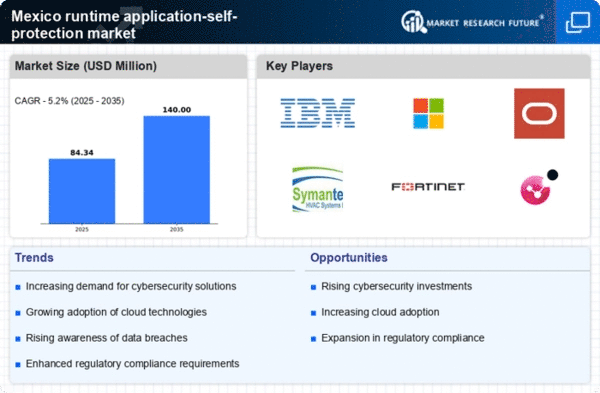

Mexico's ongoing digital transformation initiatives are significantly influencing the runtime application-self-protection market. As businesses increasingly adopt cloud computing, mobile applications, and IoT technologies, the attack surface expands, necessitating enhanced security measures. In 2025, it is projected that the digital economy in Mexico will reach $100 billion, driving organizations to prioritize application security. The runtime application-self-protection market industry is positioned to benefit from this trend, as companies recognize the importance of integrating security into their development processes. By implementing runtime application self-protection solutions, organizations can proactively defend against vulnerabilities and ensure compliance with evolving security standards.

Demand for Continuous Security Monitoring

The demand for continuous security monitoring is emerging as a crucial driver for the runtime application-self-protection market in Mexico. As cyber threats evolve, organizations are realizing that static security measures are no longer adequate. Continuous monitoring allows for real-time detection and response to potential threats, which is essential for maintaining application integrity. In 2025, it is projected that the market for continuous security solutions will grow by 30% in Mexico. This trend is likely to propel the runtime application-self-protection market industry forward, as businesses seek to implement solutions that offer ongoing protection and adaptability to new vulnerabilities.

Increased Awareness of Application Security

There is a growing awareness of the importance of application security among businesses in Mexico, which is driving the runtime application-self-protection market. As organizations recognize that traditional security measures are insufficient to protect against modern threats, they are increasingly investing in advanced solutions. In 2025, it is estimated that the application security market in Mexico will grow by 25%, reflecting this heightened awareness. The runtime application-self-protection market industry is likely to benefit from this trend, as companies seek to implement solutions that provide real-time protection and monitoring of their applications, thereby reducing the risk of exploitation.