Growth of E-commerce Platforms

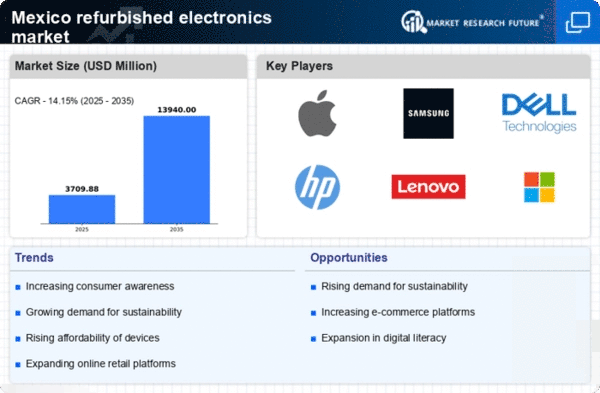

The growth of e-commerce platforms significantly impacts the refurbished electronics market in Mexico. With the rise of online shopping, consumers have greater access to a variety of refurbished products. In 2025, e-commerce sales of refurbished electronics account for approximately 30% of total sales in the market. This trend is facilitated by the convenience of online shopping and the ability to compare prices and products easily. Additionally, many e-commerce platforms offer warranties and return policies that enhance consumer confidence in purchasing refurbished items. The refurbished electronics market is likely to continue expanding as e-commerce becomes an increasingly dominant sales channel.

Increased Awareness of Product Lifespan

Increased awareness of product lifespan and the benefits of extending the life of electronics contribute to the growth of the refurbished electronics market in Mexico. Consumers are becoming more informed about the environmental and economic advantages of choosing refurbished products. In 2025, surveys indicate that 65% of consumers consider the longevity of electronics when making purchasing decisions. This awareness encourages consumers to opt for refurbished items, which are often just as functional as new ones but at a fraction of the cost. The refurbished electronics market stands to gain from this trend as consumers prioritize sustainability and value.

Rising Consumer Demand for Affordability

The refurbished electronics market in Mexico experiences a notable surge in consumer demand driven by the need for affordability. As economic conditions fluctuate, many consumers seek cost-effective alternatives to new electronics. This trend is particularly pronounced among younger demographics and budget-conscious households. In 2025, the average price of refurbished smartphones in Mexico is approximately $200, compared to $600 for new models. This price disparity encourages consumers to consider refurbished options, thereby expanding the market. Additionally, the increasing availability of refurbished products across various platforms enhances accessibility, further stimulating demand. The refurbished electronics market is likely to continue benefiting from this trend as consumers prioritize value for money.

Environmental Regulations and Initiatives

The refurbished electronics market in Mexico is increasingly influenced by environmental regulations and initiatives aimed at promoting sustainability. Government policies encouraging recycling and responsible disposal of electronic waste are gaining traction. In 2025, the Mexican government implements stricter regulations on electronic waste management, which indirectly boosts the refurbished market. As consumers become more aware of the environmental impact of electronic waste, they are more inclined to purchase refurbished products as a sustainable alternative. This shift in consumer behavior aligns with the objectives of the refurbished electronics market, which seeks to reduce waste and promote a circular economy.

Technological Advancements in Refurbishment Processes

Technological advancements play a crucial role in enhancing the quality and reliability of refurbished electronics in Mexico. Innovations in refurbishment processes, such as automated testing and quality control systems, ensure that products meet high standards before reaching consumers. This improvement in quality is reflected in the growing trust consumers place in refurbished products. In 2025, approximately 70% of consumers express confidence in the reliability of refurbished electronics, a significant increase from previous years. The refurbished electronics market is thus positioned to thrive as these advancements not only improve product quality but also reduce return rates, fostering a more sustainable market environment.