Economic Factors

Economic conditions in Japan play a crucial role in shaping the refurbished electronics market. With rising living costs and economic uncertainty, consumers are increasingly seeking cost-effective alternatives to new electronics. The refurbished electronics market offers a viable solution, providing high-quality devices at significantly lower prices. In 2025, the average price of refurbished smartphones in Japan is projected to be around 30% lower than their new counterparts. This price differential is likely to attract budget-conscious consumers, thereby expanding the market. Additionally, the economic landscape encourages businesses to explore refurbished options as a means to reduce operational costs, further driving demand in the industry.

Environmental Regulations

Stringent environmental regulations aimed at reducing electronic waste increasingly influence the refurbished electronics market in Japan. The Japanese government has implemented policies that encourage recycling and the reuse of electronic devices, which aligns with the principles of sustainability. As a result, consumers are more inclined to purchase refurbished products, knowing that they contribute to environmental conservation. In 2024, the recycling rate for electronic waste in Japan reached approximately 25%, indicating a growing awareness among consumers regarding the importance of responsible disposal and reuse. This regulatory framework not only promotes the refurbished electronics market but also fosters a culture of sustainability among consumers, making it a significant driver in the industry.

Technological Integration

Advanced technology integration in the refurbishment process is transforming the refurbished electronics market in Japan. Companies are adopting sophisticated refurbishment techniques, including automated testing and quality assurance protocols, to enhance the reliability of refurbished products. This technological advancement not only improves the quality of refurbished electronics but also instills greater consumer confidence in purchasing these products. As of 2025, approximately 40% of refurbished electronics sold in Japan are equipped with the latest software updates and features, making them competitive with new devices. This trend indicates a shift towards a more technologically integrated approach in the refurbishment process, which is likely to attract a broader consumer base.

Consumer Demand for Quality

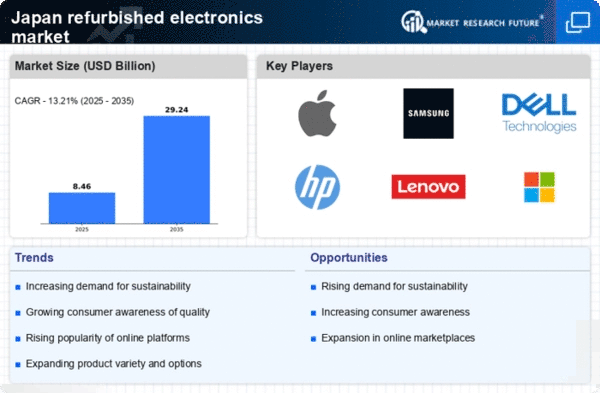

In Japan, there is a notable shift in consumer preferences towards high-quality refurbished electronics. The refurbished electronics market is benefiting from a growing segment of consumers who prioritize quality over brand new products. This trend is particularly evident among tech-savvy individuals who seek reliable devices at a lower cost. According to recent surveys, around 60% of consumers in Japan express a willingness to purchase refurbished electronics, citing quality assurance and warranty options as key factors influencing their decisions. This demand for quality refurbished products is driving growth in the market, as retailers and manufacturers respond by enhancing their refurbishment processes to meet consumer expectations.

Growing E-commerce Platforms

E-commerce platform growth in Japan significantly impacts the refurbished electronics market. Online marketplaces are increasingly offering a wide range of refurbished products, making them more accessible to consumers. This shift towards digital shopping is particularly appealing to younger demographics who prefer the convenience of online purchasing. In 2025, it is estimated that online sales of refurbished electronics will account for over 50% of total sales in the market. This growth in e-commerce not only facilitates easier access to refurbished products but also allows consumers to compare prices and features more effectively, thereby driving competition and innovation within the industry.