Mexico Property Insurance Market

Mexico Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

Mexico Property Insurance Market Overview

As per MRFR analysis, the Mexico Property Insurance Market Size was estimated at 19.04 (USD Billion) in 2023.The Mexico Property Insurance Market is expected to grow from 19.66(USD Billion) in 2024 to 29.62 (USD Billion) by 2035. The Mexico Property Insurance Market CAGR (growth rate) is expected to be around 3.796% during the forecast period (2025 - 2035).

Key Mexico Property Insurance Market Trends Highlighted

The Mexico Property Insurance Market is witnessing significant trends influenced by various factors. One of the key drivers is the increasing awareness of the need for property protection due to rising natural disasters in the region, such as earthquakes and floods. The government of Mexico has recognized this need and actively promotes risk management and insurance as essential components of property ownership. Moreover, urbanization is accelerating, leading to more investment in properties and thus bolstering demand for property insurance.

Property owners are seeking insurance solutions not just for securing their investments but also for the peace of mind that accompanies comprehensive coverage.Recent trends also show that the insurance industry is moving toward digitalization. More and more companies are offering online platforms for managing policies and processing claims. This is because more and more people are looking for convenience in financial services and are comfortable with technology.

Customized insurance packages that meet the needs of individual customers are becoming more popular. This means that providers need to change what they offer. There is also a growing interest in green and sustainable properties, which opens up a market for insurance products that cover buildings that are good for the environment. The market also shows that there is room for new ideas in terms of the types of products available, especially for renters and low-income families, who have not always had many insurance options.

This segment is gradually gaining attention from insurers looking to expand their customer base. Overall, these trends highlight a dynamic environment within the Mexico Property Insurance Market, marked by increasing demand, technological advancement, and a shift toward inclusivity in insurance accessibility.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Mexico Property Insurance Market Drivers

Increasing Urbanization in Mexico

The Mexico Property Insurance Market is significantly influenced by the rapid urbanization occurring in the country. According to the National Institute of Statistics and Geography in Mexico (INEGI), as of 2020, approximately 80% of the Mexican population lives in urban areas. This urban population growth leads to an increase in residential properties and commercial buildings, which in turn drives demand for property insurance.

The higher concentration of assets in urban regions elevates the risk associated with natural disasters, theft, and vandalism, resulting in more homeowners and businesses seeking insurance coverage.With the government promoting urban development through various initiatives, the need for strong property insurance products continues to grow, thereby enhancing the prospects for the Mexico Property Insurance Market. The trend shows no signs of slowing down, as projections suggest that by 2030, urbanization may reach about 85%, further propelling demand for comprehensive property insurance solutions.

Rising Natural Disasters and Climate Change Impact

Mexico is increasingly susceptible to natural disasters such as earthquakes, hurricanes, and floods. The National Disaster Fund (FONDEN) reported that between 2010 and 2020, Mexico experienced over 20 significant disasters, collectively resulting in damages exceeding 80 billion Mexican Pesos.

Such statistics highlight the pressing need for robust property insurance coverage, as these events not only threaten individual assets but also the overall economy.The government has begun to recognize the importance of property insurance in disaster risk reduction strategies. The increasing frequency and intensity of these events, influenced by climate change, will continue to fuel demand for property insurance, driving growth in the Mexico Property Insurance Market. Insurers are also adapting by enhancing their offerings in line with these emerging risks.

Growing Middle-Class and Increased Asset Ownership

As Mexico's economy progresses, the middle-class population is expanding, which directly influences the Mexico Property Insurance Market. According to a report from the Mexican Center for Competitiveness, the middle class has increased to approximately 54% of the population in the last decade. This demographic shift represents a growing number of individuals owning homes, vehicles, and businesses, all of which require insurance. With increased asset ownership comes heightened awareness of the importance of protecting these investments, leading to a surge in demand for property insurance policies.

Companies like Grupo Nacional Provincial (GNP) and MetLife Mexico are capitalizing on this trend, offering tailored insurance products designed to meet the needs of this expanding demographic. This substantial middle-class growth is projected to contribute significantly to the market by fostering greater consumer confidence in obtaining insurance.

Technological Advancements in Insurance Services

The integration of technology into the Mexico Property Insurance Market is reshaping how insurance services are delivered and consumed. The advent of digital platforms and mobile applications has made it more convenient for consumers to access insurance products and manage their policies.

According to the Association of Mexican Insurers, around 30% of insurance policies are now sold online, marking a significant shift in consumer behavior.Insurers are also leveraging big data analytics, artificial intelligence, and machine learning to assess risks and personalize coverage options for customers. This technological evolution is not only streamlining operations but also enhancing customer experience, which can lead to increased penetration of property insurance in the market. With continued investment in technological innovations, established insurance players are likely to strengthen their market positions in the Mexico Property Insurance Market.

Mexico Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

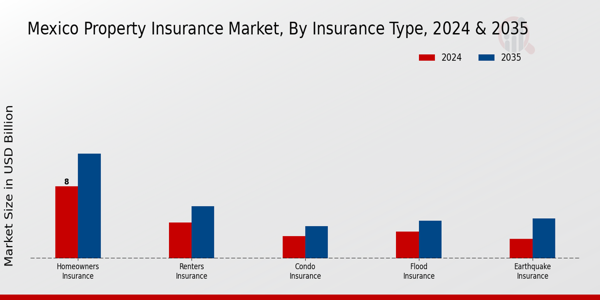

The Mexico Property Insurance Market, particularly within the realm of Insurance Type, comprises critical segments that outline the diverse coverage options available to policyholders. Homeowners Insurance stands out as a significant component, providing essential protection for residential properties against various risks such as fire, theft, and liability claims. It plays a fundamental role in safeguarding investments for the growing middle-class population in urban areas of Mexico. Furthermore, Renters Insurance has emerged as an important product, especially in urban centers where a substantial portion of the population resides in rental properties.

By offering coverage for personal belongings and liability claims, it addresses the rising demand for protection among individuals who do not own their homes. Meanwhile, Condo Insurance remains a notable category, as Mexico's urbanization trend leads to an increase in multi-family living structures, necessitating protection for both the unit and shared areas against hazards like water damage or theft.In the face of increasing climate-related events, Flood Insurance has gained traction, providing crucial financial support to homeowners in flood-prone regions, emphasizing the need for enhanced risk management solutions.

Similarly, Earthquake Insurance has become a vital offering for Mexican homeowners, given the country's geographical positioning along the Pacific Ring of Fire, where seismic activities are prevalent. The government encourages the adoption of such policies to mitigate risks and to bolster the resilience of communities against natural disasters. The significance of these varied insurance types lies in their ability to address specific risks faced by property owners and renters alike, thereby reflecting a growing awareness regarding the importance of securing personal and commercial assets. Overall, the Mexico Property Insurance Market continues to evolve, driven by demographic changes, urbanization trends, and heightened environmental awareness, demonstrating a solid adaptability to the unique needs of its consumers.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Mexico Property Insurance Market is significantly influenced by the diverse Coverage Type options available to consumers, each serving unique needs. Among these, Actual Cash Value is crucial as it provides policyholders with compensation for losses adjusted for depreciation, making it a feasible choice for many. In contrast, Replacement Cost coverage offers policyholders the ability to replace damaged property at current market value, presenting an attractive option for those wanting to ensure full replacement without deduction for depreciation.Extended Replacement Cost goes a step further, allowing for coverage above the stated limit, which is vital in an ever-increasing market where property values can rise unexpectedly.

Lastly, Guaranteed Replacement Cost provides the highest level of security, ensuring that policyholders can replace their property regardless of cost, which is particularly important in a landscape marked by fluctuations in construction costs and regional economic conditions. These Coverage Types not only reflect the growing awareness among consumers in Mexico regarding financial security but also highlight the overall evolution of the Mexico Property Insurance Market towards accommodating varying consumer preferences and risk management strategies.As the market expands, each Coverage Type will continue to capture essential segments of property owners seeking to protect their assets effectively.

Property Insurance Market End Use Insights

The Mexico Property Insurance Market showcases promising potential across various end-use categories, including Residential, Commercial, and Industrial sectors. The Residential segment is pivotal as it caters to the growing homeowner demographic in Mexico, where increased awareness about property security drives demand for insurance coverage against natural disasters and theft. The Commercial segment plays a significant role, especially in urban areas witnessing economic growth, encouraging businesses to secure their assets from various risks, and is influenced by increasing commercial activities and investments in retail sectors.

Meanwhile, the Industrial segment is equally essential, with a focus on capital-intensive industries that necessitate comprehensive insurance to mitigate risks linked to operations and equipment. Overall, the evolution of urbanization in Mexico, along with government initiatives promoting infrastructural development, is contributing to the market growth and the increasing significance of these end-use sectors within the Mexico Property Insurance Market landscape. The diversification of insurance products tailored to meet the unique needs of these segments further enhances attractiveness and accessibility, thereby expanding overall market participation.

Property Insurance Market Distribution Channel Insights

The Distribution Channel segment of the Mexico Property Insurance Market plays a crucial role in reaching consumers effectively. Direct Sales offers a personalized approach, allowing insurance providers to maintain direct communication with customers, which enhances trust and satisfaction. Brokerage channels serve as intermediaries, providing valuable market insights and facilitating tailored insurance solutions that meet varying consumer needs, thus significantly impacting market dynamics.

In recent years, Online Platforms have gained traction, simplifying the purchasing process for tech-savvy Mexican consumers and offering convenience and immediate access to product information, thereby transforming how insurance products are marketed and sold.Additionally, Banks have emerged as significant players in the distribution of property insurance, leveraging their established trust and customer bases to cross-sell insurance alongside their financial products. Collectively, these channels contribute to the overall success of the Mexico Property Insurance Market by ensuring accessibility, convenience, and tailored solutions for consumers while fostering competition among insurers, which ultimately benefits policyholders.

Mexico Property Insurance Market Key Players and Competitive Insights

The Mexico Property Insurance Market is characterized by a diverse array of players, each contributing to the competitive landscape that shapes the industry. With a growing awareness of the need for property insurance among consumers due to increasing natural disasters and economic uncertainties, companies are actively vying for market share.

The competitive insights reveal a trend toward innovation in product offerings and service delivery as firms seek to differentiate themselves in a crowded marketplace. Additionally, the presence of both international and domestic insurers enhances competition, driving improvements in service quality and customer satisfaction. Regulatory frameworks and economic conditions further influence the strategic decisions made by these companies as they adapt to meet the evolving needs of the Mexican populace.

Banorte has a notable presence in the Mexico Property Insurance Market, leveraging its strong brand reputation and extensive distribution network to provide a range of property insurance solutions. The company’s strength lies in its ability to tap into its broad banking infrastructure, which allows it to offer bundled financial services that integrate seamlessly with property insurance products. This holistic approach not only strengthens customer relations but also enhances cross-selling opportunities.

Furthermore, Banorte stands out for its commitment to customer service and innovation, making strides in leveraging technology to streamline claims processing and improve customer interactions, thus establishing a loyal customer base that relies on its expertise and financial stability in a competitive market.

AXA Mexico plays a crucial role in the country’s property insurance sector, delivering comprehensive coverage options tailored for both individuals and businesses. The company offers diverse products, including homeowners insurance, commercial property coverage, and specialized policies for high-value assets, demonstrating its ability to cater to varied customer needs within the Mexican market. AXA Mexico’s robust market presence is bolstered by its reputation for reliability and strong claims support, which resonates well with consumers seeking peace of mind.

Furthermore, the company's strategic focus on digital transformation and partnerships fosters innovation, enabling it to enhance customer experience and streamline operations. Through mergers and acquisitions, AXA Mexico has strengthened its position, enabling it to expand its offerings and improve service delivery in this competitive landscape, making it a formidable player in the property insurance market.

Key Companies in the Mexico Property Insurance Market Include:

- Banorte

- AXA Mexico

- NSM Seguros

- Allianz Mexico

- Zurich Mexico

- Seguros Monterrey New York Life

- Chubb Mexico

- Qualitas Controladora

- Grupo Nacional Provincial

- HDI Seguros

- Sancor Seguros

- MetLife

- Mapfre Mexico

- BBase Seguros

- GNP Seguros

Mexico Property Insurance Market Developments

The Mexico Property Insurance Market has witnessed several significant developments in recent months. As of September 2023, Banorte and Seguros Monterrey New York Life have prominently increased their market presence, aiming to enhance customer engagement and improve their product offerings. In a notable development, AXA Mexico announced the launch of a new suite of property insurance products designed to cater to the growing demand for comprehensive coverage among residential clients.

Meanwhile, Allianz Mexico has reported a steady growth rate, contributing to the overall market shift towards digitalization and automation in policy administration. Merger and acquisition activity remains a vital aspect, with GNP Seguros acquiring a minor local insurance provider in July 2023, thereby expanding its geographic footprint. Zurich Mexico has also been actively campaigning for sustainability in insurance practices, reflecting a broader trend within the industry.

Companies like Chubb Mexico and Qualitas Controladora continue to innovate in claims processing technology, enhancing customer experience. Additionally, the push towards ethical and transparent underwriting practices is reshaping competitive strategies among major players, including Mapfre Mexico and HDI Seguros, as they adapt to regulatory changes in the country.

Mexico Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the Mexico Property Insurance Market in 2024?

The Mexico Property Insurance Market is expected to be valued at 19.66 billion USD in 2024.

What is the projected market growth rate for the Mexico Property Insurance Market from 2025 to 2035?

The expected compound annual growth rate (CAGR) for the Mexico Property Insurance Market from 2025 to 2035 is 3.796%.

What will be the market size of Homeowners Insurance in 2035?

Homeowners Insurance in the Mexico Property Insurance Market is expected to reach 11.6 billion USD by 2035.

Which insurance type is expected to have the highest market value in 2024?

Homeowners Insurance will have the highest market value, projected at 8.0 billion USD in 2024.

What are the key players in the Mexico Property Insurance Market?

Major players in the market include Banorte, AXA Mexico, Allianz Mexico, and others, contributing significantly to market dynamics.

What is the expected growth value for Earthquake Insurance from 2024 to 2035?

Earthquake Insurance is expected to grow from 2.16 billion USD in 2024 to 4.42 billion USD by 2035.

What is the market size for Renters Insurance in 2024?

Renters Insurance in the Mexico Property Insurance Market is valued at 4.0 billion USD in 2024.

How much is the Flood Insurance market expected to grow by 2035?

Flood Insurance is expected to grow from 3.0 billion USD in 2024 to 4.2 billion USD by 2035.

What is the expected market size for Condo Insurance in 2035?

Condo Insurance is projected to reach a market size of 3.6 billion USD in 2035.

How does the Mexico Property Insurance Market reflect potential opportunities and challenges?

The market presents opportunities driven by urbanization and climate challenges, fostering demand for various insurance types.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”