Growing Awareness of Cybersecurity Threats

the market in Mexico is also being shaped by the growing awareness of cybersecurity threats. As cyberattacks become more sophisticated, organizations are increasingly prioritizing security in their networking strategies. This heightened awareness is prompting businesses to seek solutions that not only provide connectivity but also incorporate robust security features. Recent reports indicate that 65% of Mexican enterprises are investing in enhanced security measures as part of their networking solutions. This trend underscores the importance of integrating security into the network as-a-service offerings. As organizations navigate the complexities of cybersecurity, the demand for secure networking solutions is expected to drive growth in the market, presenting opportunities for service providers to differentiate themselves through comprehensive security features.

Growing Demand for Flexible Networking Solutions

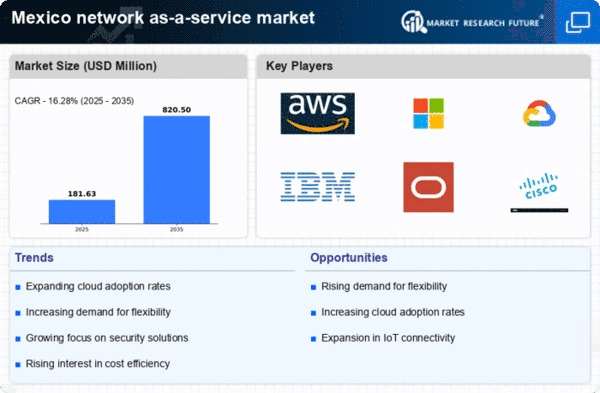

the network as-a-service market in Mexico is experiencing a notable surge in demand for flexible solutions. Businesses are increasingly seeking to adapt their network infrastructure to meet dynamic operational needs. This shift is driven by the necessity for scalability and agility in a competitive landscape. According to recent data, approximately 60% of enterprises in Mexico are prioritizing flexible networking options to enhance their operational efficiency. This trend indicates a significant opportunity for service providers to offer tailored solutions that align with the evolving requirements of businesses. As organizations continue to embrace digital transformation, the network as-a-service market is likely to expand, catering to the diverse needs of various sectors, including finance, healthcare, and retail.

Investment in Digital Transformation Initiatives

In Mexico, the ongoing investment in digital transformation initiatives is a critical driver for the network as-a-service market. Organizations are allocating substantial budgets to modernize their IT infrastructure, with a reported increase of 25% in IT spending over the past year. This investment is aimed at enhancing operational efficiency and improving customer experiences. As companies transition to more digital-centric models, the demand for advanced networking solutions is expected to rise. The network as-a-service market stands to benefit from this trend, as businesses seek to leverage cloud-based networking solutions that offer cost-effectiveness and improved performance. The alignment of digital transformation strategies with networking needs presents a promising landscape for growth in the market.

Rising Need for Cost-Effective Networking Solutions

the market in Mexico is significantly influenced by the rising need for cost-effective networking solutions. Many organizations are facing budget constraints and are looking for ways to optimize their IT expenditures. The shift towards subscription-based models allows businesses to reduce upfront capital investments while maintaining access to advanced networking technologies. Recent surveys indicate that nearly 70% of Mexican companies are considering network as-a-service options to manage costs effectively. This trend suggests a growing recognition of the financial benefits associated with adopting as-a-service models. As organizations strive to balance performance and budgetary considerations, the network as-a-service market is likely to see increased adoption across various industries.

Enhanced Focus on Network Performance and Reliability

In the context of the network as-a-service market, there is an enhanced focus on network performance and reliability among Mexican enterprises. As businesses increasingly rely on digital platforms for their operations, the demand for high-performance networking solutions has intensified. Organizations are prioritizing service level agreements (SLAs) that guarantee uptime and performance metrics. Recent data shows that 80% of companies in Mexico consider network reliability a top priority when selecting service providers. This emphasis on performance is driving innovation within the network as-a-service market, as providers strive to deliver solutions that meet stringent performance criteria. The competitive landscape is likely to evolve as businesses seek partners that can ensure optimal network performance.