Growth in Automotive Sector

The automotive industry in Mexico is a significant driver for the lead acid-battery market. With the country being a major hub for automobile manufacturing, the demand for lead acid batteries in vehicles remains robust. In 2025, it is estimated that the automotive sector will contribute to over 40% of the total lead acid-battery consumption in Mexico. This growth is fueled by the increasing production of both conventional and electric vehicles, where lead acid batteries are often used for starting, lighting, and ignition systems. The automotive sector's expansion not only supports the lead acid-battery market but also encourages advancements in battery technology to meet evolving automotive needs.

Increased Recycling Efforts

The lead acid battery market in Mexico is positively impacted by heightened recycling efforts. The country has implemented regulations aimed at promoting the recycling of lead acid batteries, which not only addresses environmental concerns but also supports the circular economy. In 2025, it is anticipated that the recycling rate for lead acid batteries will reach approximately 95%, significantly reducing the need for new raw materials. This trend not only enhances sustainability but also lowers production costs, making lead acid batteries more competitive in the market. The emphasis on recycling is likely to bolster the lead acid-battery market by ensuring a steady supply of recycled materials for battery production.

Infrastructure Development Initiatives

Infrastructure development in Mexico is a critical factor influencing the lead acid-battery market. The government's commitment to enhancing transportation and energy infrastructure has led to increased investments in various projects. In 2025, infrastructure spending is expected to rise by 10%, creating a higher demand for lead acid batteries in applications such as backup power systems and uninterruptible power supplies (UPS). These batteries are essential for ensuring operational continuity in critical infrastructure, including hospitals, data centers, and transportation systems. As infrastructure projects progress, the lead acid-battery market is likely to benefit from the growing need for reliable power solutions.

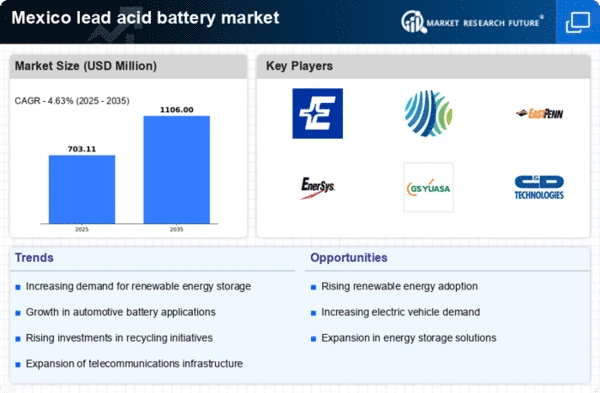

Rising Demand for Renewable Energy Storage

The lead acid-battery market in Mexico is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources. As the country aims to enhance its energy mix, the need for efficient energy storage solutions becomes paramount. Lead acid batteries, known for their cost-effectiveness and reliability, are being utilized to store energy generated from solar and wind sources. In 2025, the renewable energy sector in Mexico is projected to grow by approximately 15%, further driving the lead acid-battery market. This trend indicates a shift towards sustainable energy practices, where lead acid batteries play a crucial role in stabilizing energy supply and ensuring grid reliability.

Technological Innovations in Battery Manufacturing

Technological innovations in battery manufacturing are shaping the lead acid-battery market in Mexico. Advances in production techniques and materials are enhancing the performance and lifespan of lead acid batteries. In 2025, it is expected that new manufacturing processes will improve energy density and reduce charging times, making these batteries more appealing for various applications. The integration of smart technologies in battery management systems is also on the rise, allowing for better monitoring and efficiency. These innovations are likely to attract new investments in the lead acid-battery market, as manufacturers seek to meet the growing demands of consumers and industries alike.