Rising Industrial Applications

The industrial sector's growing reliance on lead acid batteries is a significant driver for the Lead Acid Battery Market. Industries such as telecommunications, construction, and material handling increasingly utilize lead acid batteries for backup power and operational efficiency. In 2025, the demand for uninterrupted power supply systems is anticipated to rise, further bolstering the lead acid battery's role in industrial applications. The durability and robustness of lead acid batteries make them suitable for harsh environments, enhancing their appeal in various industrial settings. This trend suggests that the Lead Acid Battery Market will continue to thrive as industries seek reliable energy solutions.

Increasing Demand for Electric Vehicles

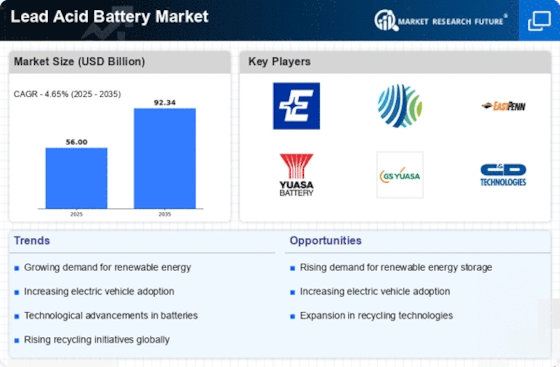

The rising demand for electric vehicles (EVs) is a pivotal driver for the Lead Acid Battery Market. As governments and consumers increasingly prioritize sustainable transportation solutions, the need for reliable energy storage systems becomes paramount. In 2025, the EV market is projected to grow significantly, with lead acid batteries playing a crucial role in providing the necessary power for various vehicle functions. This trend is further supported by the expansion of charging infrastructure and advancements in battery technology, which enhance the performance and lifespan of lead acid batteries. Consequently, the Lead Acid Battery Market is likely to experience substantial growth as manufacturers adapt to meet the evolving needs of the automotive sector.

Regulatory Support for Battery Recycling

Regulatory frameworks promoting battery recycling are influencing the Lead Acid Battery Market positively. Governments worldwide are implementing policies aimed at reducing waste and encouraging the recycling of lead acid batteries. In 2025, the emphasis on circular economy principles is expected to drive the demand for recycled lead acid batteries, which can be produced at a lower environmental cost. This regulatory support not only enhances the sustainability of the lead acid battery lifecycle but also fosters innovation in recycling technologies. As a result, the Lead Acid Battery Market is likely to benefit from increased consumer awareness and regulatory incentives.

Technological Innovations in Battery Design

Technological advancements in battery design are reshaping the Lead Acid Battery Market. Innovations such as improved grid design and enhanced electrolyte formulations are leading to batteries with higher efficiency and longer life spans. In 2025, these advancements are expected to attract new applications and markets, particularly in sectors requiring high-performance energy storage solutions. The integration of smart technologies into lead acid batteries is also anticipated to enhance their functionality, making them more appealing to consumers. This trend indicates that the Lead Acid Battery Market is on the cusp of a transformation, driven by continuous innovation and the pursuit of enhanced performance.

Growth in Renewable Energy Storage Solutions

The transition towards renewable energy sources is driving the Lead Acid Battery Market, particularly in energy storage applications. As solar and wind energy installations proliferate, the demand for efficient energy storage systems is increasing. Lead acid batteries, known for their cost-effectiveness and reliability, are often utilized in off-grid renewable energy systems. In 2025, the market for energy storage solutions is expected to expand, with lead acid batteries providing a viable option for balancing supply and demand. This growth is indicative of a broader trend towards sustainable energy practices, positioning the Lead Acid Battery Market as a key player in the renewable energy landscape.