Rising Demand for Automation

The industrial networking-solutions market in Mexico experiences a notable surge in demand for automation technologies. As industries strive for enhanced efficiency and productivity, the integration of automated systems becomes paramount. This trend is particularly evident in manufacturing sectors, where automation can lead to a reduction in operational costs by up to 20%. The push for automation is driven by the need to optimize processes and minimize human error. Consequently, companies are increasingly investing in networking solutions that facilitate seamless communication between machines and systems. This shift not only enhances operational efficiency but also positions businesses to respond swiftly to market changes. The industrial networking-solutions market is thus poised for growth as organizations prioritize automation to remain competitive in a rapidly evolving landscape.

Increased Focus on Data Analytics

The industrial networking-solutions market in Mexico is witnessing an increased focus on data analytics as organizations seek to harness the power of big data. Companies are recognizing the value of data-driven decision-making, which can lead to improved operational efficiency and enhanced customer experiences. The integration of advanced networking solutions enables real-time data collection and analysis, allowing businesses to identify trends and optimize processes. This trend is particularly relevant in sectors such as logistics and supply chain management, where data analytics can reduce costs by up to 15%. As the demand for data-driven insights grows, the industrial networking-solutions market is likely to expand, with companies investing in technologies that facilitate effective data management and analysis.

Investment in Infrastructure Development

Investment in infrastructure development is a key driver for the industrial networking-solutions market in Mexico. The government is actively promoting initiatives aimed at modernizing industrial infrastructure, which includes upgrading networking capabilities. This investment is expected to reach approximately $5 billion over the next three years, significantly impacting the industrial networking-solutions market. Enhanced infrastructure not only supports the deployment of advanced networking technologies but also attracts foreign investment and fosters economic growth. As industries upgrade their infrastructure, the demand for reliable and efficient networking solutions is likely to increase, positioning the industrial networking-solutions market for substantial growth in the coming years.

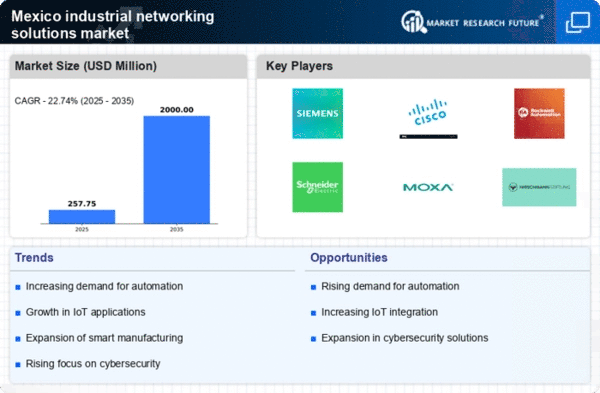

Expansion of Smart Manufacturing Initiatives

Smart manufacturing initiatives are gaining traction within the industrial networking-solutions market in Mexico. The government and private sectors are increasingly focusing on the implementation of smart technologies to enhance production capabilities. This shift is expected to contribute to a projected growth rate of 15% in the industrial networking-solutions market over the next five years. By leveraging advanced networking solutions, manufacturers can achieve real-time data analytics, predictive maintenance, and improved supply chain management. The integration of these technologies not only streamlines operations but also fosters innovation and sustainability. As companies adopt smart manufacturing practices, the demand for robust networking solutions that support these initiatives is likely to escalate, driving further investment in the industrial networking-solutions market.

Growing Importance of Interoperability Standards

Interoperability standards are becoming increasingly crucial in the industrial networking-solutions market in Mexico. As industries adopt diverse technologies and systems, the need for seamless communication between different platforms is paramount. The establishment of standardized protocols can enhance compatibility and reduce integration challenges, thereby fostering collaboration among various stakeholders. This trend is particularly significant in sectors such as energy and manufacturing, where diverse systems must work together efficiently. The push for interoperability is expected to drive innovation in networking solutions, as companies seek to develop products that comply with these standards. Consequently, the industrial networking-solutions market may experience growth as organizations prioritize interoperability to enhance operational efficiency and reduce costs.