Emergence of Edge Computing

The Industrial Networking Solutions Market is being shaped by the emergence of edge computing technologies. As industries increasingly adopt IoT devices, the need for processing data closer to the source is becoming essential. Edge computing allows for real-time data processing and analysis, reducing latency and enhancing operational efficiency. Recent forecasts suggest that the edge computing market could reach a valuation of over 15 billion by 2025. This trend is driving the demand for industrial networking solutions that can support edge devices and facilitate seamless communication between the edge and the cloud. As organizations recognize the benefits of edge computing, the Industrial Networking Solutions Market is likely to experience significant growth, as companies invest in networking solutions that enable efficient data management and processing.

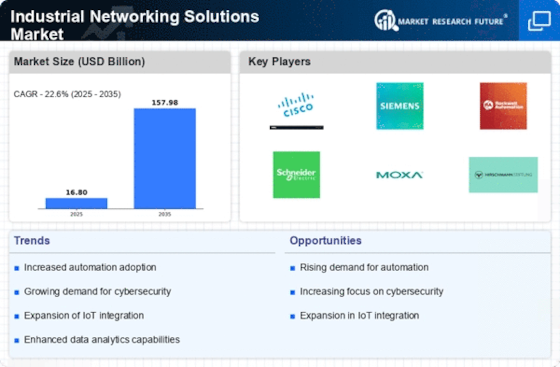

Rising Demand for Automation

The Industrial Networking Solutions Market is experiencing a notable surge in demand for automation across various sectors. Industries are increasingly adopting automated processes to enhance efficiency and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend is driving the need for robust networking solutions that can support real-time data exchange and communication between devices. As manufacturers seek to optimize production lines and improve supply chain management, the reliance on advanced networking solutions becomes paramount. Consequently, this growing demand for automation is likely to propel the Industrial Networking Solutions Market forward, as companies invest in technologies that facilitate seamless connectivity and data sharing.

Growing Focus on Data Analytics

The Industrial Networking Solutions Market is witnessing a growing focus on data analytics as organizations seek to leverage data for informed decision-making. The ability to collect, analyze, and utilize data in real-time is becoming a critical factor for competitive advantage. Recent reports suggest that the data analytics market is projected to grow at a CAGR of around 25% in the coming years. This trend is driving the demand for advanced networking solutions that can facilitate the seamless transfer of large volumes of data from various sources. As industries recognize the value of data-driven insights, the need for robust industrial networking solutions becomes increasingly apparent. Consequently, this emphasis on data analytics is likely to propel the growth of the Industrial Networking Solutions Market, as companies invest in technologies that enable effective data management and analysis.

Expansion of Smart Manufacturing

The Industrial Networking Solutions Market is significantly influenced by the expansion of smart manufacturing initiatives. As industries strive to implement Industry 4.0 principles, the integration of smart technologies is becoming increasingly prevalent. This shift is characterized by the use of interconnected devices, sensors, and data analytics to optimize production processes. Recent statistics indicate that the smart manufacturing market is expected to reach a valuation of over 500 billion by 2026. This growth is fostering a heightened demand for industrial networking solutions that can support the connectivity and interoperability of various devices. As manufacturers embrace smart technologies, the Industrial Networking Solutions Market is poised to benefit from the increased need for reliable and efficient networking infrastructure.

Increased Investment in Infrastructure

The Industrial Networking Solutions Market is benefiting from increased investment in infrastructure development across various sectors. Governments and private entities are allocating substantial resources to enhance connectivity and modernize industrial facilities. Recent data indicates that infrastructure spending is expected to reach trillions in the next decade, with a significant portion directed towards upgrading networking capabilities. This investment is crucial for supporting the growing demand for high-speed communication and data transfer in industrial environments. As industries seek to improve operational efficiency and reduce downtime, the need for advanced networking solutions becomes evident. Therefore, the influx of investment in infrastructure is likely to drive the growth of the Industrial Networking Solutions Market, as companies strive to implement state-of-the-art networking technologies.