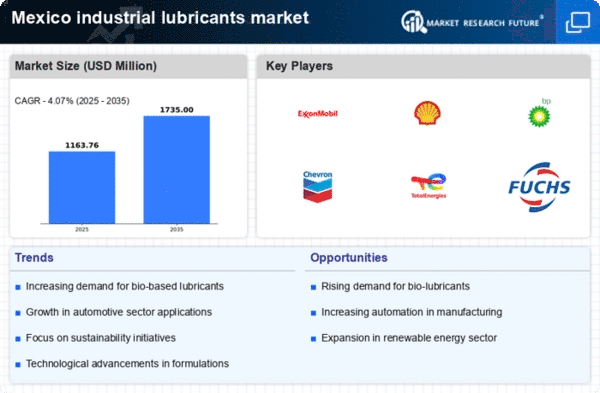

The industrial lubricants market in Mexico is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as ExxonMobil (US), Shell (GB), and BP (GB) are actively pursuing strategies that emphasize technological advancements and eco-friendly product lines. ExxonMobil (US), for instance, has been focusing on enhancing its product portfolio with high-performance lubricants that cater to the evolving needs of various industries, thereby solidifying its market position. Shell (GB) has also been investing in digital transformation initiatives, which aim to optimize supply chain efficiencies and improve customer engagement, while BP (GB) is leveraging its The industrial lubricants market share through strategic acquisitions and collaborations.The business tactics employed by these companies reflect a moderately fragmented market structure, where localized manufacturing and supply chain optimization play crucial roles. The collective influence of these key players is significant, as they not only drive innovation but also set industry standards that smaller competitors must follow. This competitive environment encourages continuous improvement and adaptation, which is essential for maintaining market relevance.

In October Shell (GB) announced a partnership with a local Mexican firm to develop bio-based lubricants aimed at reducing environmental impact. This strategic move underscores Shell's commitment to sustainability and positions it favorably in a market that increasingly values eco-friendly solutions. The collaboration is expected to enhance Shell's product offerings while simultaneously supporting local economic growth.

In September BP (GB) launched a new line of synthetic lubricants specifically designed for the automotive sector, which incorporates advanced additives to improve performance and longevity. This initiative not only reflects BP's focus on innovation but also addresses the growing demand for high-quality lubricants in Mexico's automotive industry. The introduction of these products is likely to strengthen BP's competitive edge and attract a broader customer base.

In August ExxonMobil (US) expanded its distribution network in Mexico by establishing new partnerships with regional distributors. This strategic action aims to enhance product availability and customer service, thereby reinforcing ExxonMobil's market presence. By optimizing its distribution channels, the company is better positioned to respond to market demands and improve overall operational efficiency.

As of November the competitive trends in the industrial lubricants market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based strategies to a focus on technological advancements and sustainable practices, which are likely to become the new benchmarks for success in this dynamic market.