Rising Labor Costs

In Mexico, rising labor costs are compelling manufacturers to seek automation solutions to maintain profitability. As wages increase, companies are exploring ways to reduce reliance on manual labor, which is driving demand for automation services. The industrial automation-services market is likely to benefit from this trend, as businesses invest in robotics and automated systems to enhance efficiency. Reports indicate that labor costs in the manufacturing sector have risen by approximately 10% over the past two years. This economic pressure is expected to accelerate the adoption of automation technologies, thereby propelling growth in the industrial automation-services market.

Government Initiatives and Support

The Mexican government is actively promoting the industrial automation-services market through various initiatives aimed at enhancing productivity and competitiveness. Programs that provide financial incentives for adopting automation technologies are becoming more prevalent. For instance, the government has allocated approximately $500 million to support small and medium-sized enterprises (SMEs) in their automation efforts. This financial backing is expected to stimulate growth in the industrial automation-services market, as SMEs represent a significant portion of the manufacturing sector. The government's commitment to fostering innovation and technological adoption is likely to create a favorable environment for market expansion.

Increased Focus on Quality Control

Quality control remains a critical concern for manufacturers in Mexico, leading to a heightened demand for automation services. The industrial automation-services market is witnessing a shift towards solutions that enhance product quality and consistency. Automated inspection systems and real-time monitoring technologies are being integrated into production lines to minimize defects and ensure compliance with industry standards. This focus on quality is likely to drive market growth, as companies recognize the importance of maintaining high standards to compete effectively. The trend suggests that investments in automation for quality assurance will continue to rise in the coming years.

Technological Advancements in Automation

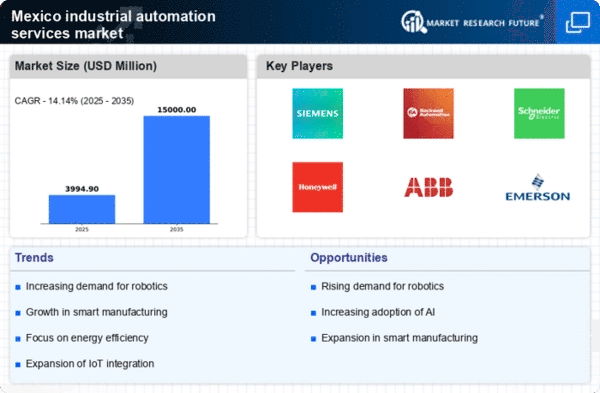

The industrial automation-services market in Mexico is experiencing a surge due to rapid technological advancements. Innovations in artificial intelligence (AI), machine learning, and the Internet of Things (IoT) are transforming traditional manufacturing processes. These technologies enable real-time data analysis, predictive maintenance, and enhanced operational efficiency. As a result, companies are increasingly investing in automation solutions to remain competitive. In 2025, the market is projected to grow by approximately 15%, driven by the need for improved productivity and reduced operational costs. This trend indicates a strong shift towards integrating advanced technologies within the industrial automation-services market.

Expansion of E-commerce and Supply Chain Optimization

The growth of e-commerce in Mexico is reshaping the industrial landscape, necessitating improvements in supply chain efficiency. The industrial automation-services market is poised to benefit from this trend, as companies seek to optimize their logistics and distribution processes. Automation technologies, such as warehouse management systems and automated sorting solutions, are being adopted to enhance operational efficiency. As e-commerce continues to expand, the demand for automation services is expected to rise significantly. This shift indicates a potential growth trajectory for the industrial automation-services market, driven by the need for streamlined supply chain operations.