Rising Energy Demand

Mexico's increasing energy demand is a critical driver for the hydrogen electrolyzer market. As the population grows and industrial activities expand, the need for sustainable energy sources becomes more pressing. The country's energy consumption is expected to rise by approximately 2.5% annually, necessitating innovative solutions to meet this demand. Hydrogen, produced through electrolyzers, offers a viable alternative to traditional fossil fuels, particularly in sectors such as transportation and manufacturing. The hydrogen electrolyzer market is poised to capitalize on this trend, as industries seek to diversify their energy sources and reduce carbon footprints. This shift towards cleaner energy solutions is likely to propel the market forward, potentially leading to a doubling of electrolyzer installations by 2030.

Regulatory Support for Clean Energy

The hydrogen electrolyzer market in Mexico benefits from robust regulatory frameworks aimed at promoting clean energy solutions. The Mexican government has established various policies that incentivize the adoption of renewable energy technologies, including hydrogen production. For instance, the Energy Transition Law encourages investments in clean energy projects, which could lead to a projected increase in hydrogen production capacity by 30% by 2030. This regulatory support not only fosters a conducive environment for market growth but also aligns with Mexico's commitment to reducing greenhouse gas emissions by 22% by 2030. As a result, the hydrogen electrolyzer market is expected to experience significant expansion, driven by favorable policies and financial incentives.

Technological Innovations in Electrolysis

Technological innovations in electrolysis are transforming the hydrogen electrolyzer market in Mexico. Advances in electrolyzer technology, such as proton exchange membrane (PEM) and alkaline electrolyzers, are enhancing efficiency and reducing operational costs. These innovations are crucial as they enable the production of green hydrogen at competitive prices, making it an attractive option for various industries. The market is witnessing a shift towards more efficient systems, with some manufacturers reporting efficiency improvements of up to 20%. This technological progress not only supports the growth of the hydrogen electrolyzer market but also aligns with Mexico's goals of achieving energy independence and sustainability. As these technologies continue to evolve, they are expected to play a pivotal role in the market's expansion.

Investment in Renewable Energy Infrastructure

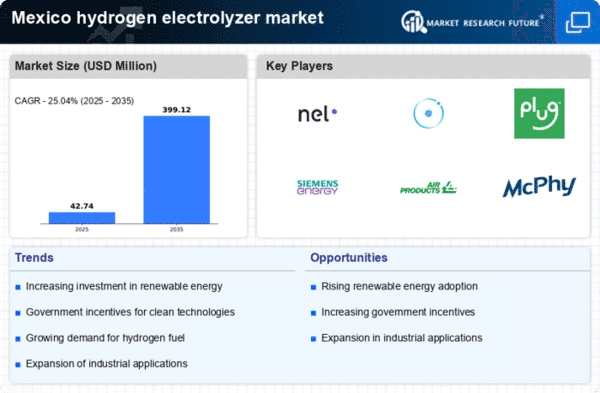

Investment in renewable energy infrastructure is a significant driver for the hydrogen electrolyzer market in Mexico. The government and private sector are increasingly channeling funds into renewable energy projects, with a focus on solar and wind energy. In 2025, investments in renewable energy are projected to reach $10 billion, creating a favorable landscape for hydrogen production. This influx of capital not only enhances the capacity for renewable energy generation but also facilitates the integration of hydrogen electrolyzers into the energy mix. As a result, the hydrogen electrolyzer market is likely to see accelerated growth, with an anticipated increase in production facilities and technological advancements that improve efficiency and reduce costs.

Growing Awareness of Environmental Sustainability

Growing awareness of environmental sustainability among consumers and businesses is a key driver for the hydrogen electrolyzer market in Mexico. As climate change concerns escalate, there is a notable shift towards sustainable practices across various sectors. Companies are increasingly adopting green technologies to enhance their corporate social responsibility profiles. This trend is reflected in the rising demand for hydrogen as a clean energy source, which is perceived as a solution to reduce carbon emissions. The hydrogen electrolyzer market is likely to benefit from this heightened awareness, as more organizations seek to implement hydrogen solutions in their operations. This cultural shift towards sustainability could potentially lead to a 15% increase in hydrogen adoption rates by 2030, further propelling market growth.