Mexico Helium Market Summary

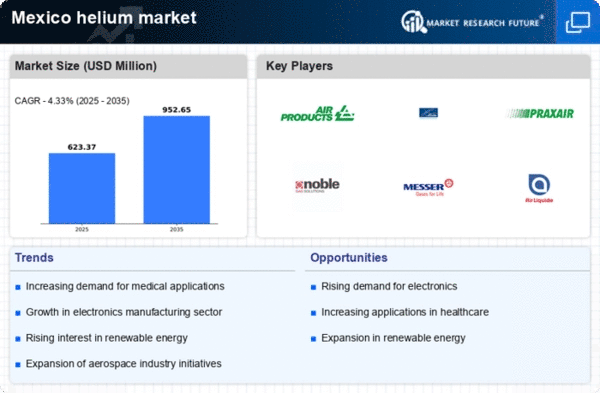

As per Market Research Future analysis, the Mexico helium market Size was estimated at 597.5 USD Million in 2024. The Helium market is projected to grow from 623.37 USD Million in 2025 to 952.65 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Mexico helium market is experiencing robust growth driven by diverse applications and technological advancements.

- The healthcare segment is the largest consumer of helium, driven by its use in MRI machines and other medical technologies.

- Technological innovations in extraction methods are enhancing the efficiency and sustainability of helium production.

- The party balloon industry is witnessing rapid growth, contributing to the overall demand for helium in consumer markets.

- Key market drivers include the expansion of industrial applications and the rising demand for research and development in emerging medical applications.

Market Size & Forecast

| 2024 Market Size | 597.5 (USD Million) |

| 2035 Market Size | 952.65 (USD Million) |

| CAGR (2025 - 2035) | 4.33% |

Major Players

Air Products and Chemicals Inc (US), Linde plc (IE), Praxair Technology Inc (US), Noble Gas Solutions Inc (US), Messer Group GmbH (DE), Air Liquide S.A. (FR), Helium One Global Ltd (GB), Universal Helium Inc (US), Gazprom (RU)