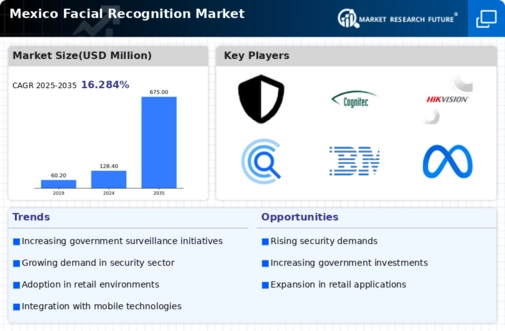

Commercial Adoption

The commercial sector in Mexico is increasingly adopting facial recognition technology, which is driving the growth of the Mexico facial recognition market. Retailers and financial institutions are integrating facial recognition systems to enhance customer experience and improve security measures. For example, banks are utilizing this technology for identity verification during transactions, which has reportedly reduced fraud cases by a notable margin. Additionally, retail chains are employing facial recognition for customer analytics, allowing them to tailor marketing strategies effectively. The commercial adoption of such technologies is projected to expand as businesses recognize the potential benefits of facial recognition systems in streamlining operations and enhancing security protocols, thereby contributing to the overall growth of the Mexico facial recognition market.

Government Initiatives

The Mexico facial recognition market is experiencing a surge in growth due to various government initiatives aimed at enhancing public safety and security. The Mexican government has been investing in advanced surveillance technologies, including facial recognition systems, to combat crime and improve law enforcement efficiency. For instance, the implementation of facial recognition technology in major cities like Mexico City has led to a reported decrease in crime rates. Furthermore, the government has allocated significant budgets for technology upgrades in police departments, which is expected to bolster the adoption of facial recognition systems across the nation. This proactive approach by the government not only fosters a safer environment but also encourages private sector investment in the Mexico facial recognition market.

Regulatory Developments

Regulatory developments play a crucial role in shaping the Mexico facial recognition market. The government is actively formulating policies to govern the use of facial recognition technology, ensuring that privacy concerns are addressed while promoting innovation. Recent discussions in legislative bodies indicate a move towards establishing clear guidelines for the deployment of facial recognition systems in both public and private sectors. This regulatory framework is expected to create a more favorable environment for investment in the Mexico facial recognition market, as companies will have clearer compliance requirements. Moreover, the establishment of ethical standards for the use of such technology may enhance public trust, further driving adoption rates across various sectors.

Technological Advancements

Technological advancements are significantly influencing the Mexico facial recognition market. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of facial recognition systems. As these technologies evolve, they are becoming more accessible to various sectors, including security, retail, and healthcare. For instance, the integration of real-time facial recognition capabilities is enabling law enforcement agencies to identify suspects more swiftly during public events. Additionally, advancements in cloud computing are facilitating the storage and processing of vast amounts of facial data, making it easier for organizations to implement these systems. The continuous evolution of technology is likely to propel the Mexico facial recognition market forward, as businesses and government entities seek to leverage these advancements for improved operational efficiency.

Public Awareness and Acceptance

Public awareness and acceptance of facial recognition technology are emerging as key drivers in the Mexico facial recognition market. As citizens become more informed about the benefits of facial recognition systems, such as enhanced security and streamlined services, there is a growing acceptance of its use in public spaces. Educational campaigns and community engagement initiatives are being implemented to address privacy concerns and promote the advantages of this technology. Surveys indicate that a significant portion of the population supports the use of facial recognition for public safety purposes, which is likely to encourage further investment and deployment of these systems. This shift in public perception is crucial for the sustained growth of the Mexico facial recognition market, as it fosters a conducive environment for both government and private sector initiatives.