Integration with Smart City Initiatives

The Japan facial recognition market is increasingly aligning with smart city initiatives, which aim to enhance urban living through technology. Cities like Tokyo are investing in smart infrastructure that incorporates facial recognition systems for various applications, including traffic management and public safety. This integration is expected to streamline operations and improve the quality of life for residents. The government has allocated significant funding for smart city projects, which may lead to a market valuation exceeding 250 billion yen by 2027. The collaboration between technology providers and municipal authorities is crucial in developing effective solutions that address urban challenges. Consequently, the Japan facial recognition market is poised for growth as it becomes an integral part of the smart city ecosystem.

Regulatory Framework and Compliance Standards

The Japan facial recognition market is influenced by the evolving regulatory framework and compliance standards surrounding data privacy and security. The government is actively working to establish guidelines that govern the use of facial recognition technology, ensuring that it aligns with privacy rights and ethical considerations. As organizations adopt facial recognition systems, they must navigate these regulations to avoid potential legal repercussions. The establishment of clear compliance standards is expected to foster trust among consumers and businesses alike, potentially leading to a market growth of 30% by 2028. This regulatory landscape will play a crucial role in shaping the future of the Japan facial recognition market, as it balances innovation with the need for responsible technology use.

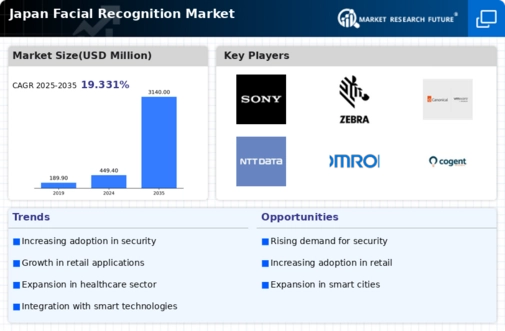

Growing Demand for Enhanced Security Solutions

The Japan facial recognition market is experiencing a notable surge in demand for enhanced security solutions. This trend is driven by increasing concerns over public safety and crime prevention. Government initiatives, such as the implementation of advanced surveillance systems in urban areas, are contributing to this growth. According to recent data, the market is projected to reach approximately 200 billion yen by 2026, reflecting a compound annual growth rate of around 15%. This growth is further supported by the integration of facial recognition technology in law enforcement agencies, which enhances their ability to identify suspects and prevent criminal activities. As a result, the Japan facial recognition market is likely to see continued investment in security applications, fostering innovation and technological advancements.

Rising Adoption in Retail and Customer Engagement

The Japan facial recognition market is witnessing a rising adoption of facial recognition technology in retail and customer engagement sectors. Retailers are increasingly utilizing this technology to personalize shopping experiences and enhance customer service. By analyzing customer demographics and preferences, businesses can tailor their offerings, leading to improved customer satisfaction and loyalty. Recent studies indicate that the retail sector's investment in facial recognition technology could reach 50 billion yen by 2026. This trend is indicative of a broader shift towards data-driven decision-making in retail, where understanding customer behavior is paramount. As a result, the Japan facial recognition market is likely to see sustained growth as retailers seek innovative ways to engage consumers.

Advancements in AI and Machine Learning Technologies

The Japan facial recognition market is benefiting from rapid advancements in artificial intelligence (AI) and machine learning technologies. These innovations enhance the accuracy and efficiency of facial recognition systems, making them more appealing to various sectors, including security, retail, and healthcare. The integration of AI algorithms allows for real-time processing and improved identification rates, which are critical for applications in high-security environments. As of January 2026, the market is estimated to be valued at around 180 billion yen, with a significant portion attributed to AI-driven solutions. This trend suggests that the Japan facial recognition market will continue to evolve, driven by technological advancements that enhance user experience and operational effectiveness.