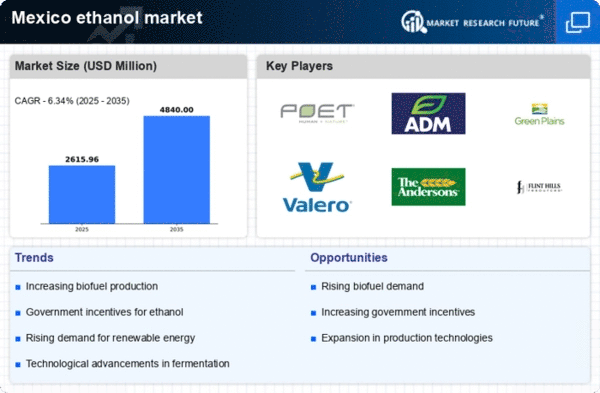

The ethanol market in Mexico is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as POET LLC (US), Archer Daniels Midland Company (US), and Valero Energy Corporation (US) are actively pursuing strategies that enhance their operational efficiencies and market presence. POET LLC (US) focuses on expanding its production capabilities while investing in advanced technologies to improve yield and reduce environmental impact. Archer Daniels Midland Company (US) emphasizes its commitment to sustainability through the development of biofuels and renewable energy solutions, which positions it favorably in a market that is progressively leaning towards greener alternatives. Valero Energy Corporation (US) is also enhancing its operational focus on renewable diesel and ethanol production, indicating a strategic pivot towards more sustainable energy sources. Collectively, these strategies contribute to a dynamic competitive environment where innovation and sustainability are paramount.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for a diverse range of products and services, fostering competition that drives innovation and responsiveness to market demands.

In October POET LLC (US) announced the launch of a new facility in Mexico aimed at increasing its ethanol production capacity by 30%. This strategic move is significant as it not only enhances POET's operational footprint in the region but also aligns with the growing demand for renewable fuels. The expansion is expected to create local jobs and stimulate economic growth, further solidifying POET's position as a leader in the market.

In September Archer Daniels Midland Company (US) entered into a partnership with a local agricultural cooperative to source feedstock for its ethanol production. This collaboration is strategically important as it ensures a stable supply of raw materials while supporting local farmers. By integrating local agricultural resources, ADM enhances its sustainability profile and strengthens its supply chain resilience, which is increasingly critical in today's market.

In August Valero Energy Corporation (US) completed the acquisition of a smaller ethanol producer in Mexico, which is expected to bolster its market share and operational capabilities. This acquisition reflects Valero's strategy to consolidate its position in the ethanol market while expanding its production capacity. The integration of the acquired company is likely to enhance Valero's efficiency and innovation potential, allowing it to better compete in a rapidly evolving landscape.

As of November current competitive trends in the ethanol market are heavily influenced by digitalization, sustainability initiatives, and the integration of artificial intelligence in production processes. Strategic alliances are becoming increasingly vital, as companies seek to leverage shared resources and expertise to enhance their competitive edge. Looking ahead, the competitive differentiation in the market is expected to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in navigating the complexities of the ethanol market.