Rising Environmental Awareness

Increasing environmental awareness among consumers is a significant driver for the Mexico Electric Vehicle Ev Insurance Market. As more individuals recognize the impact of traditional vehicles on climate change, there is a growing preference for electric vehicles as a sustainable alternative. Surveys indicate that over 60% of potential car buyers in Mexico are considering electric vehicles due to their lower carbon footprint. This shift in consumer mindset is prompting insurers to develop products that not only provide coverage but also promote eco-friendly practices. Insurers are likely to introduce discounts for electric vehicle owners who engage in sustainable driving behaviors, further incentivizing the transition to electric mobility. Thus, rising environmental awareness is a key factor influencing the growth of the Mexico Electric Vehicle Ev Insurance Market.

Government Incentives and Support

The Mexican government has implemented various incentives to promote electric vehicle adoption, which in turn fuels the Mexico Electric Vehicle Ev Insurance Market. Programs such as tax rebates, subsidies for electric vehicle purchases, and investments in charging infrastructure are designed to encourage consumers to transition to electric mobility. As of January 2026, the government has allocated over 1 billion pesos to support these initiatives, significantly impacting the insurance landscape. Insurers are responding by developing policies that align with government objectives, offering competitive rates and coverage options that appeal to environmentally conscious consumers. This synergy between government support and insurance offerings is likely to enhance market growth and consumer confidence in electric vehicle insurance.

Growing Electric Vehicle Adoption

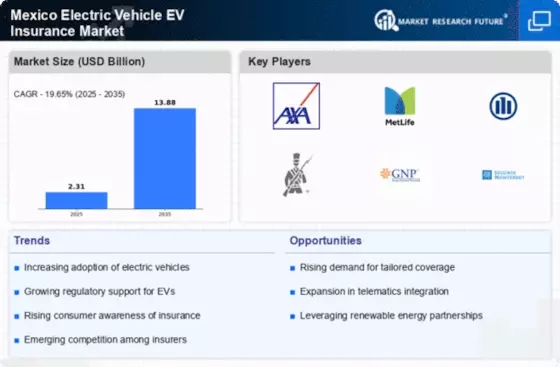

The Mexico Electric Vehicle Ev Insurance Market is experiencing a notable surge in electric vehicle adoption, driven by increasing consumer awareness and environmental concerns. As of January 2026, the number of electric vehicles registered in Mexico has surpassed 200,000, reflecting a growth rate of approximately 30% year-on-year. This rising trend necessitates specialized insurance products tailored to the unique needs of electric vehicle owners. Insurers are adapting their offerings to cover specific risks associated with electric vehicles, such as battery damage and charging infrastructure. Consequently, the growing electric vehicle adoption is a pivotal driver for the Mexico Electric Vehicle Ev Insurance Market, compelling insurers to innovate and expand their product lines to cater to this burgeoning segment.

Expansion of Charging Infrastructure

The expansion of charging infrastructure across Mexico is a critical driver for the Mexico Electric Vehicle Ev Insurance Market. As of January 2026, the number of public charging stations has increased significantly, with projections indicating a growth to over 10,000 stations nationwide. This enhanced accessibility alleviates range anxiety among potential electric vehicle owners, encouraging more consumers to consider electric vehicles as a viable option. Insurers are recognizing the importance of this infrastructure in their risk assessments and are likely to adjust their policies accordingly. The availability of charging stations not only supports the growth of electric vehicle adoption but also influences the insurance landscape, as insurers may offer specialized coverage for charging equipment and related services. Therefore, the expansion of charging infrastructure is a vital component driving the Mexico Electric Vehicle Ev Insurance Market.

Technological Innovations in Insurance

Technological advancements are reshaping the Mexico Electric Vehicle Ev Insurance Market, enabling insurers to offer more efficient and tailored products. The integration of telematics and data analytics allows insurers to assess risk more accurately and personalize insurance premiums based on driving behavior. As electric vehicles often come equipped with advanced technology, insurers can leverage this data to create innovative insurance solutions that cater specifically to electric vehicle owners. By January 2026, it is anticipated that a significant portion of insurers will adopt these technologies, enhancing customer experience and streamlining claims processes. This technological evolution is a crucial driver for the Mexico Electric Vehicle Ev Insurance Market, as it fosters a more competitive and responsive insurance environment.