Advancements in Sensor Technology

Technological advancements in sensor technology are significantly impacting the crowd analytics market. The proliferation of IoT devices and sophisticated sensors enables the collection of vast amounts of data related to crowd dynamics. In India, the integration of these technologies is expected to enhance the accuracy and efficiency of crowd monitoring systems. For instance, the deployment of thermal imaging cameras and mobile tracking applications allows for precise tracking of crowd density and movement. This is particularly relevant in sectors such as transportation and public events, where understanding crowd behavior is crucial. The market is likely to see an increase in investments in sensor technology, which could lead to more innovative solutions in crowd analytics, thereby driving market growth.

Increased Focus on Customer Experience

The heightened emphasis on customer experience is driving the crowd analytics market as businesses strive to understand consumer behavior more deeply. In India, retailers and service providers are increasingly adopting crowd analytics to tailor their offerings and enhance customer satisfaction. By analyzing foot traffic and customer interactions, companies can optimize store layouts, improve service delivery, and create personalized marketing strategies. The retail sector, in particular, is projected to witness a growth rate of around 20% in the adoption of crowd analytics solutions over the next five years. This focus on customer-centric strategies is likely to propel the demand for crowd analytics tools, as organizations recognize the importance of data in enhancing the overall customer journey.

Government Initiatives for Urban Planning

Government initiatives aimed at improving urban planning and infrastructure development are fostering growth in the crowd analytics market. In India, various state and central government projects focus on smart city development, which includes the implementation of crowd analytics solutions to manage urban spaces effectively. These initiatives often involve the use of data analytics to assess foot traffic patterns, optimize public transport routes, and enhance public safety. The Indian government has allocated substantial budgets for urban development, with an estimated $1.5 billion earmarked for smart city projects in the upcoming fiscal year. Such investments are likely to create a conducive environment for the crowd analytics market, as municipalities seek to utilize data-driven insights for better urban management.

Rising Security Concerns in Public Spaces

The growing concerns regarding security in public spaces are significantly influencing the crowd analytics market. In India, incidents of crowd-related incidents have prompted authorities and businesses to invest in crowd management solutions. The need for effective monitoring and analysis of crowd behavior is becoming increasingly critical, particularly in high-traffic areas such as malls, airports, and public events. The market is expected to expand as organizations seek to implement advanced analytics tools to enhance safety measures. With an estimated increase in spending on security technologies by 15% in the next year, the crowd analytics market is likely to benefit from this trend, as stakeholders prioritize the safety and security of individuals in crowded environments.

Growing Demand for Real-Time Data Analysis

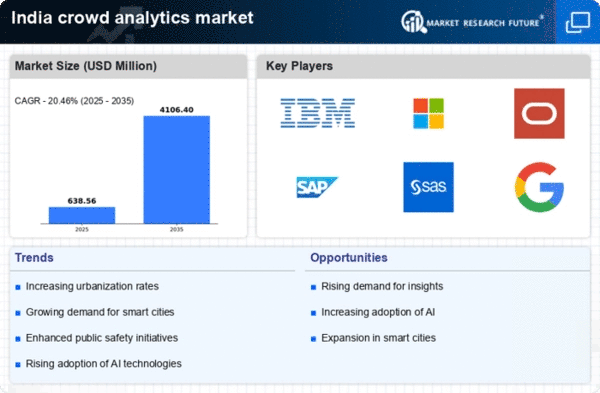

The increasing need for real-time data analysis is a primary driver in the crowd analytics market. Organizations across various sectors, including retail, transportation, and event management, are seeking to leverage crowd analytics to enhance decision-making processes. In India, the market is projected to grow at a CAGR of approximately 25% from 2025 to 2030, driven by the demand for immediate insights into crowd behavior and movement patterns. This trend is particularly evident in urban areas where large gatherings occur frequently. The ability to analyze data in real-time allows businesses to optimize operations, improve customer experiences, and enhance safety measures. Consequently, the crowd analytics market is witnessing a surge in adoption. as companies recognize the value of timely information in a fast-paced environment.