Enhanced Security Features

The blockchain insurance market in Mexico benefits from enhanced security features inherent in blockchain technology. By utilizing cryptographic techniques, blockchain provides a secure environment for storing sensitive data, which is crucial for insurance transactions. This heightened security reduces the risk of fraud, a significant concern in the insurance sector. According to recent estimates, fraud accounts for approximately 10% of total insurance claims in Mexico. The implementation of blockchain can potentially mitigate these losses, thereby increasing trust among consumers and insurers alike. As the market evolves, the demand for secure solutions is likely to drive growth in the blockchain insurance market, as stakeholders seek to protect their interests and ensure the integrity of their operations.

Cost Efficiency and Operational Savings

Cost efficiency is a pivotal driver for the blockchain insurance market in Mexico. By automating processes through smart contracts, insurers can significantly reduce administrative costs associated with policy management and claims processing. Reports indicate that operational costs in the insurance sector can be reduced by up to 30% with the adoption of blockchain technology. This reduction in costs not only benefits insurers but also translates to lower premiums for consumers, making insurance more accessible. As companies in Mexico increasingly recognize the financial advantages of blockchain, the market is poised for substantial growth, driven by the pursuit of operational savings and improved profitability.

Increased Consumer Awareness and Education

Increased consumer awareness and education regarding blockchain technology are driving factors in the blockchain insurance market in Mexico. As individuals become more informed about the benefits of blockchain, such as transparency and security, their willingness to engage with blockchain-based insurance products is likely to rise. Educational initiatives by industry stakeholders can enhance understanding and trust in these innovative solutions. This growing awareness may lead to a broader acceptance of blockchain insurance offerings, thereby expanding the market. As consumers demand more information and clarity, insurers will need to adapt their strategies to effectively communicate the advantages of blockchain technology in their products.

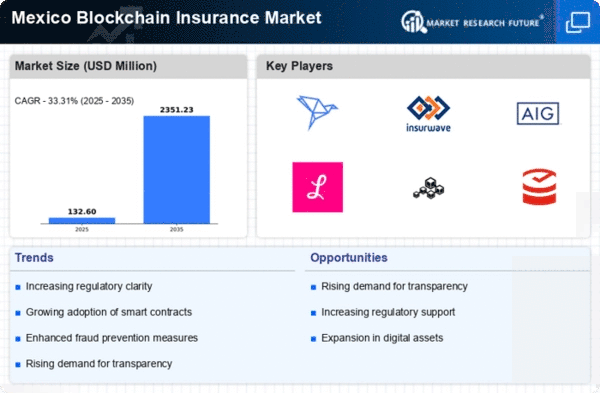

Regulatory Support and Framework Development

Regulatory support plays a crucial role in the blockchain insurance market in Mexico. The government has shown a willingness to explore and establish frameworks that facilitate the integration of blockchain technology within the insurance sector. This proactive approach is essential for fostering innovation and ensuring that the market operates within a secure and compliant environment. As regulations evolve, they are expected to provide clarity and guidance for insurers looking to adopt blockchain solutions. This supportive regulatory landscape may encourage investment and participation in the blockchain insurance market, ultimately contributing to its growth and sustainability.

Growing Demand for Innovative Insurance Products

The blockchain insurance market in Mexico is witnessing a growing demand for innovative insurance products tailored to the needs of a tech-savvy population. As consumers become more familiar with digital solutions, there is an increasing expectation for insurance products that leverage technology for enhanced user experience. Blockchain enables the creation of customized policies and on-demand insurance, which appeals to younger demographics. This shift in consumer preferences is likely to drive the development of new offerings within the blockchain insurance market, as companies strive to meet the evolving demands of their clients and remain competitive in a rapidly changing landscape.