Rise of Insurtech Startups

The blockchain insurance market is witnessing a surge in insurtech startups that are leveraging blockchain technology to disrupt traditional insurance models. These startups are often more agile and innovative, offering tailored solutions that appeal to a tech-savvy consumer base. In 2025, it is estimated that insurtech investments in the UK will reach £1 billion, with a significant portion directed towards blockchain applications. This influx of capital and innovation is likely to accelerate the adoption of blockchain solutions within the insurance sector, as established insurers may partner with or acquire these startups to enhance their offerings and remain competitive.

Enhanced Operational Efficiency

The blockchain insurance market is experiencing a shift towards enhanced operational efficiency, driven by the technology's ability to streamline processes. By automating claims processing and underwriting through blockchain, insurers can reduce administrative costs by up to 30%. This efficiency not only lowers operational expenses but also improves customer satisfaction through faster service delivery. As the market evolves, companies are increasingly adopting blockchain solutions to eliminate redundancies and enhance transparency. The potential for significant cost savings and improved service quality positions the blockchain insurance market as a compelling option for insurers looking to remain competitive in a rapidly changing landscape.

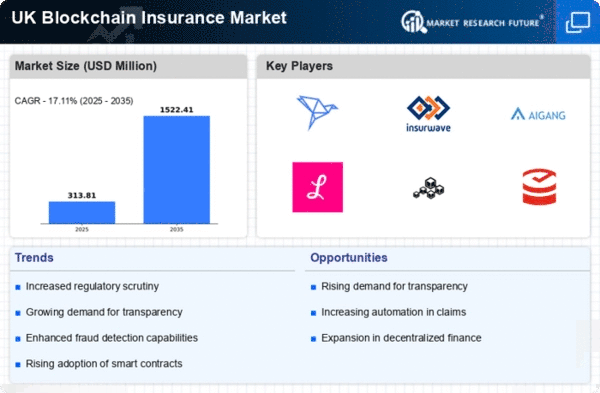

Growing Demand for Transparency

In the blockchain insurance market, there is a notable increase in demand for transparency among consumers and businesses alike. Stakeholders are increasingly aware of the benefits that blockchain technology offers in terms of traceability and accountability. This demand is reflected in a survey indicating that 70% of consumers prefer insurers that utilize blockchain for its transparent nature. As a result, insurers are compelled to adopt blockchain solutions to meet these expectations, thereby enhancing their market position. The emphasis on transparency is likely to drive further innovation within the blockchain insurance market, as companies seek to leverage this technology to build trust with their clients.

Increased Focus on Risk Management

The blockchain insurance market is increasingly focusing on risk management, as insurers seek to leverage blockchain technology to better assess and mitigate risks. By utilizing smart contracts and decentralized data storage, insurers can gain real-time insights into risk factors, leading to more accurate pricing and underwriting. This shift is particularly relevant in sectors such as health and property insurance, where risk assessment is critical. As the market evolves, the integration of blockchain technology is expected to enhance risk management capabilities, potentially reducing claims costs by up to 20%. This focus on risk management is likely to be a key driver for growth in the blockchain insurance market.

Regulatory Support for Blockchain Technology

The blockchain insurance market in the UK benefits from increasing regulatory support, which appears to foster innovation and adoption. The Financial Conduct Authority (FCA) has been proactive in establishing guidelines that encourage the use of blockchain technology within the insurance sector. This regulatory framework not only enhances consumer trust but also provides a clear pathway for insurers to integrate blockchain solutions. As of 2025, the UK government has allocated approximately £10 million to support blockchain initiatives, indicating a strong commitment to this technology. Such backing is likely to stimulate growth in the blockchain insurance market, as companies feel more secure in investing in blockchain-based solutions.