Growing Automotive Sector

The automotive sector is a pivotal driver for the Metal Keystock Market, as the demand for vehicles continues to rise. With The Metal Keystock Market projected to grow at a compound annual growth rate of 3.5% through 2025, the need for high-quality keystock components is becoming increasingly critical. Metal keystock is integral to various automotive applications, including engine assembly and transmission systems. As manufacturers strive for improved performance and efficiency, the Metal Keystock Market is likely to benefit from this trend. Additionally, the shift towards electric vehicles may introduce new requirements for keystock materials, prompting innovation within the industry. The interplay between automotive growth and keystock demand suggests a promising outlook for the Metal Keystock Market.

Infrastructure Development Projects

Infrastructure development projects are significantly influencing the Metal Keystock Market. Governments and private entities are investing heavily in infrastructure, including transportation, energy, and urban development. This investment is expected to reach trillions of dollars over the next decade, creating a robust demand for construction materials, including metal keystock. The Metal Keystock Market stands to gain from this trend, as keystock is essential in various applications, such as bridges, roads, and buildings. The increasing focus on sustainable infrastructure also suggests that manufacturers will need to adapt their offerings to meet new standards. As infrastructure projects proliferate, the Metal Keystock Market is likely to see a corresponding rise in demand, driven by the need for reliable and durable components.

Increased Focus on Quality Standards

The Metal Keystock Market is witnessing an increased focus on quality standards, driven by regulatory requirements and consumer expectations. As industries become more quality-conscious, manufacturers are compelled to adhere to stringent standards to ensure product reliability and safety. This trend is particularly evident in sectors such as aerospace and defense, where the demand for high-quality keystock is paramount. In 2025, it is expected that compliance with international quality standards will become even more critical, influencing purchasing decisions across the Metal Keystock Market. Companies that prioritize quality assurance are likely to gain a competitive edge, as customers increasingly seek out reliable suppliers. This heightened emphasis on quality is poised to shape the future landscape of the Metal Keystock Market.

Rising Demand in Manufacturing Sector

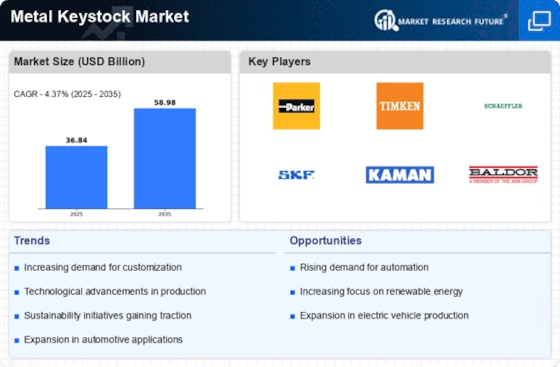

The Metal Keystock Market is experiencing a notable surge in demand, primarily driven by the expansion of the manufacturing sector. As industries increasingly adopt automation and advanced machinery, the need for reliable keystock components has escalated. In 2025, the manufacturing sector is projected to grow at a rate of approximately 4.5%, which directly correlates with the rising consumption of metal keystock. This growth is indicative of a broader trend towards enhanced production efficiency and precision engineering. Consequently, manufacturers are seeking high-quality keystock solutions to ensure optimal performance in their machinery. The Metal Keystock Market is thus positioned to benefit from this upward trajectory, as companies prioritize durability and reliability in their component choices.

Technological Innovations in Production

Technological innovations are reshaping the Metal Keystock Market, leading to enhanced production processes and product quality. Advances in manufacturing technologies, such as 3D printing and automated machining, are enabling the production of more precise and complex keystock designs. These innovations not only improve efficiency but also reduce waste, aligning with the industry's sustainability goals. In 2025, it is anticipated that the adoption of these technologies will increase by 20%, further driving the Metal Keystock Market. As manufacturers embrace these advancements, they are likely to offer a wider range of products, catering to diverse applications across various sectors. This evolution in production capabilities is expected to bolster the competitive landscape of the Metal Keystock Market.