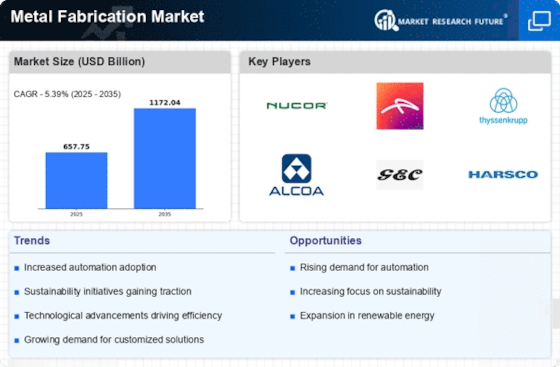

Growth in Renewable Energy Sector

The renewable energy sector is witnessing substantial growth, which is likely to have a positive impact on the Metal Fabrication Market. As nations strive to meet sustainability goals, investments in solar, wind, and other renewable energy projects are increasing. Metal fabrication is essential for producing components such as solar panel frames and wind turbine structures. Reports suggest that the renewable energy market could expand at a rate of 8% annually, creating a robust demand for fabricated metal products. This trend indicates that the Metal Fabrication Market is poised to benefit from the ongoing transition towards cleaner energy sources.

Rising Demand in Construction Sector

The construction sector is experiencing a notable surge in demand, which appears to be a primary driver for the Metal Fabrication Market. As urbanization accelerates, the need for robust infrastructure, including residential and commercial buildings, is increasing. This sector's growth is projected to contribute significantly to the metal fabrication market, with estimates suggesting a compound annual growth rate of around 5% over the next few years. Metal fabrication plays a crucial role in providing essential components such as beams, columns, and frames, which are integral to construction projects. Furthermore, the trend towards prefabrication in construction is likely to enhance the demand for fabricated metal products, thereby bolstering the Metal Fabrication Market.

Advancements in Automation and Robotics

Technological advancements in automation and robotics are transforming the Metal Fabrication Market. The integration of automated systems in fabrication processes enhances efficiency, reduces labor costs, and improves precision. Recent data indicates that the adoption of robotic welding and cutting technologies has increased productivity by up to 30% in some manufacturing environments. This shift towards automation not only streamlines operations but also addresses the skilled labor shortage faced by the industry. As companies seek to optimize their production capabilities, the demand for advanced metal fabrication solutions is likely to rise, further propelling the Metal Fabrication Market forward.

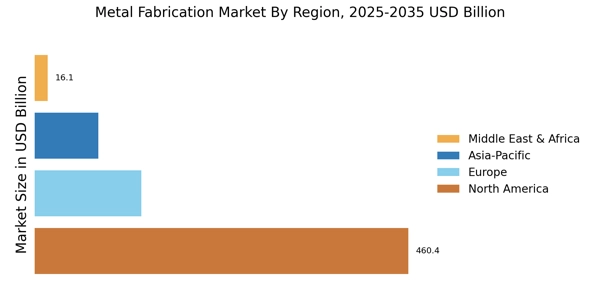

Emerging Markets and Economic Development

Emerging markets are experiencing rapid economic development, which appears to be a significant driver for the Metal Fabrication Market. As these economies grow, there is an increasing demand for infrastructure, manufacturing, and consumer goods, all of which rely heavily on metal fabrication. Reports indicate that regions such as Asia-Pacific and Latin America are witnessing substantial investments in industrialization, leading to a heightened need for fabricated metal products. This trend suggests that the Metal Fabrication Market could see considerable growth opportunities as emerging markets continue to develop and expand their manufacturing capabilities.

Increased Investment in Automotive Manufacturing

The automotive manufacturing sector is undergoing a transformation, with increased investments in electric vehicles (EVs) and advanced manufacturing technologies. This shift is expected to drive demand within the Metal Fabrication Market, as the production of EVs requires specialized metal components and lightweight materials. Data suggests that the automotive sector's investment in metal fabrication could reach billions of dollars in the coming years, as manufacturers seek to enhance vehicle performance and sustainability. Consequently, the Metal Fabrication Market is likely to experience growth driven by the evolving needs of the automotive sector.