Growing Environmental Regulations

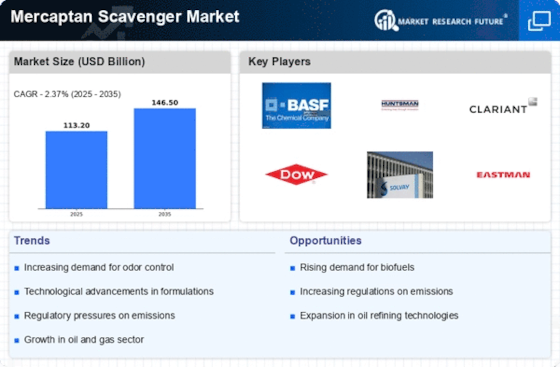

The Mercaptan Scavenger Market is significantly influenced by the tightening of environmental regulations aimed at reducing harmful emissions. Governments and regulatory bodies are increasingly mandating the use of effective odor control solutions in various sectors, particularly in oil and gas operations. This regulatory landscape compels companies to adopt mercaptan scavengers to comply with environmental standards, thereby driving market growth. For instance, the implementation of stricter emission norms has led to a heightened demand for mercaptan scavengers, as they play a crucial role in minimizing the release of volatile organic compounds. As environmental concerns continue to escalate, the Mercaptan Scavenger Market is expected to witness sustained growth, as industries seek to align with regulatory requirements while maintaining operational efficiency.

Increasing Industrial Applications

The Mercaptan Scavenger Market is experiencing a notable surge in demand due to its increasing applications across various industrial sectors. Industries such as oil and gas, petrochemicals, and wastewater treatment are increasingly utilizing mercaptan scavengers to mitigate the adverse effects of mercaptans, which are notorious for their foul odor and corrosive properties. The oil and gas sector, in particular, is projected to account for a substantial share of the market, driven by the need for effective odor control and corrosion prevention. As industries expand and evolve, the reliance on mercaptan scavengers is likely to grow, indicating a robust trajectory for the Mercaptan Scavenger Market. Furthermore, the rising awareness of environmental regulations is pushing industries to adopt these solutions, thereby enhancing market growth.

Expansion of the Oil and Gas Sector

The Mercaptan Scavenger Market is poised for growth due to the expansion of the oil and gas sector, which remains a primary consumer of mercaptan scavengers. As exploration and production activities increase, the need for effective odor control solutions becomes more pronounced. The oil and gas industry is characterized by the presence of mercaptans, which can lead to operational challenges if not adequately managed. Consequently, the demand for mercaptan scavengers is expected to rise in tandem with the sector's growth. Furthermore, the increasing investments in oil and gas infrastructure, particularly in emerging markets, are likely to further bolster the Mercaptan Scavenger Market. This expansion presents a significant opportunity for manufacturers and suppliers of mercaptan scavengers to cater to the evolving needs of the industry.

Rising Awareness of Health and Safety Standards

The Mercaptan Scavenger Market is increasingly shaped by the rising awareness of health and safety standards across various sectors. Industries are becoming more cognizant of the potential health risks associated with mercaptans, which can pose serious hazards if not managed properly. This awareness is prompting companies to implement effective odor control measures, including the use of mercaptan scavengers, to ensure a safe working environment. The oil and gas sector, in particular, is under pressure to adhere to stringent health and safety regulations, which is driving the demand for mercaptan scavengers. As organizations prioritize employee safety and regulatory compliance, the Mercaptan Scavenger Market is likely to experience robust growth, as more companies seek to mitigate health risks associated with mercaptans.

Technological Innovations in Scavenger Formulations

The Mercaptan Scavenger Market is benefiting from ongoing technological innovations that enhance the efficacy and efficiency of scavenger formulations. Recent advancements in chemical engineering have led to the development of more effective mercaptan scavengers that can operate under a wider range of conditions. These innovations not only improve the performance of scavengers but also reduce the overall costs associated with their application. For instance, the introduction of multifunctional scavengers that can target multiple contaminants simultaneously is gaining traction. This trend is likely to attract more industries to adopt mercaptan scavengers, thereby expanding the market. As companies continue to invest in research and development, the Mercaptan Scavenger Market is poised for significant growth, driven by the demand for more sophisticated and effective solutions.