Rising Water Scarcity

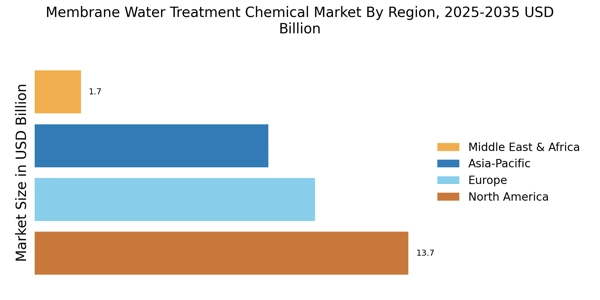

The increasing prevalence of water scarcity across various regions appears to be a primary driver for the Membrane Water Treatment Chemical Market. As populations grow and industrial demands escalate, the need for efficient water treatment solutions intensifies. According to recent data, approximately 2 billion people currently live in water-stressed areas, which is likely to increase. This situation compels industries and municipalities to adopt advanced water treatment technologies, including membrane filtration systems. Consequently, the demand for specialized chemicals that enhance membrane performance and longevity is expected to rise, thereby propelling the Membrane Water Treatment Chemical Market forward.

Environmental Regulations

Stringent environmental regulations are driving the demand for effective water treatment solutions, thereby influencing the Membrane Water Treatment Chemical Market. Governments worldwide are implementing policies aimed at reducing water pollution and promoting sustainable water management practices. For example, regulations that limit the discharge of contaminants into water bodies compel industries to adopt advanced treatment technologies. This regulatory landscape creates a favorable environment for the adoption of membrane filtration systems, which require specific chemicals to maintain their efficacy. As compliance becomes more critical, the Membrane Water Treatment Chemical Market is likely to experience sustained growth.

Technological Innovations

Technological innovations in membrane filtration technologies are reshaping the landscape of the Membrane Water Treatment Chemical Market. Advancements such as the development of more efficient membranes and the integration of automation in water treatment processes enhance operational efficiency. For instance, the introduction of nanofiltration and reverse osmosis membranes has improved the removal of contaminants, leading to higher quality water output. As these technologies evolve, the need for specialized chemicals that optimize membrane performance becomes increasingly critical. This trend suggests a robust growth trajectory for the Membrane Water Treatment Chemical Market as companies seek to leverage these innovations.

Industrial Growth and Urbanization

Rapid industrial growth and urbanization are significant contributors to the expansion of the Membrane Water Treatment Chemical Market. As urban areas expand, the demand for clean water for both residential and industrial use surges. Industries such as food and beverage, pharmaceuticals, and textiles require high-quality water treatment solutions to meet regulatory standards. Reports indicate that the industrial sector's water consumption is projected to increase by 20% over the next decade. This trend necessitates the use of membrane technologies, which in turn drives the demand for effective treatment chemicals, thus fostering growth in the Membrane Water Treatment Chemical Market.

Increased Awareness of Water Quality

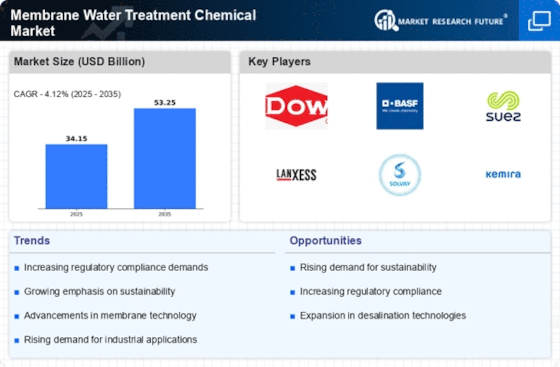

The growing awareness of water quality and its impact on health is emerging as a key driver for the Membrane Water Treatment Chemical Market. Consumers and industries alike are becoming more conscious of the importance of clean water, leading to heightened demand for effective treatment solutions. This trend is reflected in the rising investments in water treatment infrastructure and technologies. Market data suggests that The Membrane Water Treatment Chemical Market is expected to reach USD 50 billion by 2027, with a significant portion attributed to membrane technologies. As awareness continues to rise, the Membrane Water Treatment Chemical Market is poised for substantial growth.