- Q2 2024: OhioHealth opens $400M Pickerington Methodist Hospital OhioHealth opened its new Pickerington Methodist Hospital in April 2024, featuring state-of-the-art medical vacuum systems as part of its critical care and surgical infrastructure upgrades.

- Q2 2024: Atlas Copco launches new oil-free medical vacuum pump for hospitals Atlas Copco introduced a new oil-free medical vacuum pump in May 2024, designed to meet stricter hospital air quality and infection control standards, expanding its product portfolio for healthcare facilities.

- Q2 2024: Gardner Denver Medical announces partnership with Medtronic for hospital vacuum systems Gardner Denver Medical entered a strategic partnership with Medtronic in June 2024 to supply advanced medical vacuum systems for Medtronic's new hospital projects in North America.

- Q3 2024: Drägerwerk AG acquires US-based vacuum system manufacturer Precision Medical Drägerwerk AG completed the acquisition of Precision Medical in July 2024, strengthening its position in the North American medical vacuum systems market.

- Q3 2024: Ohio Medical receives FDA clearance for next-generation centralized medical vacuum system Ohio Medical announced in August 2024 that it received FDA clearance for its new centralized medical vacuum system, designed for large hospital networks and surgical centers.

- Q3 2024: Allied Healthcare Products wins contract to supply vacuum systems to new UAE hospital Allied Healthcare Products secured a contract in September 2024 to provide medical vacuum systems for a major new hospital under construction in Abu Dhabi.

- Q4 2024: Atlas Copco opens new manufacturing facility for medical vacuum systems in Texas Atlas Copco inaugurated a new manufacturing plant in Texas in October 2024, dedicated to producing medical vacuum systems for the North American market.

- Q4 2024: Stryker appoints new VP of Medical Infrastructure Solutions Stryker announced the appointment of a new Vice President for its Medical Infrastructure Solutions division in November 2024, overseeing the expansion of its medical vacuum systems business.

- Q1 2025: Siemens Healthineers launches smart monitoring platform for hospital vacuum systems Siemens Healthineers introduced a digital platform in January 2025 that enables real-time monitoring and predictive maintenance for hospital medical vacuum systems.

- Q1 2025: BeaconMedaes secures NHS contract for centralized vacuum systems in UK hospitals BeaconMedaes announced in February 2025 that it won a multi-year contract to supply centralized medical vacuum systems to several new NHS hospital projects across the UK.

- Q2 2025: Ohio Medical expands into Asia-Pacific with new Singapore office Ohio Medical opened a regional office in Singapore in May 2025 to support sales and service of its medical vacuum systems in the Asia-Pacific region.

- Q2 2025: Drägerwerk AG receives CE mark for advanced medical vacuum system Drägerwerk AG announced in June 2025 that its latest medical vacuum system received CE mark approval, allowing sales and installation across the European Union.

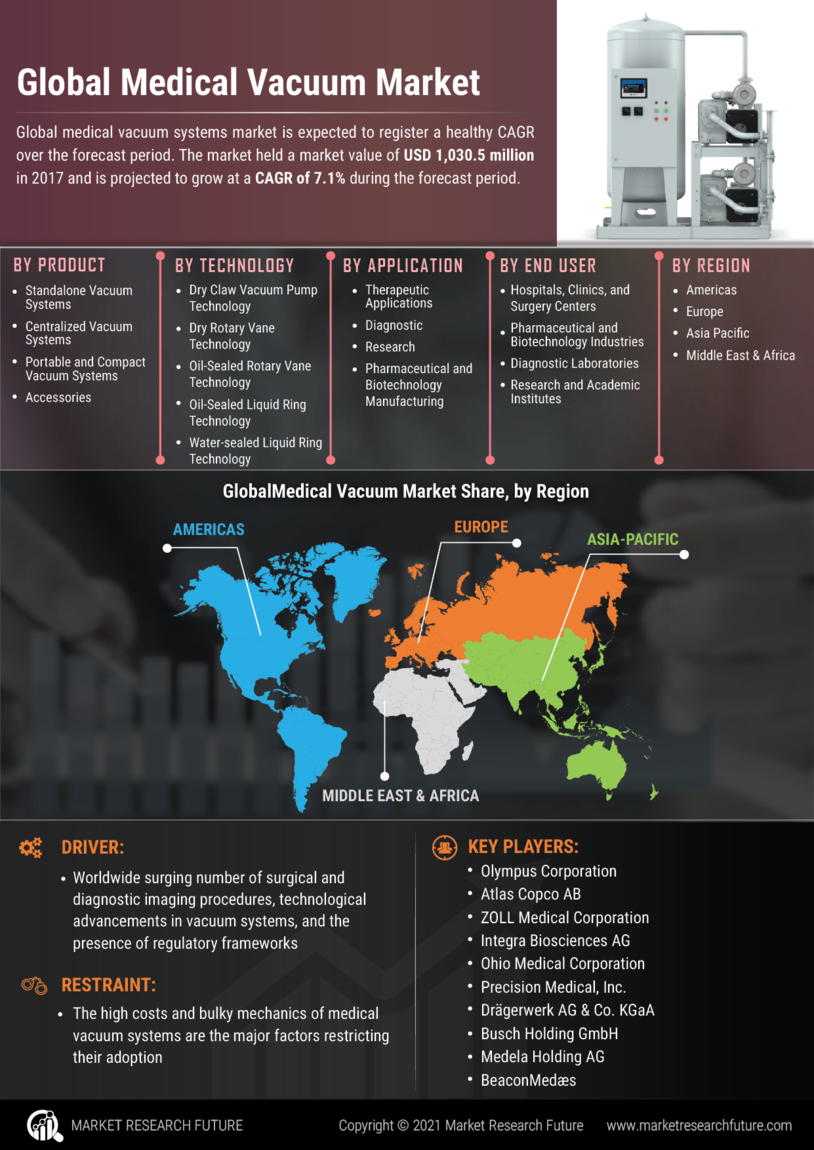

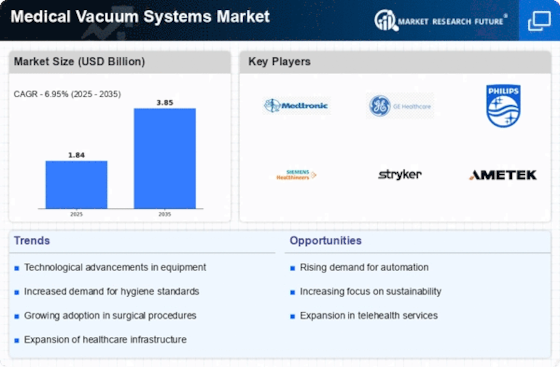

Medical Vacuum Systems Market Dynamics

Growing demand for suction systems in healthcare will drive the market during the forecast period. Applying medical vacuum systems in anesthesiology, gynecology, and dentistry, among others, to remove excess fluid should boost business growth. The advent of technology in wound drainage, gastric emptying, liposuction, cleaning endotracheal tubes, and chest & lung drainage will offer several opportunities for the market over the forecast period. Additionally, applying vacuum systems in healthcare with integrated NFPA 99 requirements can play a vital role in transforming the healthcare system, thereby accelerating the medical vacuum systems industry's growth.

Market Drivers

- Increasing demand for technologically advanced and superior quality medical vacuums

Growing demand for technologically advanced and superior-quality medical vacuums for installation in hospital settings will favor industry growth. Newly launched medical vacuum systems are created to produce a suction system that facilitates the safe removal of undesirable fluids and gases to ensure sterility during surgical intervention. The above factors should enhance the demand for these systems in the healthcare industry.

- Rising prevalence of chronic diseases

There is an increasing prevalence of chronic disorders, including diabetes, cancer, and other infectious diseases, owing to the adoption of sedentary lifestyles and other factors. Also, healthcare agencies in various countries focus on increasing the diagnosis and treatment rates through the increasing number of awareness programs. With the growing prevalence and awareness of such conditions, the patient population requiring diagnostic procedures and tests is also increasing.

Market Restraints:

The industry has noticed noteworthy developments in the past decade regarding unique technologies being executed and unique design modifications, among others. However, these devices are costly, which includes a comparatively higher acquisition price, and subsequent maintenance expenses, thereby leading to an overall increased device price and ownership. Some cutting-edge devices are associated with several other components, such as chips, sensors, batteries, and other accessories, which need periodic replacement. Thus, the high price has been responsible for the comparatively limited adoption of the medical vacuum system.

Market Opportunities:

- The rapidly surging number of hospital admissions

The rapidly surging number of hospital admissions will be a positive impact rendering factor for business growth. Thus, the growing demand for technologically advanced and superior-quality medical vacuums for installation in hospital settings will favor industry growth. Newly introduced medical vacuum systems are designed to produce a suction system that facilitates the safe removal of undesirable fluids and gases to ensure sterility during surgical intervention. The factors above should enhance the demand for these systems in the healthcare industry.

Medical Vacuum Systems Market Market Segmentation

Usage Insights

The medical vacuum systems market segmentation, based on product, is standalone vacuum systems, centralized vacuum systems, portable, and compact. The medical vacuum systems market growth was prominently high under the standalone vacuum systems category in 2021, as these systems are highly preferred during dental surgeries in dental clinics and research laboratories. However, centralized vacuum systems are the fastest growing category in the coming years due to the growing benefits offered by centralized vacuum systems, such as ease of use and availability of systems in different specifications will boost the business growth.

Technology Insights