Focus on Infection Control

Infection control remains a critical concern in healthcare settings across South America, significantly impacting the medical vacuum-systems market. The need to maintain sterile environments during surgical procedures drives the adoption of advanced vacuum systems that effectively manage waste and contaminants. Regulatory bodies are increasingly emphasizing stringent infection control protocols, which may lead to a projected growth of 20% in the adoption of medical vacuum systems by 2026. This focus on infection prevention not only enhances patient outcomes but also positions the medical vacuum-systems market as a vital component in the broader healthcare infrastructure.

Increased Awareness of Patient Safety

There is a growing awareness of patient safety among healthcare providers in South America, which is significantly influencing the medical vacuum-systems market. As hospitals prioritize patient outcomes, the demand for reliable medical vacuum systems that ensure safe waste management and infection control is on the rise. This heightened focus on safety is likely to drive market growth by approximately 18% by 2026. Healthcare facilities are increasingly investing in high-quality vacuum systems to comply with safety standards and enhance their reputation, thereby reinforcing the importance of this market in the overall healthcare landscape.

Rising Demand for Surgical Procedures

The medical vacuum-systems market in South America is experiencing an increase in demand for surgical procedures. This trend is driven by a growing population and an increase in chronic diseases, which necessitate surgical interventions. As healthcare facilities expand their surgical capabilities, the need for efficient medical vacuum systems becomes paramount. In 2025, the surgical procedures in South America are projected to rise by approximately 15%, leading to a corresponding increase in the demand for medical vacuum systems. This surge indicates a robust growth trajectory for the industry, as hospitals and clinics seek to enhance their operational efficiency and patient safety through advanced vacuum technologies.

Expansion of Healthcare Infrastructure

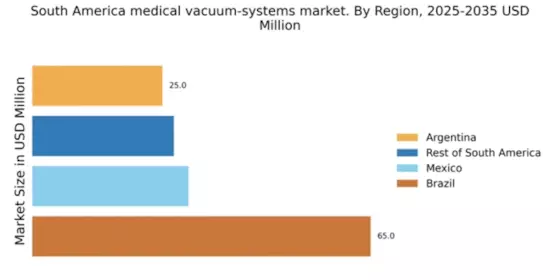

The expansion of healthcare infrastructure in South America is a key driver for the medical vacuum-systems market. Governments and private investors are channeling substantial funds into building new hospitals and upgrading existing facilities. This investment is expected to reach approximately $10 billion by 2026, creating a favorable environment for the adoption of advanced medical technologies, including vacuum systems. As new healthcare facilities emerge, the demand for reliable and efficient medical vacuum systems is likely to increase, thereby propelling the industry forward. This trend indicates a long-term growth potential for manufacturers and suppliers in the medical vacuum-systems market.

Technological Integration in Healthcare

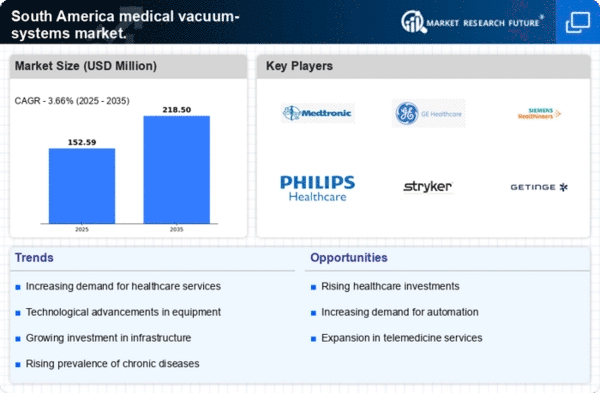

The integration of advanced technologies in healthcare is transforming the medical vacuum-systems market in South America. Innovations such as automated vacuum systems and smart monitoring solutions are gaining traction, enhancing operational efficiency and safety in medical environments. As healthcare providers increasingly adopt these technologies, the market is expected to grow at a compound annual growth rate (CAGR) of 12% over the next five years. This technological shift not only improves the performance of medical vacuum systems but also aligns with the broader trend of digital transformation in healthcare, indicating a promising future for the industry.