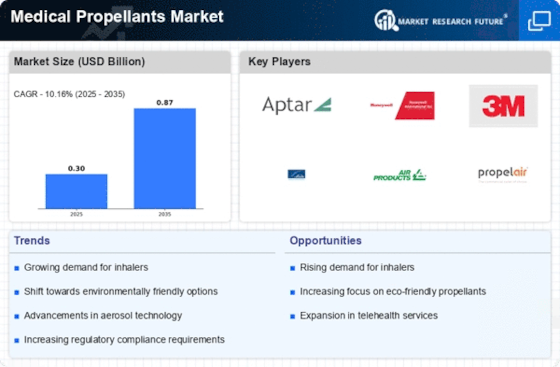

Rising Demand for Inhalation Therapies

The increasing prevalence of respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) is driving the demand for inhalation therapies, which utilize medical propellants. The Medical Propellants Market is witnessing a surge in the development of inhalers and nebulizers, which are essential for delivering medication effectively. According to recent data, the inhalation therapy segment is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next few years. This growth is largely attributed to the rising awareness of respiratory health and the need for effective treatment options. As a result, manufacturers are focusing on innovative formulations and delivery mechanisms, further propelling the Medical Propellants Market.

Growing Focus on Patient-Centric Solutions

The Medical Propellants Market is increasingly shifting towards patient-centric solutions, driven by the need for improved user experience and adherence to treatment regimens. Manufacturers are now prioritizing the development of inhalation devices that are easier to use and more convenient for patients. This trend is reflected in the design of metered-dose inhalers (MDIs) and dry powder inhalers (DPIs), which are being tailored to meet the specific needs of diverse patient populations. The emphasis on user-friendly devices is expected to enhance patient compliance, thereby increasing the overall demand for medical propellants. As a result, the Medical Propellants Market is likely to see a rise in sales and market penetration.

Advancements in Pharmaceutical Formulations

Innovations in pharmaceutical formulations are significantly influencing the Medical Propellants Market. The development of new drug formulations that require specific propellant characteristics is becoming increasingly common. For instance, the introduction of hydrofluoroalkane (HFA) propellants has revolutionized the inhalation delivery systems, offering improved efficacy and safety profiles. The market for HFA propellants is expected to expand, with estimates suggesting a growth rate of around 5% annually. This trend indicates a shift towards more effective and patient-friendly delivery systems, which is likely to enhance the overall market landscape. As pharmaceutical companies continue to invest in research and development, the Medical Propellants Market is poised for further advancements.

Increasing Regulatory Support for Innovative Products

Regulatory bodies are increasingly supporting the development of innovative medical products, which is positively impacting the Medical Propellants Market. Recent initiatives aimed at expediting the approval process for new inhalation devices and propellants are encouraging manufacturers to invest in research and development. This regulatory support is crucial, as it not only facilitates faster market entry for new products but also ensures that they meet safety and efficacy standards. The Medical Propellants Market is likely to benefit from these changes, as companies are motivated to innovate and bring forth advanced solutions that cater to patient needs. The anticipated growth in regulatory approvals could lead to a more dynamic market environment.

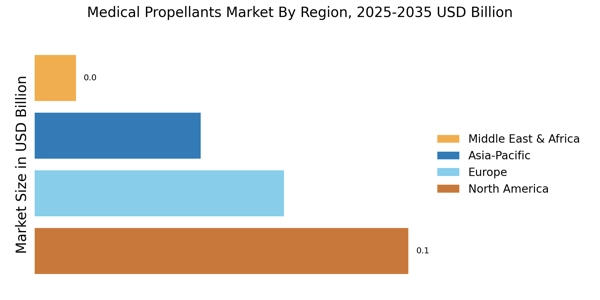

Emerging Markets and Expanding Healthcare Infrastructure

Emerging markets are witnessing rapid growth in healthcare infrastructure, which is contributing to the expansion of the Medical Propellants Market. As countries invest in healthcare facilities and services, the demand for medical devices, including inhalation products, is on the rise. This trend is particularly evident in regions where respiratory diseases are prevalent, leading to an increased need for effective treatment options. The market is projected to grow at a rate of approximately 6% in these regions, driven by improved access to healthcare and rising disposable incomes. Consequently, the Medical Propellants Market is likely to experience significant growth opportunities as manufacturers seek to capitalize on these emerging markets.