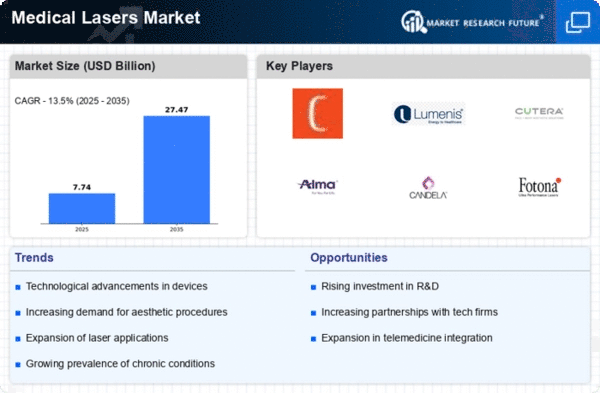

Market Growth Projections

The Global Medical Lasers Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 6.57 USD Billion in 2024 and further expand to 12 USD Billion by 2035, the industry is poised for a robust trajectory. The anticipated compound annual growth rate (CAGR) of 5.63% from 2025 to 2035 indicates a strong demand for medical laser technologies across various applications. This growth is likely to be driven by factors such as technological advancements, increasing prevalence of chronic diseases, and rising consumer interest in aesthetic procedures. The market's expansion reflects the ongoing evolution of healthcare practices and the increasing reliance on laser-based solutions.

Technological Advancements

The Global Medical Lasers Market Industry is experiencing rapid technological advancements that enhance the efficacy and safety of laser treatments. Innovations such as fiber lasers and solid-state lasers are becoming increasingly prevalent, offering improved precision and reduced recovery times for patients. For instance, the introduction of laser systems that integrate artificial intelligence for better treatment planning is gaining traction. These advancements not only improve patient outcomes but also expand the range of applications for medical lasers, thereby driving market growth. As a result, the market is projected to reach 6.57 USD Billion in 2024, reflecting the impact of these technological innovations.

Regulatory Support and Standardization

Regulatory support and standardization play a crucial role in the Global Medical Lasers Market Industry, as they ensure the safety and efficacy of laser devices. Governments and health organizations are increasingly establishing guidelines and regulations that promote the responsible use of medical lasers. This regulatory framework not only enhances consumer confidence but also encourages manufacturers to innovate and improve their products. As a result, the market is likely to benefit from a more structured environment, fostering growth and development. The establishment of clear standards may also facilitate international trade, allowing for a broader distribution of advanced laser technologies across global markets.

Increasing Prevalence of Chronic Diseases

The Global Medical Lasers Market Industry is significantly influenced by the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and dermatological conditions. As these health issues become more widespread, the demand for effective treatment options rises correspondingly. Medical lasers are utilized in various therapeutic applications, including tumor ablation and vascular treatments, providing targeted solutions that are often more effective than traditional methods. This trend is likely to contribute to a compound annual growth rate (CAGR) of 5.63% from 2025 to 2035, reflecting the growing reliance on laser technology in managing chronic health conditions.

Expanding Applications in Aesthetic Medicine

The Global Medical Lasers Market Industry is witnessing an expansion in applications within aesthetic medicine, driven by increasing consumer awareness and demand for cosmetic procedures. Treatments such as laser hair removal, skin resurfacing, and tattoo removal are gaining popularity among consumers seeking non-invasive solutions to enhance their appearance. This trend is supported by the rise of social media, which amplifies the visibility of aesthetic procedures. As a result, the market is poised for growth, with projections indicating a significant increase in revenue as more individuals opt for laser-based aesthetic treatments, further solidifying the industry's position in the healthcare landscape.

Rising Demand for Minimally Invasive Procedures

There is a growing demand for minimally invasive procedures within the Global Medical Lasers Market Industry, driven by patient preferences for reduced recovery times and lower risks associated with traditional surgical methods. Medical lasers offer precise targeting of tissues, which minimizes damage to surrounding areas, thus aligning with the trend towards less invasive treatment options. This shift is evident in various fields, including dermatology and ophthalmology, where laser treatments are increasingly preferred. The market is expected to grow significantly, with projections indicating a rise to 12 USD Billion by 2035, underscoring the importance of this driver in shaping the industry's future.

Leave a Comment