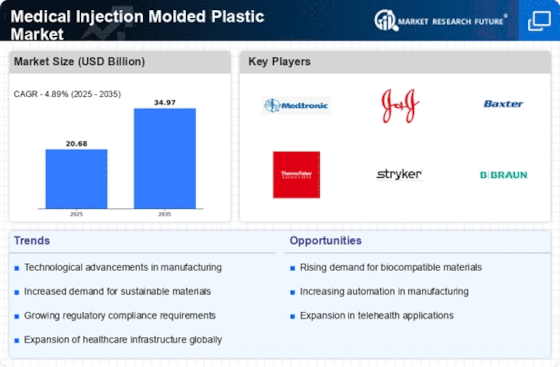

Growing Focus on Sustainability

Sustainability is becoming an increasingly important consideration within the Medical Injection Molded Plastic Market. As environmental concerns rise, manufacturers are exploring eco-friendly materials and processes to minimize their carbon footprint. The shift towards biodegradable plastics and recyclable materials is gaining traction, driven by both regulatory pressures and consumer preferences for sustainable products. This trend not only aligns with global sustainability goals but also presents opportunities for innovation in product design and manufacturing. Companies that prioritize sustainability are likely to enhance their brand reputation and attract environmentally conscious consumers. Consequently, the growing focus on sustainability is a key driver for the Medical Injection Molded Plastic Market, influencing product development and market strategies.

Rising Demand for Medical Devices

The Medical Injection Molded Plastic Market is experiencing a notable surge in demand for medical devices. This trend is largely driven by the increasing prevalence of chronic diseases and the aging population, which necessitate advanced medical solutions. According to recent data, the medical device market is projected to reach approximately 600 billion USD by 2025, indicating a robust growth trajectory. As a result, manufacturers are increasingly turning to injection molded plastics for their ability to produce complex shapes and designs that meet stringent regulatory standards. This shift not only enhances product functionality but also reduces production costs, thereby making medical devices more accessible. Consequently, the rising demand for innovative medical devices is a pivotal driver for the Medical Injection Molded Plastic Market.

Cost-Effectiveness of Injection Molding

Cost efficiency remains a critical factor influencing the Medical Injection Molded Plastic Market. Injection molding is recognized for its ability to produce high volumes of parts with minimal waste, which significantly lowers production costs. This process allows manufacturers to achieve economies of scale, making it an attractive option for producing medical components. Furthermore, the ability to use a variety of thermoplastics enhances the versatility of the manufacturing process, enabling the production of lightweight and durable medical products. As healthcare providers seek to optimize their budgets while maintaining quality, the cost-effectiveness of injection molded plastics is likely to drive further adoption in the medical sector. This trend underscores the importance of efficient manufacturing processes in the Medical Injection Molded Plastic Market.

Technological Innovations in Manufacturing

Technological advancements are reshaping the Medical Injection Molded Plastic Market. Innovations such as 3D printing and automation are enhancing the efficiency and precision of the injection molding process. These technologies enable manufacturers to produce complex geometries and customized solutions that were previously unattainable. Moreover, the integration of smart manufacturing techniques allows for real-time monitoring and quality control, ensuring that products meet the highest standards. As the industry continues to evolve, the adoption of these technologies is likely to accelerate, driving growth in the Medical Injection Molded Plastic Market. The potential for increased productivity and reduced lead times positions manufacturers to respond swiftly to market demands, thereby enhancing their competitive edge.

Regulatory Compliance and Quality Standards

The Medical Injection Molded Plastic Market is heavily influenced by stringent regulatory compliance and quality standards. Regulatory bodies, such as the FDA, impose rigorous guidelines to ensure the safety and efficacy of medical products. This necessitates that manufacturers adopt advanced materials and processes that comply with these regulations. The increasing focus on patient safety and product reliability has led to a heightened demand for high-quality injection molded plastics that meet these standards. As a result, companies are investing in research and development to innovate and enhance their product offerings. This commitment to quality not only fosters consumer trust but also positions manufacturers favorably in a competitive market. Thus, adherence to regulatory compliance is a significant driver for the Medical Injection Molded Plastic Market.