Expansion of Home Healthcare Services

The Medical Gas and Equipment Market is witnessing a significant shift towards home healthcare services, which is reshaping the landscape of medical gas utilization. As more patients prefer receiving care in the comfort of their homes, the demand for portable medical gas equipment, such as oxygen concentrators and cylinders, is on the rise. This trend is further supported by the increasing aging population and the prevalence of chronic illnesses that necessitate ongoing treatment. Market data indicates that the home healthcare segment is expected to grow substantially, with a projected increase of around 8% annually. This shift not only enhances patient convenience but also reduces healthcare costs, thereby driving the Medical Gas and Equipment Market to adapt to new consumer needs and preferences.

Regulatory Compliance and Safety Standards

The Medical Gas and Equipment Market is significantly influenced by stringent regulatory compliance and safety standards imposed by health authorities. These regulations are designed to ensure the safe handling, storage, and administration of medical gases, thereby protecting both patients and healthcare providers. Compliance with these standards often necessitates the adoption of advanced equipment and training programs, which can drive market growth. Recent data suggests that the enforcement of these regulations is expected to increase, leading to a heightened demand for compliant medical gas systems. As healthcare facilities strive to meet these requirements, the Medical Gas and Equipment Market is likely to see a surge in investments aimed at enhancing safety and operational efficiency.

Rising Awareness of Patient Safety and Quality of Care

The Medical Gas and Equipment Market is increasingly shaped by the rising awareness of patient safety and the quality of care provided in healthcare settings. Healthcare providers are prioritizing the implementation of best practices in gas management to minimize risks associated with medical gas use. This heightened focus on safety is driving the demand for high-quality medical gas equipment and reliable supply systems. Market analysis indicates that facilities that prioritize patient safety are more likely to invest in advanced medical gas technologies, which can lead to improved patient outcomes. As a result, the Medical Gas and Equipment Market is expected to grow as healthcare organizations seek to enhance their safety protocols and overall quality of care.

Technological Innovations in Medical Gas Delivery Systems

Technological advancements play a pivotal role in shaping the Medical Gas and Equipment Market. Innovations in gas delivery systems, such as automated monitoring and control systems, are enhancing the safety and efficiency of medical gas administration. These systems are designed to minimize human error and ensure precise dosages, which is crucial in critical care settings. The integration of smart technologies, including IoT-enabled devices, is also gaining traction, allowing for real-time monitoring of gas levels and patient conditions. As healthcare facilities increasingly adopt these advanced technologies, the Medical Gas and Equipment Market is likely to experience accelerated growth, with a projected market value reaching several billion dollars in the coming years.

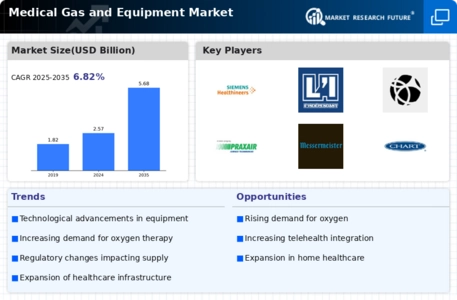

Increasing Demand for Medical Gas in Healthcare Facilities

The Medical Gas and Equipment Market experiences a notable surge in demand for medical gases, particularly oxygen and nitrous oxide, within healthcare facilities. This trend is driven by the rising prevalence of chronic respiratory diseases and the growing number of surgical procedures requiring anesthesia. According to recent data, the market for medical gases is projected to expand at a compound annual growth rate of approximately 7.5% over the next few years. Hospitals and clinics are increasingly investing in advanced gas delivery systems to ensure patient safety and compliance with stringent regulations. This heightened focus on quality and reliability in gas supply systems is likely to propel the Medical Gas and Equipment Market forward, as healthcare providers seek to enhance patient outcomes and operational efficiency.