Market Trends

Key Emerging Trends in the Medical Bionic Implant Artificial Organs Market

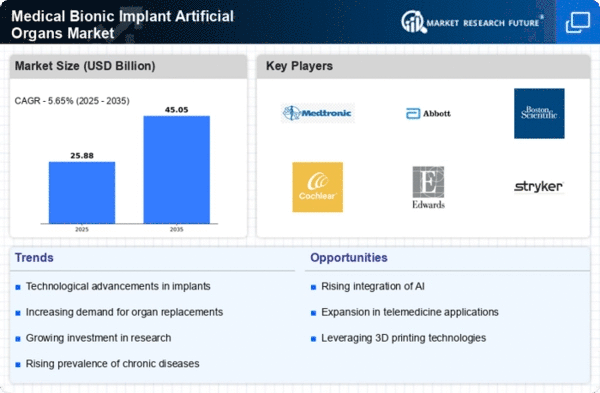

Over the last few years, medical bionic implants and artificial organs have experienced significant market trends driven by advanced technology, increasing incidence of chronic diseases and growing aging population. Here are some key trends that come up when we delve into the present landscape.

First of all, medical bionics has undergone a technological evolution whose impact on the medical field is unbelievable. This has resulted to more sophisticated and efficient artificial organs through innovations in materials, miniaturization and wireless connectivity. Bionic limbs, cochlear implants and artificial hearts exhibit this trend. Additionally, these implants are enhanced by their integration with smart sensors as well as artificial intelligence which helps in improving patients’ experience while using such devices.

Secondly, the prevalence of chronic disorders such as cardiovascular problems and diabetes has contributed to an increased need for medical bionic implants. There is a growing demand for innovative approaches to improve people’s lives given the increasing prevalence of chronic diseases across the globe. Moreover, there is greater presence of artificial organs like pacemakers or insulin pumps besides artificial kidneys which help restore more normal life even though they come with them certain set- backs.

The market is also experiencing a rise in research activities especially on expanding the range of available artificial organs. For instance researchers and companies producing medical devices want to develop bionic solutions for organs like lungs pancreas or even brain.The quest for innovation is opening up medical bionics beyond imagination leading to more individualized treatments.and making them accessible only to those who could pay for it.

Additionally, affordability and accessibility are becoming paramount issues associated with availability of medical bionic devices. With technological improvements costs per unit of production decline gradually making these life changing tools affordable to many people .Furthermore partnerships between insurers and health-care providers can also lead to wider access and affordability issues related to high-end medical technologies

Another important trend us increased cooperation among manufacturers of medical devices industry players institutions. Such collaboration provides vibrant ground for research and development by bringing together scientists, engineers as well as healthcare professionals. The close working relationship between industry and academia speeds up the pace at which new bionic implants can be brought to market.

However, there are challenges related to regulatory frameworks and ethical concerns. Medical bionics approval processes need to consider safety and at the same time allow for innovation. Also, there are ethical considerations concerning high- skilled technology incorporation into a person’s body. Striking the right balance between innovation and standards of ethics is a fundamental factor in driving further growth in medical bionic implant market.

Leave a Comment