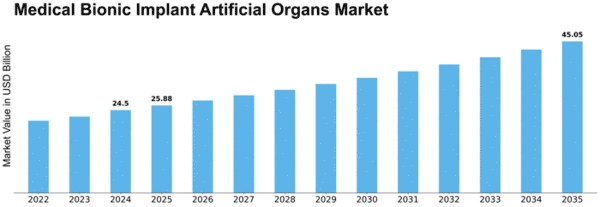

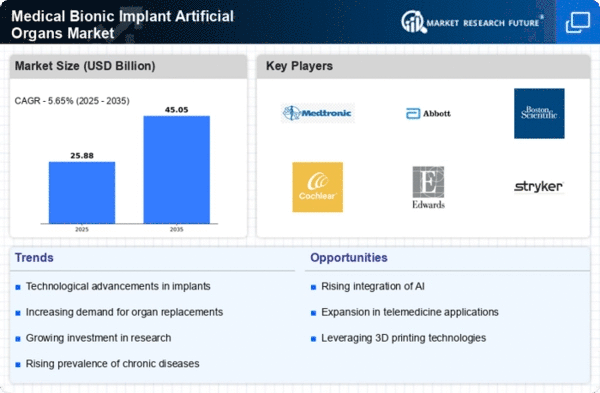

Medical Bionic Implant Artificial Organs Size

Medical Bionic Implant Artificial Organs Market Growth Projections and Opportunities

The Medical Bionic Implant/Artificial Organs Market is an evolving and vibrant sector that is influenced by various market drivers that shape its trajectory. The rising incidence of chronic diseases and organ failure, for which medical bionics and artificial organs are being developed, is one of the most important factors driving this market. The rate of occurrences for diseases like heart failure, kidney failure, and diabetes among others has increased with a rapidly aging world population resulting in greater need for innovative medical resolutions.

Technology advancements are central to driving this market forward as pertains to Medical Bionic Implant/Artificial Organs Market. Progress in materials science, bioengineering, and robotics has led to the development of advanced artificial organs. There have been great strides made in miniaturization, biocompatibility, and wireless communication which have enhanced implantable devices thereby improving patient acceptance rates leading to better outcomes. These technological advances seek not only to make artificial organs more efficient but also speed up the implantation process itself while ensuring that it is safe.

Similarly, regulatory landscape and approval processes have an enormous effect on the dynamics of medical bionic implants market. Strict regulatory requirements as well as extensive clinical trials are some of the pertinent considerations that affect entry into market places as well as commercialization of these innovative technologies. Manufacturers need regulatory approval before marketing their products which influences product timelines besides impacting on market penetration into selected geographical areas. Conversely there could be faster introduction of new types of medical bionic implants if there was streamlining in regulations affecting them hence causing growth in business volume.

Economic factors also exert a considerable influence on the Medical Bionic Implant/Artificial Organs Market. Clearly the cost implications due to research and development (R&D), manufacturing costs are directly transferred onto final consumer price making such products highly expensive commodities when compared internationally. Between different countries or regions economic differences can imply that these devices may not be affordable or available in all such places. For these transformative medical solutions to be sustainable and inclusive, they must strike a balance between innovation and cost-effectiveness.

Market competition and industry collaborations further shape the landscape of medical bionic implants. Companies already operating in the market as well as new entrants struggling for higher market share result into product improvements with time. Ecosystems involving strategic partnerships among players within the industry, research bodies and healthcare providers have been the driving force behind rapid development and commercialization of such implants.

The acceptance & awareness of consumers is also important in embracing medical bionic implants. One way to achieve this is through educational campaigns and outreach programs that enlighten citizens about the benefits linked to advanced medical technologies. As a result, addressing safety issues, creating trust in patients’ minds on those devices’ long-term effectiveness will play a vital role for positive patient’s perception about medical bionic implants."

Leave a Comment