Expansion of Meat Processing Facilities

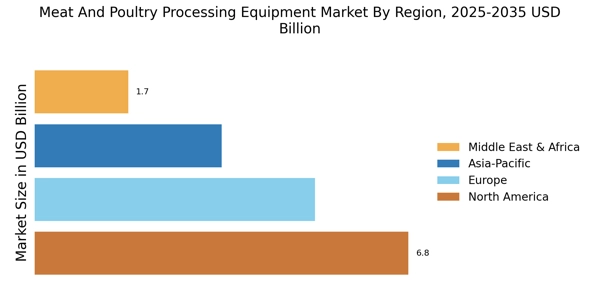

The Meat And Poultry Processing Equipment Market is witnessing a notable expansion of meat processing facilities. This growth is driven by the increasing consumption of meat products and the need for localized processing to meet regional demands. New processing plants are being established, particularly in emerging markets, to cater to the rising population and changing dietary preferences. This expansion necessitates the procurement of advanced processing equipment to ensure efficiency and compliance with safety standards. Market forecasts indicate that the establishment of new facilities could lead to a 15% increase in equipment demand over the next few years. Consequently, the Meat And Poultry Processing Equipment Market is poised for growth as companies invest in modernizing their processing capabilities.

Rising Demand for Processed Meat Products

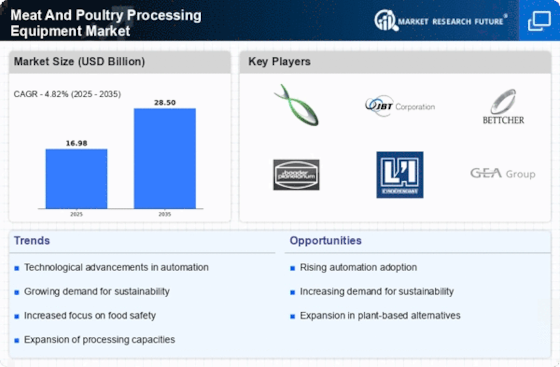

The Meat And Poultry Processing Equipment Market is significantly influenced by the rising demand for processed meat products. As consumer preferences shift towards convenience and ready-to-eat options, the need for efficient processing equipment becomes paramount. Market data indicates that the processed meat segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This trend is driven by busy lifestyles and an increasing inclination towards meat-based snacks and meals. Consequently, manufacturers are compelled to upgrade their processing capabilities to meet this demand, leading to an expansion in the Meat And Poultry Processing Equipment Market. The ability to produce high-quality, safe, and diverse meat products is essential for companies aiming to capture a larger market share.

Sustainability and Environmental Concerns

Sustainability is becoming a pivotal driver in the Meat And Poultry Processing Equipment Market. As environmental concerns grow, consumers and businesses alike are seeking more sustainable practices in meat processing. This includes reducing waste, minimizing energy consumption, and utilizing eco-friendly materials in equipment manufacturing. Companies that adopt sustainable practices may not only enhance their brand image but also comply with emerging regulations aimed at reducing the environmental impact of food production. Market analysis suggests that the demand for energy-efficient and sustainable processing equipment could increase by 20% in the coming years. Thus, manufacturers that prioritize sustainability in their operations are likely to thrive in the evolving Meat And Poultry Processing Equipment Market.

Focus on Food Safety and Quality Standards

In the Meat And Poultry Processing Equipment Market, there is an increasing emphasis on food safety and quality standards. Regulatory bodies are implementing stricter guidelines to ensure that meat products are safe for consumption. This has led to a heightened demand for processing equipment that complies with these regulations. Companies are investing in advanced technologies that facilitate traceability, hygiene, and quality control throughout the processing stages. For example, equipment that incorporates real-time monitoring systems can detect contaminants and ensure compliance with safety standards. As a result, the Meat And Poultry Processing Equipment Market is likely to see a rise in demand for equipment that not only meets regulatory requirements but also enhances product quality, thereby fostering consumer trust.

Technological Advancements in Processing Equipment

The Meat And Poultry Processing Equipment Market is experiencing a surge in technological advancements that enhance efficiency and productivity. Innovations such as automation, robotics, and artificial intelligence are being integrated into processing lines, allowing for faster production rates and reduced labor costs. For instance, automated cutting and packaging systems are becoming increasingly prevalent, streamlining operations and minimizing human error. According to industry reports, the adoption of advanced technologies could potentially increase processing capacity by up to 30%. Furthermore, these advancements not only improve output but also ensure higher quality standards, which are crucial in meeting consumer expectations. As a result, companies that invest in state-of-the-art processing equipment are likely to gain a competitive edge in the Meat And Poultry Processing Equipment Market.