Emergence of Edge Computing

The emergence of edge computing is poised to transform the MEA Cloud Computing Market by enabling faster data processing and reduced latency. As organizations generate vast amounts of data, the need for real-time analytics and processing becomes paramount. Edge computing allows data to be processed closer to the source, minimizing delays and enhancing performance. This trend is particularly relevant in sectors such as manufacturing, healthcare, and smart cities, where timely data insights are critical. The integration of edge computing with cloud services is likely to create new opportunities for cloud providers in the MEA region, as businesses seek to optimize their operations and improve decision-making capabilities. Consequently, the MEA Cloud Computing Market may experience a shift towards hybrid models that combine cloud and edge solutions.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the MEA Cloud Computing Market. Various governments in the region are actively promoting cloud adoption through favorable policies and regulations. For instance, the UAE government has launched the 'UAE Cloud Computing Strategy' to encourage public and private sector organizations to migrate to cloud services. This initiative aims to enhance the country's digital economy and improve service delivery. Additionally, the Saudi Arabian government has invested heavily in cloud infrastructure as part of its Vision 2030 plan, which seeks to diversify the economy and reduce dependence on oil. Such supportive measures are likely to accelerate the growth of the MEA Cloud Computing Market, attracting both local and international cloud service providers.

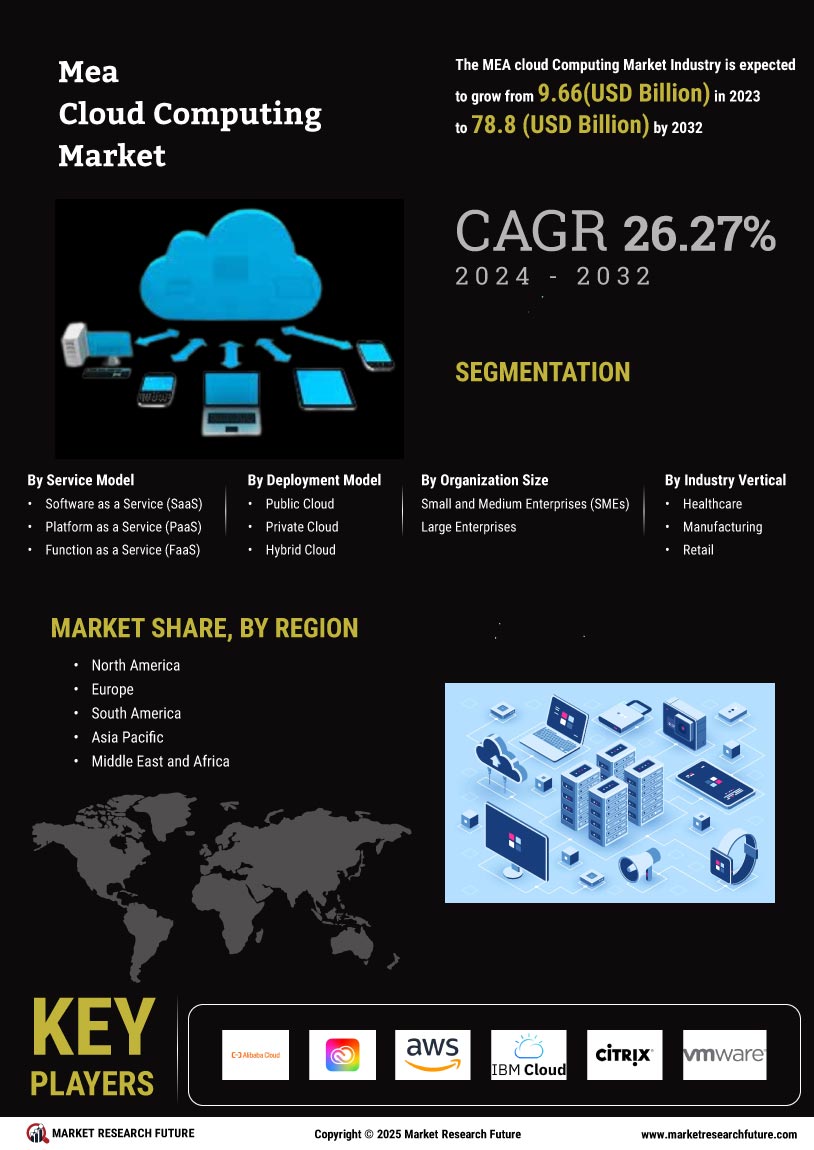

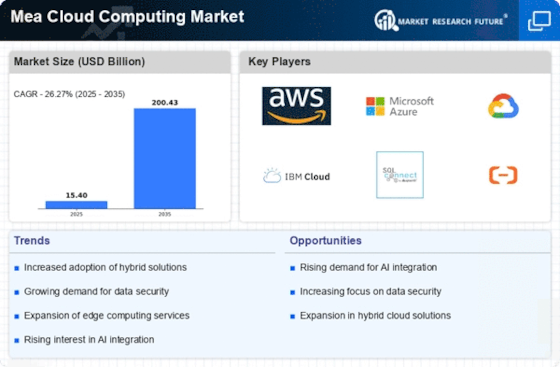

Rising Demand for Digital Transformation

The MEA Cloud Computing Market is experiencing a notable surge in demand for digital transformation initiatives across various sectors. Organizations are increasingly adopting cloud solutions to enhance operational efficiency, improve customer experiences, and drive innovation. According to recent data, the cloud services market in the Middle East and Africa is projected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth is fueled by the need for businesses to modernize their IT infrastructure and leverage advanced technologies such as artificial intelligence and machine learning. As companies transition to cloud-based platforms, the MEA Cloud Computing Market is likely to witness a significant increase in investments aimed at facilitating this transformation.

Increased Adoption of Remote Work Solutions

The MEA Cloud Computing Market is witnessing a significant shift towards remote work solutions, driven by the need for flexibility and collaboration in the workplace. Organizations are increasingly leveraging cloud-based tools to facilitate remote work, enabling employees to access critical applications and data from anywhere. This trend is supported by the growing availability of high-speed internet and mobile connectivity across the region. According to industry reports, the demand for cloud-based collaboration tools has surged by over 30% in the past year alone. As businesses continue to embrace remote work as a long-term strategy, the MEA Cloud Computing Market is expected to expand further, with an increasing number of companies investing in cloud infrastructure to support their remote workforce.

Growing Focus on Compliance and Data Sovereignty

As the MEA Cloud Computing Market matures, there is an increasing emphasis on compliance and data sovereignty. Organizations are becoming more aware of the regulatory requirements surrounding data protection and privacy, particularly in light of laws such as the General Data Protection Regulation (GDPR) and local data protection regulations. This heightened focus on compliance is driving businesses to seek cloud solutions that offer robust security features and adhere to regional regulations. Cloud service providers are responding by enhancing their offerings to ensure compliance with local laws, thereby fostering trust among customers. As a result, the MEA Cloud Computing Market is likely to see a rise in demand for compliant cloud services, which could further stimulate market growth.