Expansion of E-commerce and Online Retail

The Cloud Supply Chain Management Market is significantly influenced by the rapid expansion of e-commerce and online retail. As consumer preferences shift towards online shopping, businesses are compelled to adapt their supply chain strategies to meet the increasing demand for fast and efficient delivery. Recent data suggests that e-commerce sales are expected to reach over 6 trillion dollars by 2024, prompting companies to invest in cloud-based supply chain solutions. These solutions facilitate better inventory management, order fulfillment, and logistics coordination, which are essential for meeting customer expectations in the digital marketplace. The growth of e-commerce is thus a critical driver for the Cloud Supply Chain Management Market, as it necessitates the adoption of agile and scalable supply chain technologies.

Rising Demand for Real-Time Data Analytics

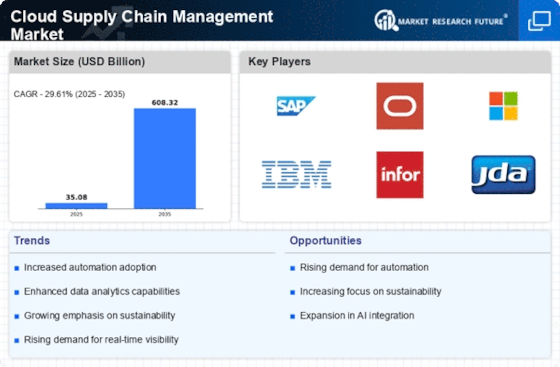

The Cloud Supply Chain Management Market is experiencing a notable surge in demand for real-time data analytics. Companies are increasingly recognizing the value of data-driven decision-making, which enhances operational efficiency and responsiveness. According to recent estimates, the market for data analytics in supply chain management is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This trend indicates that organizations are prioritizing the integration of advanced analytics tools within their cloud supply chain systems. By leveraging real-time insights, businesses can optimize inventory levels, reduce lead times, and improve customer satisfaction. Consequently, the emphasis on data analytics is likely to drive innovation and investment in the Cloud Supply Chain Management Market.

Technological Advancements in Cloud Computing

The Cloud Supply Chain Management Market is being propelled by rapid technological advancements in cloud computing. Innovations such as artificial intelligence, machine learning, and the Internet of Things are transforming traditional supply chain processes. These technologies enable organizations to automate operations, enhance data sharing, and improve overall efficiency. Recent reports indicate that the cloud computing market is expected to grow to over 800 billion dollars by 2025, which will likely benefit the Cloud Supply Chain Management Market as companies seek to leverage these advancements. The integration of cutting-edge technologies into cloud supply chain solutions allows businesses to optimize their logistics, reduce costs, and enhance customer service. As a result, the ongoing evolution of cloud computing is a pivotal driver for the Cloud Supply Chain Management Market.

Growing Importance of Sustainability Initiatives

The Cloud Supply Chain Management Market is increasingly shaped by the growing importance of sustainability initiatives. Companies are under pressure to adopt environmentally friendly practices, which necessitates the reevaluation of supply chain operations. Recent studies reveal that over 60% of consumers prefer to purchase from brands that demonstrate a commitment to sustainability. This consumer behavior is prompting businesses to invest in cloud-based supply chain solutions that facilitate sustainable practices, such as reducing waste and optimizing resource utilization. By leveraging cloud technologies, organizations can track their environmental impact and implement strategies to minimize it. The focus on sustainability is thus a significant driver for the Cloud Supply Chain Management Market, as it aligns with both consumer expectations and regulatory requirements.

Increased Focus on Risk Management and Resilience

The Cloud Supply Chain Management Market is witnessing a heightened focus on risk management and resilience strategies. Organizations are increasingly aware of the vulnerabilities within their supply chains, prompting them to seek solutions that enhance their ability to respond to disruptions. Recent surveys indicate that over 70% of supply chain professionals consider risk management a top priority. This trend is driving investments in cloud-based supply chain management systems that offer enhanced visibility and predictive analytics capabilities. By adopting these technologies, companies can better anticipate potential risks and develop contingency plans, thereby ensuring continuity in operations. The emphasis on resilience is likely to propel growth in the Cloud Supply Chain Management Market as businesses strive to build more robust supply chains.