Increasing Demand for Real-Time Data

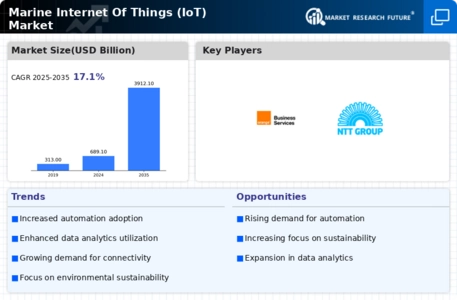

The Global Marine Internet Of Things (IoT) Industry experiences a surge in demand for real-time data analytics, which enhances operational efficiency and decision-making processes. As maritime operations become increasingly complex, stakeholders seek to leverage IoT technologies to monitor vessel performance, fuel consumption, and cargo conditions in real-time. This trend is evidenced by the projected market growth from 689.1 USD Billion in 2024 to an anticipated 3912.1 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 17.1% from 2025 to 2035. Such advancements not only optimize resource utilization but also contribute to improved safety and compliance in maritime operations.

Advancements in Connectivity Technologies

The Global Marine Internet Of Things (IoT) Industry benefits from advancements in connectivity technologies, such as satellite communications and 5G networks. These innovations facilitate seamless data transmission between vessels and shore-based operations, enabling real-time monitoring and control. Enhanced connectivity is crucial for applications like predictive maintenance, where data from onboard sensors can be analyzed to prevent equipment failures. As connectivity improves, the potential for IoT adoption in maritime operations expands, leading to greater efficiency and cost savings. This trend aligns with the overall market growth trajectory, as stakeholders recognize the value of reliable and fast communication in optimizing maritime operations.

Regulatory Compliance and Safety Standards

The Global Marine Internet Of Things (IoT) Industry is significantly influenced by stringent regulatory compliance and safety standards imposed by maritime authorities. Governments worldwide are increasingly mandating the adoption of IoT solutions to ensure vessel safety, environmental protection, and efficient resource management. For instance, the International Maritime Organization has established guidelines that encourage the integration of IoT technologies for monitoring emissions and enhancing navigational safety. This regulatory push is likely to drive investments in IoT infrastructure, as companies strive to meet compliance requirements while also capitalizing on the operational efficiencies that IoT offers.

Growing Investment in Smart Shipping Solutions

The Global Marine Internet Of Things (IoT) Industry is witnessing a growing investment in smart shipping solutions, driven by the need for enhanced operational efficiency and cost reduction. Companies are increasingly adopting IoT technologies to automate processes, monitor fleet performance, and improve supply chain visibility. This trend is supported by the projected market growth, with estimates indicating a rise from 689.1 USD Billion in 2024 to 3912.1 USD Billion by 2035. The adoption of smart shipping solutions not only streamlines operations but also enhances competitiveness in a rapidly evolving maritime landscape.

Sustainability Initiatives in Maritime Operations

The Global Marine Internet Of Things (IoT) Industry is increasingly shaped by sustainability initiatives aimed at reducing the environmental impact of maritime operations. Companies are adopting IoT solutions to monitor emissions, optimize fuel consumption, and enhance waste management practices. For example, IoT-enabled systems can track fuel usage in real-time, allowing for adjustments that minimize carbon footprints. This focus on sustainability not only aligns with global environmental goals but also appeals to consumers and investors who prioritize eco-friendly practices. As a result, the integration of IoT technologies is likely to accelerate, contributing to the overall growth of the market.