Enhanced Cybersecurity Measures

As the US Marine Internet of Things market expands, the importance of cybersecurity cannot be overstated. The increasing interconnectivity of marine systems makes them vulnerable to cyber threats, necessitating robust security measures. Stakeholders are investing in advanced cybersecurity solutions to protect sensitive data and ensure the integrity of IoT systems. The US government has issued guidelines and frameworks aimed at enhancing cybersecurity in the maritime sector. By implementing these measures, companies can safeguard their operations while leveraging IoT technologies. This focus on cybersecurity is likely to foster greater confidence in the adoption of IoT solutions across the marine industry.

Integration of Autonomous Vessels

The integration of autonomous vessels is emerging as a transformative driver in the US Marine Internet of Things market. As technology advances, the development of autonomous ships equipped with IoT sensors is becoming more feasible. These vessels can operate with minimal human intervention, relying on real-time data for navigation and decision-making. The US government has been actively supporting research and development in this area, recognizing the potential for increased safety and efficiency. By 2026, it is anticipated that the number of autonomous vessels in operation will rise, further propelling the demand for IoT solutions tailored to support these innovations.

Increased Demand for Real-Time Data

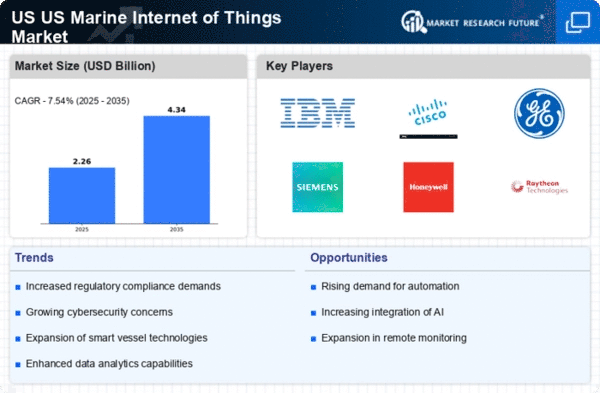

The US Marine Internet of Things market is experiencing a surge in demand for real-time data analytics. This trend is driven by the need for enhanced operational efficiency and safety in maritime operations. Real-time data allows vessel operators to monitor performance metrics, track environmental conditions, and optimize routes. According to recent estimates, the market for IoT solutions in the marine sector is projected to grow at a compound annual growth rate of over 20% through 2026. This growth is indicative of the industry's shift towards data-driven decision-making, which is essential for maintaining competitiveness in a rapidly evolving maritime landscape.

Focus on Environmental Sustainability

The US Marine Internet of Things market is increasingly influenced by a growing emphasis on environmental sustainability. Regulatory bodies and industry stakeholders are advocating for greener practices, which necessitate the adoption of IoT technologies for monitoring emissions and fuel consumption. The implementation of IoT solutions can lead to significant reductions in operational costs and environmental impact. For instance, the US Coast Guard has been promoting initiatives that encourage the use of IoT for tracking and reducing marine pollution. This focus on sustainability is likely to drive further investment in IoT technologies that support eco-friendly maritime operations.

Advancements in Connectivity Technologies

The evolution of connectivity technologies is a pivotal driver for the US Marine Internet of Things market. Innovations such as 5G and satellite communications are enhancing the ability of vessels to connect with shore-based systems and other vessels. This improved connectivity facilitates seamless data exchange, which is crucial for applications like fleet management and environmental monitoring. As of January 2026, the integration of these technologies is expected to reduce latency and increase data transmission speeds, thereby enabling more sophisticated IoT applications. The potential for enhanced communication capabilities is likely to attract more investments in IoT solutions within the marine sector.