Market Share

Marine Internet of Things Market Share Analysis

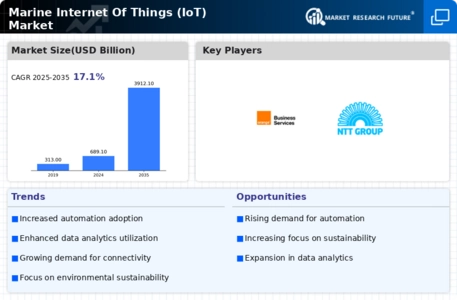

With the growing need for smart and connected solutions at sea, the Marine Internet of Things (IoT) market, a critical component of maritime industry, has witnessed remarkable growth. Companies within such a dynamic environment employ various strategies to increase their market share. Differentiation is one such strategy where firms focus on developing advanced IoT solutions targeted specifically for maritime applications which entail real-time monitoring, predictive maintenance and improved connectivity. The intention is to attract shipping companies as well as vessel operators and service providers in this sector who require state-of-the-art IoT technology so that they can efficiently manage fleets while optimizing operations.

Another strategic approach important in the Marine IoT market is cost leadership. Some players emphasize on inexpensive manufacturing of IoT devices and efficient connection solutions in order to bring down costs of these systems without compromising their quality. This approach is significant in the shipping sector where costs play an important role. By minimizing production expenses and ensuring affordability, firms brand themselves as dependable yet low-cost providers primarily in markets having budget restrictions.

In the Marine IoT sector, positioning through collaboration or partnerships are often crucial. These strategic alliances are common with ship builders, navigation equipment manufacturers and satellite communication organizations among others. They facilitate integration of existing maritime systems with IOT solutions thereby ensuring smooth compatibility and effective data exchange among other benefits. Besides, strategic partnerships enhance firms’ awareness about new marine regulations; navigation standards as well as technological trends hence resulting into tailor made offerings targeting various ships categories sailing across different oceans.

Market penetration is a strategy pursued by various companies seeking to increase their share within the Marine IoT industry. This may involve going into new markets or expanding within already established ones. As maritime industries experience digital transformations, enterprises concentrate on emerging markets as well as those regions with increasing demand for shipping routes connectivity systems and Internet-of-Things applications used in logistics at sea Successful market penetration requires deep knowledge about local marine regulations; specific vessels which dominate particular waters; peculiar challenges faced due to diverse maritime environments.

The Marine IoT market is customer centric. In this regard, priority is given to customers’ satisfaction through offering technical support, safety measures and easy interfaces. Developing strong relationships with shipping companies and maritime operators creates trust and loyalty whereby clients keep coming back or recommending their friends. Firms that understand the importance of IOT in enhancing vessel’s performance, safety and efficiency should tailor their products to meet the unique demands of various clients found in all marine sectors.

Innovation still drives the Marine IoT industry, as companies invest in R&D for introducing more advanced features like autonomous vessels monitoring, environmental sensing or energy saving solutions Continuous innovation results in an Internet of Things system that promotes sustainable maritime practices designed for changing business needs within the sector. These innovations are meant not only to attract customers who want something new but also position firms as leaders whose IoT technology is reliable especially for different marine applications.

Regulatory compliance plays a major role in market share positioning within the Marine IoT sector A company’s IOT offerings must comply with strict maritime security and data privacy standards. Following these requirements guarantees not only the safety and reliability IoT technology but also shows company’s credibility on the market by positioning its products as being compliant with industry regulations.”

Leave a Comment