North America : Leading Market Innovators

North America is poised to maintain its leadership in the Marine Cooling Systems Repair and MRO Services Market, holding a market size of $1.75B in 2025. Key growth drivers include a robust maritime industry, stringent environmental regulations, and increasing demand for efficient cooling solutions. The region's focus on technological advancements and sustainability initiatives further propels market growth, making it a hub for innovation in marine services.

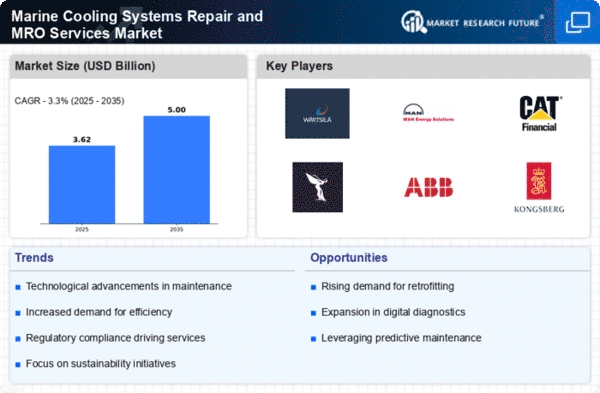

The competitive landscape is characterized by major players such as Wärtsilä, Caterpillar Inc., and Rolls-Royce, which are investing heavily in R&D to enhance service offerings. The U.S. leads the market, supported by a strong naval presence and a growing commercial shipping sector. The presence of established companies ensures a dynamic market environment, fostering competition and innovation.

Europe : Regulatory-Driven Growth

Europe's Marine Cooling Systems Repair and MRO Services Market is projected to reach $1.1B by 2025, driven by stringent environmental regulations and a shift towards sustainable maritime practices. The European Union's Green Deal and various national policies are catalysts for innovation, pushing companies to adopt eco-friendly technologies and improve energy efficiency in marine operations. This regulatory framework is essential for fostering a competitive market landscape.

Leading countries such as Germany, the UK, and Norway are at the forefront of this market, with key players like MAN Energy Solutions and ABB driving advancements. The competitive environment is marked by collaborations and partnerships aimed at enhancing service capabilities. The presence of established firms ensures a robust supply chain, contributing to the region's overall market growth.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Marine Cooling Systems Repair and MRO Services Market, with a projected size of $0.9B by 2025. Key drivers include rapid industrialization, increasing shipping activities, and a growing focus on maritime safety and efficiency. Countries like China and Japan are investing heavily in their maritime infrastructure, which is expected to boost demand for cooling systems and related services in the coming years.

China leads the market, supported by its vast shipping industry and government initiatives aimed at enhancing maritime capabilities. The competitive landscape features both local and international players, including Kongsberg Gruppen and Siemens, who are expanding their presence in the region. This dynamic environment is fostering innovation and improving service delivery, positioning Asia-Pacific as a key player in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant player in the Marine Cooling Systems Repair and MRO Services Market, with a projected size of $0.75B by 2025. The growth is driven by increasing maritime trade, investments in port infrastructure, and a rising focus on energy efficiency. Countries like the UAE and South Africa are enhancing their maritime capabilities, creating demand for advanced cooling systems and maintenance services.

The competitive landscape is characterized by a mix of local and international players, with companies like Marine Cooling Solutions and Danfoss expanding their operations. The region's strategic location as a shipping hub further enhances its market potential, attracting investments and fostering partnerships. This growth trajectory presents numerous opportunities for service providers in the marine cooling sector.