North America : Leading Market Innovators

North America is poised to maintain its leadership in the Marine Equipment Maintenance and Overhaul Services Market, holding a significant market share of 9.1 in 2024. The region's growth is driven by increasing naval investments, stringent regulatory frameworks, and a rising demand for advanced marine technologies. The U.S. government’s focus on enhancing maritime security and infrastructure further propels market expansion, creating a robust environment for service providers.

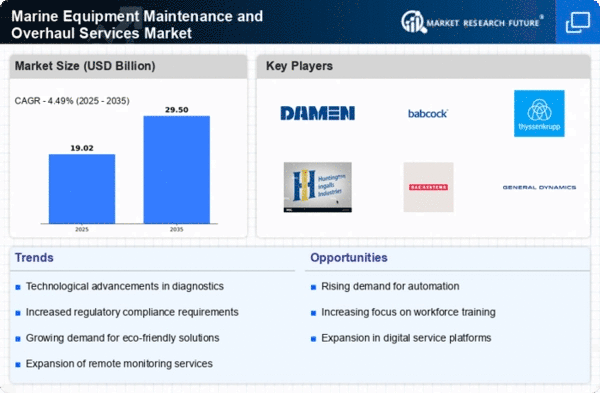

The competitive landscape in North America is characterized by the presence of major players such as Huntington Ingalls Industries and General Dynamics. These companies are leveraging technological advancements and strategic partnerships to enhance service offerings. The U.S. and Canada are the leading countries in this sector, with a strong emphasis on innovation and sustainability, ensuring a dynamic market environment.

Europe : Strategic Maritime Hub

Europe's Marine Equipment Maintenance and Overhaul Services Market is projected to reach a size of 5.5 by 2025, driven by increasing maritime activities and regulatory support for sustainable practices. The European Union's initiatives to enhance maritime safety and environmental standards are key growth catalysts. Additionally, the region's focus on technological advancements in shipbuilding and maintenance services is expected to boost demand significantly.

Leading countries such as Germany, the UK, and Italy are at the forefront of this market, with companies like Thyssenkrupp Marine Systems and Damen Shipyards Group playing pivotal roles. The competitive landscape is marked by innovation and collaboration among key players, ensuring that Europe remains a strategic hub for marine services. "The European maritime sector is committed to achieving sustainability and innovation in marine operations," European Commission report, 2023.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning Marine Equipment Maintenance and Overhaul Services Market, projected to reach 2.8 by 2025. This growth is fueled by increasing shipping activities, rising naval budgets, and a growing emphasis on maritime safety regulations. Countries like China and Japan are investing heavily in their naval capabilities, which is driving demand for maintenance and overhaul services across the region.

China, Japan, and South Korea are the leading players in this market, with a competitive landscape that includes both established firms and emerging players. The presence of key companies such as Kongsberg Gruppen and Navantia highlights the region's potential for growth. As the demand for advanced marine technologies increases, the Asia-Pacific market is set to expand significantly, attracting investments and innovations.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Marine Equipment Maintenance and Overhaul Services Market, with a projected size of 0.8 by 2025. The growth is driven by increasing maritime trade and investments in port infrastructure. Additionally, regional governments are recognizing the importance of enhancing their naval capabilities, which is expected to catalyze demand for maintenance services in the coming years.

Countries like the UAE and South Africa are leading the charge, with a focus on developing their maritime sectors. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region invests in maritime infrastructure, the potential for growth in marine services is significant, paving the way for new entrants and innovations.