North America : Market Leader in Maintenance

North America is poised to maintain its leadership in the Manufacturing Equipment Maintenance and Overhaul Market, holding a significant market share of 90.0 in 2024. The region's growth is driven by advanced manufacturing technologies, increased automation, and stringent regulatory standards that emphasize equipment reliability and safety. The demand for predictive maintenance solutions is also on the rise, as companies seek to minimize downtime and enhance operational efficiency.

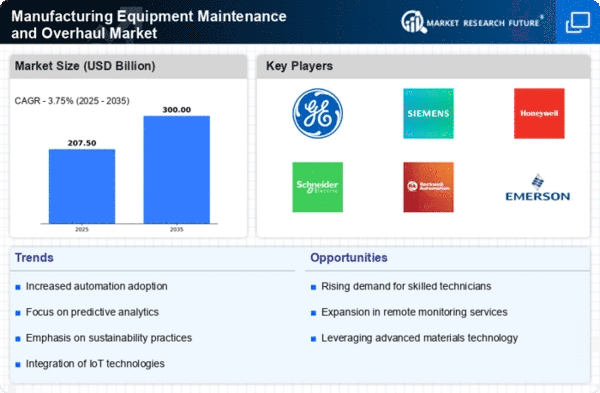

The competitive landscape in North America is robust, featuring key players such as General Electric, Honeywell, and Rockwell Automation. These companies are leveraging innovative technologies and strategic partnerships to enhance service offerings. The U.S. remains the largest market, supported by a strong industrial base and significant investments in infrastructure. The presence of leading firms ensures a dynamic environment, fostering continuous improvement and technological advancements.

Europe : Innovation and Sustainability Focus

Europe's Manufacturing Equipment Maintenance and Overhaul Market is characterized by a market size of 50.0, driven by a strong emphasis on sustainability and innovation. Regulatory frameworks, such as the EU's Green Deal, are pushing manufacturers to adopt eco-friendly practices, which in turn boosts demand for maintenance services that enhance equipment efficiency and reduce environmental impact. The region is also witnessing a shift towards digital solutions, including IoT and AI, to optimize maintenance processes.

Leading countries in this market include Germany, France, and the UK, where major players like Siemens and Schneider Electric are actively investing in R&D. The competitive landscape is marked by a focus on smart manufacturing and predictive maintenance technologies. The presence of established firms and a growing number of startups contribute to a vibrant ecosystem, ensuring that Europe remains at the forefront of manufacturing innovation.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 45.0, is rapidly emerging as a key player in the Manufacturing Equipment Maintenance and Overhaul Market. The growth is fueled by increasing industrialization, urbanization, and a rising focus on operational efficiency. Countries like China and India are investing heavily in manufacturing capabilities, leading to a surge in demand for maintenance services that ensure equipment reliability and performance. Additionally, government initiatives aimed at enhancing manufacturing competitiveness are acting as catalysts for market growth.

China stands out as the largest market in the region, with significant contributions from local and international players. Companies such as Mitsubishi Electric and ABB are expanding their presence, focusing on innovative maintenance solutions. The competitive landscape is evolving, with a mix of established firms and new entrants driving technological advancements and service diversification, positioning Asia-Pacific as a future powerhouse in this sector.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 15.0, presents untapped opportunities in the Manufacturing Equipment Maintenance and Overhaul Market. The growth is primarily driven by increasing investments in infrastructure and industrial projects, particularly in countries like the UAE and South Africa. As industries expand, the need for reliable maintenance services becomes critical to ensure operational efficiency and minimize downtime. Regulatory support for industrial growth is also enhancing market prospects.

In this region, the competitive landscape is still developing, with a mix of local and international players entering the market. Companies are focusing on establishing partnerships and collaborations to enhance service offerings. The presence of key players is gradually increasing, and as the region continues to invest in its industrial capabilities, the demand for maintenance services is expected to rise significantly, paving the way for future growth.