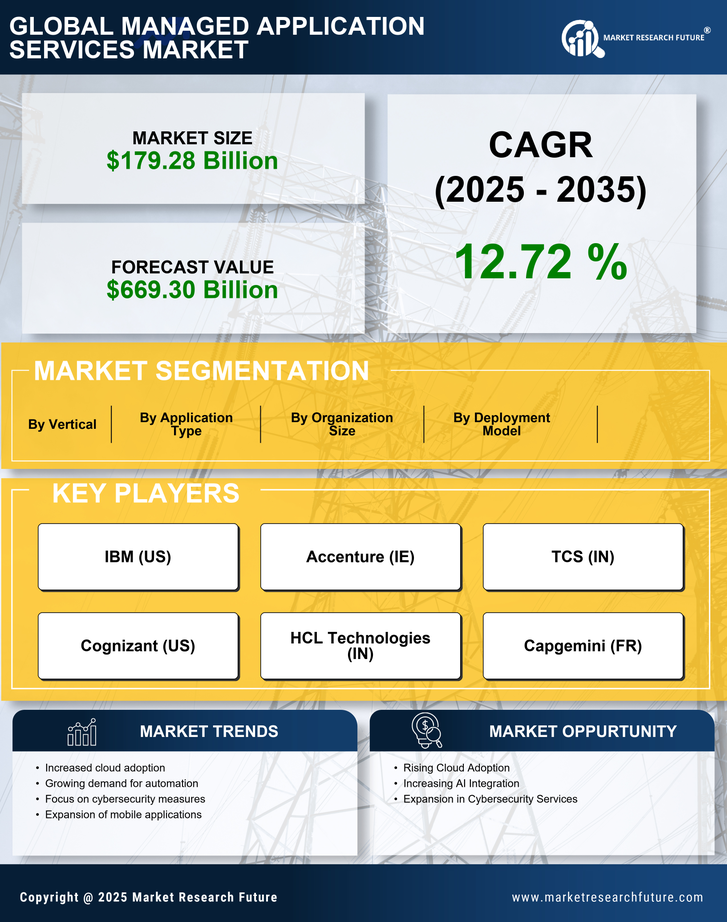

The Managed Application Services Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for digital transformation and cloud-based solutions. Major players such as IBM (US), Accenture (IE), and TCS (IN) are strategically positioning themselves to leverage these trends. IBM (US) focuses on integrating

artificial intelligence into its service offerings, enhancing operational efficiency and customer experience. Accenture (IE) emphasizes partnerships with technology innovators to expand its service portfolio, while TCS (IN) is investing heavily in automation and

machine learning to streamline application management processes. Collectively, these strategies not only enhance their competitive edge but also shape the market's evolution towards more integrated and intelligent service solutions.In terms of business tactics, companies are increasingly localizing their service delivery to better meet regional demands and optimize supply chains. The Managed Application Services Market appears moderately fragmented, with a mix of established players and emerging firms vying for market share. The collective influence of key players is significant, as they set industry standards and drive innovation, thereby impacting smaller competitors and new entrants.

In August IBM (US) announced a strategic partnership with a leading cloud provider to enhance its managed application services, aiming to deliver more robust and scalable solutions to clients. This move is likely to strengthen IBM's position in the cloud services segment, allowing it to offer integrated solutions that combine its AI capabilities with cloud infrastructure, thus appealing to businesses seeking comprehensive

digital transformation.

In September Accenture (IE) launched a new initiative focused on sustainability in application management, which includes optimizing resource usage and reducing carbon footprints. This initiative not only aligns with global sustainability goals but also positions Accenture as a leader in responsible technology solutions, potentially attracting clients who prioritize environmental considerations in their operations.

In July TCS (IN) unveiled a new automation framework designed to enhance the efficiency of application management services. This framework leverages

advanced analytics and machine learning to predict application performance issues before they arise. Such proactive measures could significantly reduce downtime for clients, thereby enhancing TCS's reputation for reliability and innovation in the market.

As of October the competitive trends in the Managed Application Services Market are increasingly defined by digitalization, sustainability, and the integration of

artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their service offerings and meet evolving client demands. Looking ahead, competitive differentiation is likely to shift from traditional price-based competition to a focus on innovation, technological advancement, and supply chain reliability, as firms strive to provide unique value propositions in a rapidly changing landscape.