Increased Awareness and Education

The Global Malabsorption Syndrome Market Industry benefits from heightened awareness and education regarding malabsorption disorders. Campaigns by health organizations and patient advocacy groups are instrumental in informing the public about symptoms and treatment options. This increased awareness leads to more individuals seeking medical advice, resulting in higher diagnosis rates. As the market evolves, the focus on patient education is likely to enhance treatment adherence and improve health outcomes. The projected growth from 0.21 USD Billion in 2024 to 4.61 USD Billion by 2035 underscores the potential impact of awareness initiatives on market expansion.

Advancements in Diagnostic Technologies

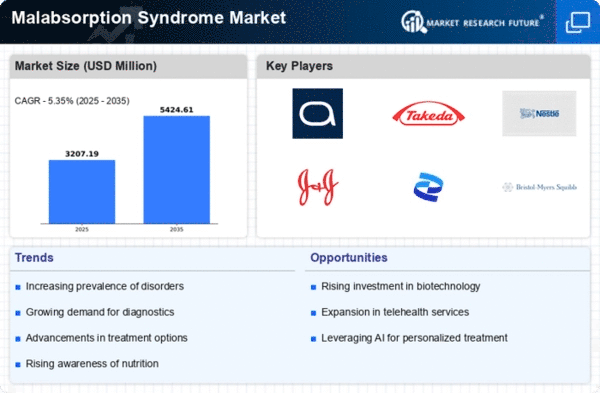

Technological advancements in diagnostic tools are significantly impacting the Global Malabsorption Syndrome Market Industry. Innovations such as non-invasive tests, genetic screening, and advanced imaging techniques enhance the accuracy of diagnosing malabsorption syndromes. These improvements facilitate earlier detection and treatment, which is crucial for patient outcomes. As healthcare providers adopt these technologies, the market is expected to grow substantially. The anticipated CAGR of 32.42% from 2025 to 2035 indicates a robust expansion driven by enhanced diagnostic capabilities, ultimately leading to better management of malabsorption disorders.

Growing Demand for Nutritional Supplements

There is a growing demand for nutritional supplements tailored for individuals with malabsorption syndromes within the Global Malabsorption Syndrome Market Industry. Patients often require specialized diets and supplements to compensate for nutrient deficiencies caused by their conditions. As awareness of these dietary needs increases, manufacturers are developing innovative products to meet this demand. The market's expansion is reflected in the projected growth from 0.21 USD Billion in 2024 to 4.61 USD Billion by 2035. This trend indicates a shift towards personalized nutrition solutions, which are likely to play a crucial role in managing malabsorption disorders.

Regulatory Support for Treatment Innovations

Regulatory bodies are increasingly supportive of innovations in treatments for malabsorption syndromes, positively influencing the Global Malabsorption Syndrome Market Industry. Initiatives aimed at expediting the approval process for new therapies and nutritional products are emerging. This regulatory environment encourages research and development, fostering the introduction of novel treatment options. As the market evolves, the anticipated CAGR of 32.42% from 2025 to 2035 suggests that regulatory support will be a key driver of growth, enabling companies to bring effective solutions to patients more rapidly.

Rising Prevalence of Malabsorption Disorders

The Global Malabsorption Syndrome Market Industry is witnessing a notable increase in the prevalence of malabsorption disorders. Factors such as dietary changes, increased awareness, and improved diagnostic techniques contribute to this trend. For instance, conditions like celiac disease and lactose intolerance are becoming more recognized, leading to higher diagnosis rates. As of 2024, the market is valued at 0.21 USD Billion, reflecting the growing need for effective treatment options. This rise in prevalence is likely to drive demand for specialized therapies and nutritional products, thereby expanding the market further.