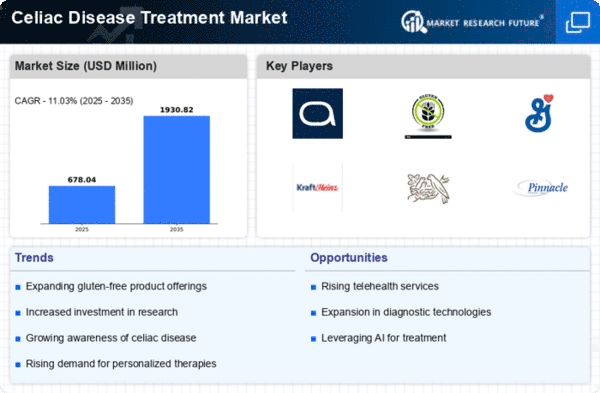

Market Growth Projections

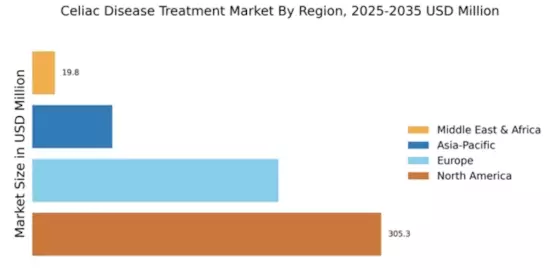

The Global Celiac Disease Treatment Market Industry is poised for substantial growth, with projections indicating a market value of 0.61 USD Billion in 2024 and an anticipated increase to 1.93 USD Billion by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 11.05% from 2025 to 2035. Such figures suggest a robust expansion driven by factors such as rising prevalence, advancements in treatment options, and increasing consumer awareness. The market's trajectory reflects a growing recognition of celiac disease and the need for effective management solutions, positioning it as a key area of focus for stakeholders in the healthcare sector.

Advancements in Treatment Options

Innovations in treatment options for celiac disease significantly influence the Global Celiac Disease Treatment Market Industry. Recent developments in gluten-free food technology and therapeutic interventions are enhancing the quality of life for patients. For instance, the introduction of enzyme-based therapies that aid in gluten digestion shows promise in clinical trials. These advancements not only provide alternatives to strict gluten avoidance but also expand the market landscape. As the industry evolves, the potential for new products to emerge is likely to attract investment and research, fostering a competitive environment that benefits patients and healthcare providers alike.

Increased Awareness and Education

The growing awareness and education surrounding celiac disease are vital drivers for the Global Celiac Disease Treatment Market Industry. Healthcare professionals and organizations are increasingly focusing on educating the public about the symptoms and risks associated with celiac disease. Campaigns aimed at increasing knowledge about gluten intolerance and the importance of diagnosis are leading to more individuals seeking medical advice. This heightened awareness is expected to contribute to a steady increase in market demand, as more patients are diagnosed and treated. Consequently, the market is projected to grow at a CAGR of 11.05% from 2025 to 2035, reflecting the impact of education on treatment accessibility.

Regulatory Support and Guidelines

Regulatory support and guidelines play a crucial role in shaping the Global Celiac Disease Treatment Market Industry. Governments and health organizations are establishing frameworks to ensure the safety and efficacy of gluten-free products and treatments. For example, the FDA has set standards for gluten-free labeling, which helps consumers make informed choices. Such regulations not only enhance consumer confidence but also encourage manufacturers to innovate and comply with safety standards. This regulatory environment is likely to foster market growth, as companies are motivated to develop new products that meet these guidelines, ultimately benefiting patients and healthcare systems.

Rising Prevalence of Celiac Disease

The increasing prevalence of celiac disease globally is a primary driver for the Global Celiac Disease Treatment Market Industry. As awareness of the condition grows, more individuals are being diagnosed, leading to a higher demand for effective treatment options. In 2024, the market is valued at 0.61 USD Billion, reflecting the urgent need for gluten-free products and therapies. This trend is expected to continue, with projections indicating that by 2035, the market could reach 1.93 USD Billion. The rising number of diagnosed cases emphasizes the necessity for innovative treatments and dietary solutions, thereby propelling market growth.

Growing Demand for Gluten-Free Products

The surging demand for gluten-free products is a significant driver of the Global Celiac Disease Treatment Market Industry. As more consumers adopt gluten-free diets, whether due to celiac disease or other health concerns, the market for gluten-free foods and supplements is expanding rapidly. This trend is reflected in the increasing number of gluten-free product launches and the diversification of offerings in supermarkets and health food stores. The market's growth trajectory indicates that by 2035, it could potentially reach 1.93 USD Billion, driven by both celiac patients and health-conscious consumers seeking gluten-free alternatives.