Integration with Industry 4.0

The Machine Vision Market is increasingly aligning with the principles of Industry 4.0, characterized by the interconnectivity of machines and systems. This integration facilitates the collection and analysis of vast amounts of data, enabling smarter decision-making processes. As industries adopt IoT and big data analytics, machine vision systems are becoming integral to smart factories. The market for Industry 4.0 solutions is projected to grow significantly, with machine vision playing a pivotal role in enhancing operational efficiency and productivity. This trend suggests that the Machine Vision Market will continue to expand as more companies embrace digital transformation.

Rising Adoption in Healthcare

The Machine Vision Market is experiencing a rising adoption of machine vision technologies in the healthcare sector. Applications such as automated inspection of medical devices, imaging for diagnostics, and robotic surgeries are becoming increasingly prevalent. The healthcare automation market is expected to grow at a rate of 12% annually, driven by the need for precision and efficiency in medical processes. As healthcare providers seek to improve patient outcomes and streamline operations, the integration of machine vision systems is likely to become more widespread. This trend indicates a promising future for the Machine Vision Market within the healthcare domain.

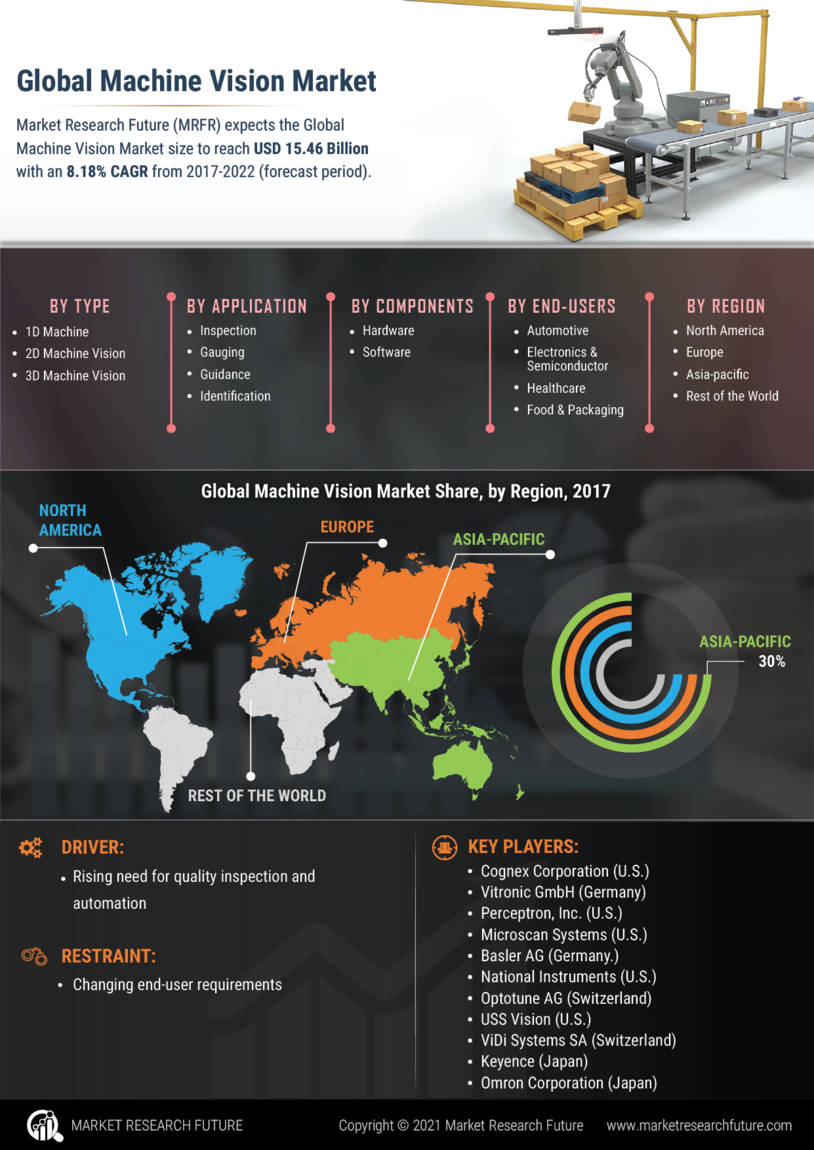

Increasing Demand for Automation

The Machine Vision Market is experiencing a notable surge in demand for automation across various sectors. Industries such as automotive, electronics, and pharmaceuticals are increasingly adopting machine vision systems to enhance operational efficiency and reduce human error. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend indicates a strong inclination towards integrating advanced technologies that facilitate real-time monitoring and quality assurance. As companies strive to optimize production processes, the adoption of machine vision solutions becomes imperative, thereby driving growth in the Machine Vision Market.

Advancements in Imaging Technologies

Technological advancements in imaging technologies are significantly influencing the Machine Vision Market. Innovations such as 3D imaging, hyperspectral imaging, and high-resolution cameras are enhancing the capabilities of machine vision systems. These advancements enable more precise inspections and analyses, which are crucial for industries that require stringent quality control measures. The market for imaging technologies is expected to expand, with projections indicating a growth rate of around 8% annually. As these technologies evolve, they are likely to provide enhanced functionalities, thereby attracting more industries to adopt machine vision solutions, further propelling the Machine Vision Market.

Growing Emphasis on Quality Assurance

The Machine Vision Market is witnessing a growing emphasis on quality assurance as manufacturers seek to maintain high standards in production. With increasing consumer expectations and regulatory requirements, companies are investing in machine vision systems to ensure product quality and compliance. The market for quality assurance solutions is anticipated to grow at a rate of 9% per year, reflecting the critical role of machine vision in detecting defects and ensuring consistency. This focus on quality not only enhances customer satisfaction but also reduces costs associated with returns and rework, thereby driving the demand for machine vision technologies in various sectors.