Research Methodology on Luxury Handbags Market

Abstract

This research report looks into the luxury handbags market and its potential for growth in the near future. The primary objective of this research is to analyze the overall market and to assess the potential of the handbags in terms of trends, opportunities, drivers, and restraints. The analyzed data is gathered from primary and secondary sources including surveys, interviews, and personal communication. Furthermore, data analysis techniques such as statistical analysis, market estimates, and Porter’s Five Forces Analysis are used.

Introduction

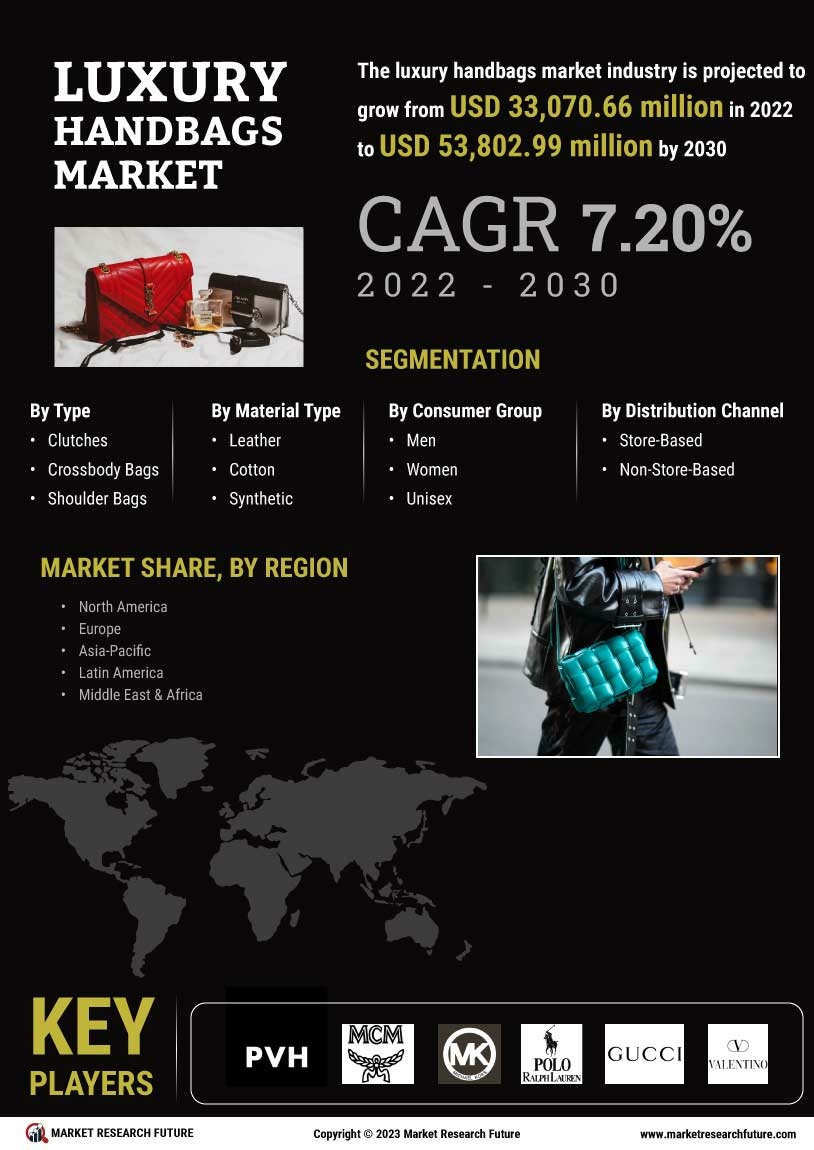

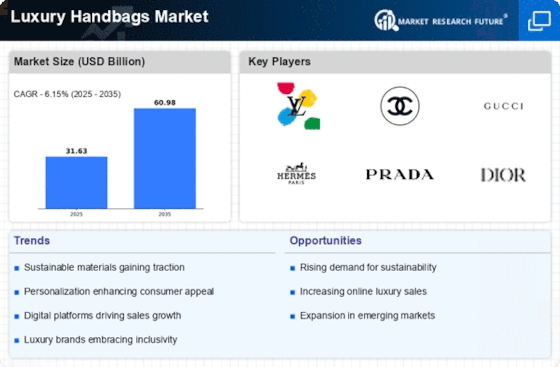

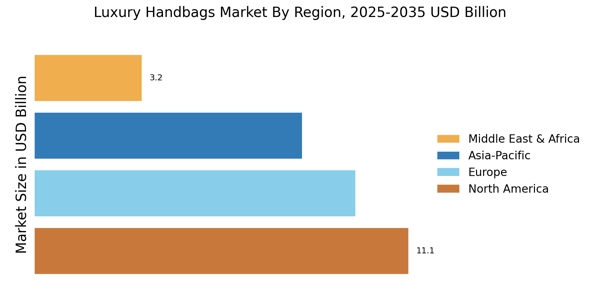

The published research report looks into the luxury handbags market to assess the potential of the industry in terms of trends, opportunities, drivers, and restraints. The luxury handbag market is one of the fastest-growing segments in the fashion industry and is expected to give more impetus to the global economy in the near future. There has been an increase in the demand for luxury handbags worldwide, driven by rising disposable incomes, the emergence of Asian markets, and the growing popularity of designer labels in the luxury handbags segment. This research aims to analyze the market, gain insights into its potential for growth, and look into the key trends and opportunities associated with the luxury handbags industry.

Research Problem

This research explores the current market status of the luxury handbags industry, its potential for growth, and the key trends and opportunities it presents.

Research Objectives

The main objectives of this study are:

- To analyze the current market status of the luxury handbags industry

- To assess the potential of the luxury handbags market for growth

- To identify the key trends and opportunities associated with the luxury handbags market

Research Questions

The research questions for this study are:

- What is the current market status of the luxury handbags industry?

- What is the potential growth of the luxury handbags market?

- What are the key trends and opportunities associated with the luxury handbags market?

Literature Review

The literature review assesses current and past trends in the luxury handbags market and analyzes the growth potential and evaluates the major trends and opportunities that the segment offers. The research review also looks into the market drivers and restraints to identify potential new opportunities for the market.

Research Methodology

Research Approach

The research approach adopted for this study is quantitative. Primary and secondary sources are used to gather the necessary data. Primary sources include surveys, interviews, and personal communication. Secondary sources include books, reports, and other published information.

Research Design

The research design is a descriptive design that aims to calculate the market size, identify market segments, and determine the key trends and opportunities associated with the luxury handbags market.

Data Sources

Primary sources used to gather data include surveys, interviews, and personal communication. Secondary sources include books, reports, and other published information.

Data Collection

Data is collected from both primary and secondary sources. Questionnaires and interviews are administered to gather primary data. Guest lectures and industry visits are also conducted. Secondary sources include books, reports, news articles, and industry publications.

Data Analysis

Quantitative analysis techniques such as statistical analysis, market estimates, and Porter’s Five Forces Analysis are used to analyze the data.

Conclusion

This research looks into the luxury handbags market and its potential for growth in the near future. Primary and secondary data sources are used to gather the necessary data, and quantitative analysis techniques such as statistical analysis, market estimates, and Porter’s Five Forces Analysis are used.