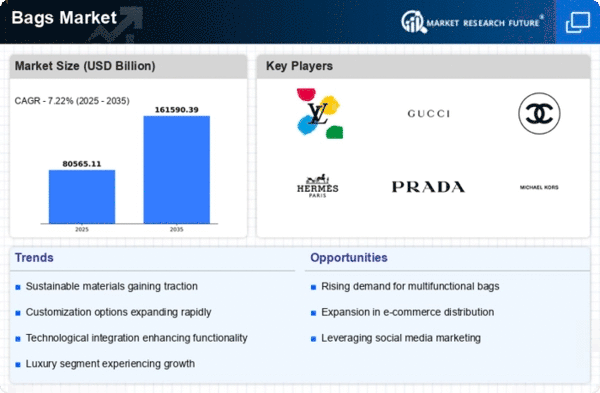

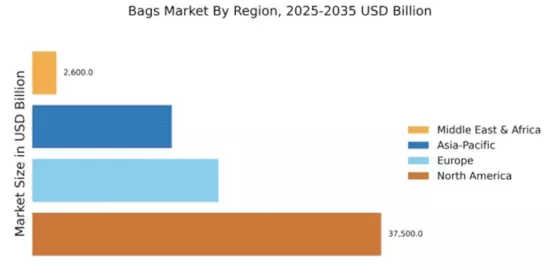

North America : Market Leader in Bags

North America continues to lead The Bags, holding a significant share of 37500.0. The region's growth is driven by rising disposable incomes, a strong retail sector, and increasing consumer preference for luxury brands. Regulatory support for e-commerce and retail innovation further fuels demand, making it a vibrant market for both established and emerging brands. The competitive landscape is characterized by key players such as Michael Kors, Coach, and Tumi, alongside luxury giants like Louis Vuitton and Gucci. The U.S. remains the largest market, with Canada and Mexico also contributing to growth. The presence of these brands, coupled with a robust distribution network, positions North America as a pivotal hub in the bags market.

Europe : Luxury Market Hub

Europe, with a market size of 20000.0, is a powerhouse in the bags market, driven by a rich heritage of luxury brands and a growing demand for high-quality products. The region benefits from a strong tourism sector, which boosts retail sales, and increasing consumer awareness of sustainable fashion. Regulatory frameworks promoting eco-friendly practices are also gaining traction, enhancing market appeal. Leading countries include France, Italy, and the UK, home to iconic brands like Chanel, Prada, and Burberry. The competitive landscape is marked by a blend of luxury and contemporary brands, ensuring a diverse offering for consumers. The presence of fashion weeks and trade shows further solidifies Europe's status as a global fashion leader.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the bags market, with a market size of 15000.0. The region's expansion is fueled by increasing urbanization, rising disposable incomes, and a growing middle class. Additionally, the demand for both luxury and affordable bags is on the rise, supported by a shift towards online shopping and digital retail platforms. Regulatory initiatives promoting e-commerce are also enhancing market accessibility. Countries like China, Japan, and India are leading the charge, with a mix of local and international brands competing for market share. The presence of key players such as Gucci and Michael Kors, along with emerging local brands, creates a dynamic competitive environment. This region's unique blend of tradition and modernity offers vast opportunities for growth in the bags market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 2600.0, presents untapped opportunities in the bags market. The growth is driven by increasing urbanization, a young population, and rising disposable incomes. Additionally, the region is witnessing a shift towards luxury and branded products, supported by a growing retail sector and e-commerce platforms. Regulatory frameworks are evolving to support market growth and attract foreign investment. Leading countries include the UAE and South Africa, where luxury brands are gaining traction. The competitive landscape is characterized by a mix of international and local brands, with key players like Louis Vuitton and Coach establishing a presence. The region's unique cultural influences also play a significant role in shaping consumer preferences and trends.